Disclosure: This article was sponsored by ByBit which is a Cryptocurrency exchange platform, the contents of this article do not necessarily reflect the views of AGR Technology

Many traders and investors in Australia are starting to include cryptocurrencies in their portfolios, with as many as 31% having the intention to continue buying crypto in 2024. And as the king among all digital currencies, Bitcoin is definitely a popular Crypto asset you should consider investing in. It is not only legal to buy Bitcoin and other crypto in Australia, but also incredibly easy to buy them.

Navigating the cryptocurrency landscape requires understanding local regulations and selecting the right platform. Australian-based exchanges offer unique advantages including local customer support and compliance with national financial guidelines. Investors can purchase Bitcoin in fractional amounts starting from small investments which means accessibility isn’t limited to those with substantial capital.

The key to successful Bitcoin investment lies in choosing a secure exchange with low transaction fees and robust identity verification processes. With multiple payment options like PayID and debit cards Australian investors can quickly enter the cryptocurrency market and potentially diversify their investment portfolio.

Ways To Buy Bitcoin in Australia in February 2026

There are five main ways to go about buying Bitcoin in Australia. You can acquire Bitcoin via a cryptocurrency exchange, a crypto wallet, a Bitcoin ATM, a peer-to-peer exchange or over-the-counter (OTC) trading.

Cryptocurrency Exchange

The easiest way to buy Bitcoin in Australia would be through a cryptocurrency exchange, as exchanges have user-friendly platforms and dedicated customer service to help beginner traders and investors just stepping into the world of crypto.

When selecting an exchange to buy your Bitcoin, you should look out for several things. First and foremost would be security. With the insolvency of one of the world’s leading exchanges, FTX, one should do due research to check if the exchange executes proper management of customers’ funds. Secondly, you should also find out if the exchange accepts AUD. After all, you wouldn’t want to go through the hassle of changing AUD to a currency the exchange accepts just to make a transaction, right? Lastly, check the cost of the exchange’s trading fees. While you might not think it affects much in a single transaction or two, a high trading fee can eat into your overall return if you intend to start actively trading in the exchange.

Firstly, it is a highly secure exchange that has never been hacked since its inception. It employs various safety features to help keep its customers’ assets safe, such as Google two-factor authentication, anti-phishing code, withdrawal lock and authenticity check features. Secondly, Bybit accepts over 172 fiat currencies, including AUD, and supports several payment methods, from credit and debit cards to electronic fund transfers. Thirdly, Bybit does not charge any transaction fee for buying their crypto, and only a minimal trading fee of 0.2% or less depending on the kind of trade.

These safety features include:

- Providing 2FA options

- Providing anti-phishing codes which are unique codes for your account that help you distinguish emails from fake ones

- Bybit also uses the New Address Withdrawal Lock function, which prevents any newly added withdrawal address from being utilised for 24 hours.

- Requiring KYC documentation which helps combat bad actors joining the platform

Crypto Wallet

Crypto wallets are not only for storing your cryptocurrencies; you can also purchase crypto through your wallet. However, it is imperative to note that most crypto wallets are non-custodial, which means only you own the private key, giving you complete control over your assets. While this may seem like an advantage at first glance, it is best to steer clear from this option if you are a beginner in crypto trading. There are two key reasons for this. Firstly, you need a certain level of crypto know-how to navigate a crypto wallet, and more importantly, if you lose your private key, you lose access to your funds, and no one will be able to help you retrieve them.

Bitcoin ATM

You can also buy Bitcoin at Bitcoin ATMs in Australia. Bitcoin ATMs function just like conventional ATMs, making your purchase fast and simple. Moreover, your transactions are completely anonymous and don’t involve any intermediaries. Hence, you can be assured of absolute safety in your Bitcoin purchase. Nevertheless, Bitcoin ATMs can charge a hefty transaction fee of as high as 15 percent.

On top of that, it can be difficult to find a Bitcoin ATM in Australia. Sydney has the most Bitcoin ATMs among all the cities, with 162 estimated ones as of 2023. Melbourne trails close behind at the second place with approximately 144 Bitcoin ATMs as of 2023.

Peer-to-Peer Trading

Another way to buy Bitcoin without going through a third party is through peer-to-peer trading. Peer-to-peer (P2P) trading is the direct buying and selling of cryptocurrencies between buyers and sellers. Since it’s a direct transaction, you can take charge of how much and at what price you want to buy Bitcoin; all you need to do is find a seller matching your requirements. Many peer-to-peer trading exchanges also include a layer of protection through an escrow payment system to help ensure the security of users’ funds.

However, a significant drawback of P2P trading is that trades may be delayed or not even go through in the end. This is because the trade confirmation depends on the buyer and seller, who may change their mind anytime during the deal. Additionally, many P2P exchanges face the issue of low liquidity, which may also cause transaction delays. Fortunately, many larger exchanges with higher liquidity now also offer P2P platforms for users to make direct crypto trades. One such example is Bybit, which allows you to perform P2P trades with over 300 payment methods at zero transaction fee.

Over-The-Counter (OTC) Trading

Over-the-counter (OTC) trading is similar to P2P trading in that buyers and sellers negotiate a deal, but the negotiation is done through a broker or dealer. Only the broker or dealer knows the asking and selling prices, so the transaction is far more private than trading on an exchange. However, as the negotiation is still relinquished to a third party, cases of fraud may arise. Typically, only high-net-worth individuals or institutions will opt for OTC trading as it involves a large volume of trades to prevent slippages.

How To Buy Bitcoin on Bybit

Now that you know of the different ways to buy Bitcoin in Australia, let’s delve deeper into the easiest way to buy Bitcoin, through a crypto exchange. It is vital to choose a safe and reliable exchange that can meet your needs, like Bybit. Bybit offers you four simple ways to buy Bitcoin.

1) Set Up a Bybit Account

You’ll first have to sign up with Bybit to create an account before you can buy Bitcoin. Signing up with Bybit is easy. You can sign up with your mobile number or email address, depending on your preference. Note that you will have to complete at least KYC (Know Your Customer) Lv. 1 to access all of Bybit’s products and services.

Buy Bitcoin in Four Ways

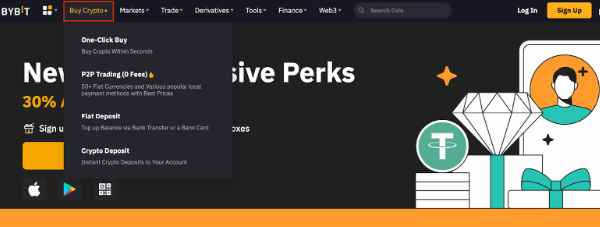

Once your account is created, you can head to Buy Crypto on the top left of the homepage to choose from four different ways to buy Bitcoin.

1) Buy Bitcoin with Debit/Credit Card or Bank Transfer

From Buy Crypto, select the first drop-down option, One-Click Buy, to buy Bitcoin with just a single click. This convenient option allows you to pay in AUD with a debit or credit card or via a bank wire transfer.

2) Buy Bitcoin with P2P Trading

As mentioned, Bybit also has its own P2P Trading platform where you can buy Bybit using AUD directly from your preferred seller at zero fee with over 80 payment methods available.

3) Buy Bitcoin with Fiat Deposit and Balance Payment Service

If you prefer to use cash to transact, Bybit also offers the Fiat Deposit and Balance Payment Service, where you can transact with over 10 currency options. Do note, however, that AUD is not available for cash transactions.

4) Buy Bitcoin with Recurring Buy

With the Recurring Buy option, you can even make regular Bitcoin purchases if you intend to grow your Bitcoin investments. This method also does not include AUD as a currency option, however.

Ways To Earn More With Your Bitcoin

At Bybit, there are more things you can do with your Bitcoin than simply holding it in your wallet. You can choose to trade, stake or lend your Bitcoin to reap more profits from this crypto coin.

Trade Your Bitcoin

Professional traders can capitalize on Bitcoin price volatility through strategic trading approaches. Investors access multiple trading formats including spot markets and derivatives contracts:

- Spot Trading: Direct purchase and sale of Bitcoin at current market prices

- Derivatives Trading:

- Inverse Perpetual Contracts

- USDC Options Pairs

- Futures Contracts

Stake Your Bitcoin

Bybit Savings is a Bybit product that allows you to stake your Bitcoin to earn a yield with your Crypto assets. You can choose from a fixed term of 30 or 60 days of staking or a flexible term or a flexible term that lets you withdraw your staked Bitcoin anytime.

Lend Your Bitcoin

Another way to grow your Bitcoin assets passively is to lend your Bitcoin. By depositing your Bitcoin into Bybit’s BTC Asset Pool, you will earn an hourly interest payout, which may vary depending on the market conditions.

Key characteristics include:

- Hourly interest payouts

- Variable interest rates based on market conditions

- Minimal lock-up periods

- Low-risk passive income generation

Investors can deposit Bitcoin into designated asset pools to earn consistent returns without active trading involvement.

Is Bitcoin Taxable in Australia?

Cryptocurrencies are treated as property in Australia; hence, crypto is taxed under capital gains tax. Crypto transactions like buying and trading will be taxed, but holding a crypto will not get you taxed. For instance, you will not be taxed for carrying Bitcoin coins in your crypto wallet, and even transferring your Bitcoin assets from one wallet to another will not get you taxed, as it is not a transaction. A capital gains tax will only be triggered when you make a Bitcoin transaction, like buying, trading, or selling Bitcoin or even using Bitcoin to make purchases. If you hold any Crypto assets it may be worth speaking to a qualified accountant to advise you on your legal obligations and any beneficial practices you utilise.

Tax Implications for Bitcoin Transactions

Cryptocurrency transactions trigger tax events in several scenarios:

- Capital Gains Tax (CGT): Selling Bitcoin incurs capital gains tax calculations

- Profit Reporting: Investors must track and report profits from Bitcoin sales

- Exchange Reporting: All Australian crypto exchanges share customer data with the ATO

Compliance Strategies

Investors should:

- Maintain detailed transaction records

- Use crypto tax calculation software

- Consult tax professionals for complex cryptocurrency portfolios

- Understand CGT implications for each Bitcoin transaction

The ATO’s approach demonstrates Australia’s cautious stance toward cryptocurrency, emphasizing strict regulatory oversight and comprehensive financial reporting requirements. If your unsure about withdrawing Crypto or making use of your investment we suggest checking with a local accountant well versed in the tax code who can guide you on your rights and responsibilities.

Other considerations to note for each method

Cryptocurrency Exchanges

Cryptocurrency exchanges provide the most accessible entry point for Bitcoin purchases in Australia. Investors should evaluate exchanges based on three critical factors: security, AUD acceptance, and transaction fees.

Key considerations for selecting an exchange include:

- Security protocols and historical performance

- Support for Australian dollar (AUD) transactions

- Competitive trading fee structures

- User-friendly interface

- Regulatory compliance with Australian financial standards

Reputable exchanges typically offer:

- Multiple cryptocurrency options

- Low transaction fees (0.1% – 0.5%)

- Robust identity verification processes

- Advanced trading features

- Integrated wallet services

Crypto Wallets

Crypto wallets enable direct cryptocurrency purchases and storage. Two primary wallet types exist:

- Hot Wallets (Online)

- Connected to the internet

- More convenient for frequent trading

- Lower security compared to cold storage

- Cold Wallets (Offline)

- Highest security level

- Physical storage device

- Recommended for long-term cryptocurrency holdings

- Requires careful private key management

Bitcoin ATMs

Bitcoin ATMs offer an alternative purchasing method across Australian cities:

| City | Estimated Bitcoin ATMs (2024) |

|---|---|

| Sydney | 162 |

| Melbourne | 144 |

Transaction characteristics:

- High transaction fees (up to 15%)

- Anonymous purchases

- Instant cryptocurrency acquisition

- Limited geographical availability

Peer-to-Peer Trading

Peer-to-peer (P2P) trading enables direct cryptocurrency transactions between individuals:

Advantages:

- Direct price negotiations

- Multiple payment method options

- Escrow payment protection

- Zero intermediary fees

Challenges:

- Potential transaction delays

- Lower liquidity

- Dependent on counterparty reliability

Over-The-Counter (OTC) Trading

OTC trading suits high-volume investors:

- Broker-mediated transactions

- Enhanced privacy

- Ideal for institutional investors

- Minimizes market price slippage

- Requires substantial trading volumes

- Select a reputable cryptocurrency exchange

- Complete identity verification

- Link payment method

- Determine investment amount

- Execute cryptocurrency purchase

- Transfer to secure wallet (optional)

Frequently Asked Questions

How easy is it to buy Bitcoin in Australia?

Buying Bitcoin in Australia is straightforward. Multiple reputable exchanges like CoinSpot, Independent Reserve, and Binance offer simple platforms for purchasing Bitcoin. You can buy Bitcoin using AUD through bank transfers, credit cards, or debit cards. Most exchanges have user-friendly interfaces, low transaction fees, and robust security measures, making cryptocurrency investment accessible for beginners and experienced investors alike.

What is the minimum amount I can invest in Bitcoin?

In Australia, you can start investing in Bitcoin with as little as $20-$50. Most cryptocurrency exchanges allow fractional Bitcoin purchases, meaning you don’t need to buy a whole Bitcoin. This low entry barrier enables investors to start small and gradually build their cryptocurrency portfolio. By using dollar-cost averaging strategies, you can invest consistently without significant financial risk.

Are Bitcoin investments taxable in Australia?

Yes, Bitcoin investments are taxable in Australia. The Australian Taxation Office (ATO) treats cryptocurrencies as property, requiring investors to report capital gains and losses. When you sell, trade, or exchange Bitcoin, you’ll need to calculate and report any profits. Tax events include selling Bitcoin, trading for other cryptocurrencies, and using Bitcoin for purchases. Maintaining detailed transaction records is crucial for accurate tax reporting.

What are the safest ways to store Bitcoin?

The safest Bitcoin storage methods include hardware wallets (cold storage) and secure software wallets. Hardware wallets like Ledger and Trezor offer offline storage, protecting your cryptocurrency from online threats. Software wallets with two-factor authentication provide another secure option. Always use strong passwords, enable additional security features, and consider splitting your Bitcoin across multiple storage methods to minimize potential losses.

Can I buy Bitcoin through my bank in Australia?

Some Australian banks allow cryptocurrency purchases through their platforms or approved exchanges. Commonwealth Bank, for example, offers crypto trading options. However, not all banks directly support Bitcoin purchases. Most investors use third-party cryptocurrency exchanges linked to their bank accounts. Always check with your specific bank about their current cryptocurrency policies and transaction capabilities.

What payment methods can I use to buy Bitcoin?

Australian investors can purchase Bitcoin using various payment methods, including bank transfers, credit cards, debit cards, PayPal, and electronic payment systems. Most exchanges support multiple payment options with different transaction fees. Bank transfers typically have lower fees, while credit card purchases might incur higher transaction costs. Choose a payment method that balances convenience, speed, and affordability for your investment strategy.

Is Bitcoin a good investment for beginners?

Bitcoin can be a good investment for beginners if approached carefully. Start by investing small amounts, understanding market volatility, and conducting thorough research. Diversify your investment portfolio and only invest money you can afford to lose. Consider dollar-cost averaging to minimize risk. Educational resources, reputable exchanges, and professional financial advice can help beginners navigate cryptocurrency investments more confidently.

How do Bitcoin transaction fees work?

Bitcoin transaction fees vary depending on network congestion and the exchange platform. Fees typically range from 0.5% to 3.5% per transaction. Exchanges might charge trading fees, deposit fees, and withdrawal fees. Some platforms offer lower fees for higher trading volumes. Always compare fee structures across different exchanges and consider the total cost of your Bitcoin investment strategy.

What are the risks of investing in Bitcoin?

Bitcoin investment risks include price volatility, regulatory changes, cybersecurity threats, and market unpredictability. Cryptocurrency markets can experience rapid price fluctuations, potentially leading to significant financial losses. Regulatory environments may change, impacting Bitcoin’s value and trading capabilities. Cybersecurity risks like hacking and fraud are also potential concerns. Thorough research, risk management, and diversification can help mitigate these challenges.

Can I sell Bitcoin easily in Australia?

Selling Bitcoin in Australia is relatively simple through cryptocurrency exchanges. Most platforms offer instant selling options with quick bank transfers. Popular exchanges like Bybit, CoinSpot, Binance, and Independent Reserve provide seamless selling processes. You can convert Bitcoin to AUD and transfer funds directly to your bank account. Always consider transaction fees, exchange rates, and potential tax implications when selling Bitcoin.

Conclusion & Final Thoughts

For those looking to dip a toe in crypto, it is always advisable to start with Bitcoin since it is the biggest crypto in terms of market capitalization. There are many ways to get your hands on Bitcoin in Australia, but the easiest would be through a crypto exchange. Bybit is a safe and dependable crypto exchange that provides you with not one but four different ways to buy Bitcoin. Further, you can amplify your Bitcoin gains with Bybit by trading, staking or lending your Bitcoin. We hope all these tips on buying Bitcoin will help you get on a fruitful crypto journey!

Key Takeaways

- 🔒 Prioritize Security: Choose reputable Australian cryptocurrency exchanges with robust security protocols, identity verification processes, and compliance with local financial regulations.

- 💳 Multiple Purchase Methods: Investors can buy Bitcoin through diverse channels including cryptocurrency exchanges, Bitcoin ATMs, peer-to-peer platforms, and over-the-counter (OTC) trading, offering flexibility for different investment strategies.

- 💰 Flexible Investment Options: Start with small, fractional Bitcoin investments using local exchanges that support Australian dollars (AUD), with transaction fees typically ranging between 0.1% – 0.5%.

- 📊 Tax Compliance is Critical: The Australian Taxation Office (ATO) treats Bitcoin as property, requiring investors to report cryptocurrency transactions and potential capital gains accurately.

- 🛡️ Wallet Management: Select appropriate crypto wallets based on investment goals – hot wallets for frequent trading and cold wallets for long-term, secure cryptocurrency storage.

- 📈 Strategic Investment Approach: Consider dollar-cost averaging and explore additional earning strategies like Bitcoin staking and lending to maximize potential investment returns.

Disclaimer:

AGR Technology may receive a commission on sales generated by partner links on this page.Crypto assets can be highly volatile unregulated investment products and like any type of investment can increase or decrease in value. By no means is this article designed to be financial advice. While we vet each platform we mention on our website and provide regular content updates, we recommend that you conduct extensive research before making investment decisions, form your own opinion, and invest only what you can afford to lose because there is no such thing as a guarantee in investing.

Other related pages on our website:

Best Cryptocurrency platforms for Australians

List of popular Crypto exchanges for Norway users

Ranked list of the best Crypto apps & exchanges for Dubai users

Some of the best Crypto exchanges for New Zealanders

References & Citation(s):

31% having the intention to continue buying crypto in 2024 –

https://www.forbes.com/advisor/au/investing/cryptocurrency/cryptocurrency-statistics/#:~:text=Australian%20Investment%20in%20Cryptocurrency,female%20investor%20portfolios%20on%20average.

insolvency of one of the world’s leading exchanges, FTX – https://www.cnbc.com/2022/11/11/sam-bankman-frieds-cryptocurrency-exchange-ftx-files-for-bankruptcy.html

Bybit – https://www.bybit.com/en-US/

employs various safety features – https://learn.bybit.com/crypto/how-to-keep-your-cryptocurrency-safe/

20 in total as of 2022 – https://www.statista.com/statistics/1211780/bitcoin-atms-city-australia/#:~:text=Bitcoin%20ATMs%20in%20Australia%20are,largest%20city%20in%20the%20county.

at least KYC (Know Your Customer) Lv. 1 – https://www.bybit.com/en-US/help-center/s/article/Individual-KYC-FAQ

Inverse Perpetual – https://www.bybit.com/en-US/help-center/s/article/What-is-Inverse-Contract

USDC Options –

https://blog.bybit.com/en-US/post/everything-you-need-to-know-about-bybit-s-usdc-options-blt905124bb9461ab21/

Spot –

https://www.bybit.com/en-US/help-center/bybitHC_Article?id=4403393791897&language=en_US

Bybit Savings –

https://www.bybit.com/en-US/earn/savings/

taxed under capital gains tax – https://www.ato.gov.au/individuals/Investments-and-assets/crypto-asset-investments/how-to-work-out-and-report-cgt-on-crypto/

Image by <a href=”https://pixabay.com/users/elf-moondance-19728901/?utm_source=link-attribution&utm_medium=referral&utm_campaign=image&utm_content=7156877″>Moondance</a> from <a href=”https://pixabay.com//?utm_source=link-attribution&utm_medium=referral&utm_campaign=image&utm_content=7156877″>Pixabay</a>

Image by <a href=”https://pixabay.com/users/mohamed_hassan-5229782/?utm_source=link-attribution&utm_medium=referral&utm_campaign=image&utm_content=3669795″>Mohamed Hassan</a> from <a href=”https://pixabay.com//?utm_source=link-attribution&utm_medium=referral&utm_campaign=image&utm_content=3669795″>Pixabay</a>

Image by <a href=”https://pixabay.com/users/sandra_schoen-53876/?utm_source=link-attribution&utm_medium=referral&utm_campaign=image&utm_content=341419″>Sandra Schön</a> from <a href=”https://pixabay.com//?utm_source=link-attribution&utm_medium=referral&utm_campaign=image&utm_content=341419″>Pixabay</a>

https://www.statista.com/statistics/1211780/bitcoin-atms-city-australia/

QR Code of this blog post for mobile visitors:

Alessio Rigoli is the founder of AGR Technology and got his start working in the IT space originally in Education and then in the private sector helping businesses in various industries. Alessio maintains the blog and is interested in a number of different topics emerging and current such as Digital marketing, Software development, Cryptocurrency/Blockchain, Cyber security, Linux and more.

Alessio Rigoli, AGR Technology

![logo-new-23[1] logo-new-23[1]](https://agrtech.com.au/wp-content/uploads/elementor/thumbs/logo-new-231-qad2sqbr9f0wlvza81xod18hkirbk9apc0elfhpco4.png)