Disclaimer: General information only. All kinds of investment (particularly trading CFDs, Cryptocurrency, commodities, and FX) involve significant risk, including the possibility of losing more than the amount invested, as well as market volatility and liquidity hazards. Past performance does not guarantee future results. This page contains sponsored links whereby we may receive compensation at no cost to you.

Finding profitable investment opportunities in today’s volatile market requires powerful tools. AI stock screeners have revolutionized how investors filter through thousands of stocks to identify potential winners based on specific criteria and patterns that human analysis might miss.

These intelligent platforms leverage machine learning algorithms and natural language processing to analyze market data, financial statements, and even social sentiment in real-time. Unlike traditional stock screeners, AI-powered alternatives can adapt to changing market conditions, recognize complex patterns, and even predict potential price movements with remarkable accuracy.

The best AI stock screeners combine cutting-edge technology with user-friendly interfaces, making sophisticated investment research accessible to both novice and experienced traders. This article examines the top AI stock screening tools that are transforming how investors discover profitable opportunities in February 2026.

Top AI-Powered Stock Screeners Revolutionizing Investment Research for February 2026

1. Trade Ideas

Trade Ideas stands out as a pioneer in AI-powered stock screening with its virtual analyst, “Holly.” This sophisticated platform scans over 8,000 stocks daily using more than 70 algorithms to identify profitable trading opportunities. Holly analyzes market patterns, technical indicators, and price movements to generate actionable trade ideas with impressive accuracy rates of up to 60% in favorable market conditions.

The platform offers real-time alerts and customizable scanning parameters that adapt to changing market conditions. What makes Trade Ideas particularly valuable is its backtesting capabilities, allowing investors to test strategies against historical data before risking real capital. Subscription plans start at $84/month, making it ideal for active traders and serious investors seeking AI-driven market insights.

Trade Ideas is a comprehensive trading platform focused on advanced stock scanning, AI-powered trade assistance, and multi-window market analysis. It caters to traders who seek real-time insights, customizable technical tools, and a structured environment to identify trading opportunities in U.S. equities.

Pros:

Advanced Stock Scanner: Trade Ideas offers a highly configurable stock scanner that continuously updates in real-time. Traders interested in momentum trading, technical pattern recognition, or volume-based setups will find this tool particularly useful for filtering through thousands of U.S. stocks and ETFs to pinpoint potential trade candidates efficiently.

AI-Driven Trade Recommendations: The platform’s artificial intelligence system, known as “Holly,” analyzes market data from multiple angles—including technical, fundamental, and social sentiment—to generate trade ideas with suggested entry and exit points. Active traders who appreciate algorithmic support for decision-making and reducing emotional bias can leverage these AI strategies to enhance their trading routines.

Multi-Window Layout and Channel Bar: Trade Ideas supports multiple customizable windows within the workspace, enabling users to monitor various market segments simultaneously, such as top gainers, losers, RSI extremes, and sector ETFs. Traders who prefer comprehensive market overviews and multi-tasking will benefit from this feature to manage diverse watchlists effectively.

Simulated Trading and Backtesting Tools: The platform includes paper trading and backtesting functionality, allowing users to practice strategies without financial risk and validate their approaches with historical data. This is ideal for beginners honing their skills, educators demonstrating concepts, and experienced traders refining strategy parameters.

Integrated Trade Execution (Brokerage Plus): By connecting compatible brokerage accounts, users can place trades directly from Trade Ideas, reducing the time between idea identification and execution. Day traders and swing traders who prioritize speed and workflow efficiency will find this integration valuable for capitalizing on timely opportunities.

Extensive Training and Educational Resources: Trade Ideas provides access to live trading rooms, video tutorials, user guides, and daily support sessions. Traders new to technical analysis or those seeking continuous learning will appreciate these resources to build confidence and deepen their market understanding.

Cons:

Limited Asset Coverage: Trade Ideas currently focuses exclusively on U.S. stocks and ETFs, without support for other asset classes such as futures, forex, or cryptocurrencies. Traders requiring multi-asset or international market exposure might need to supplement with other platforms.

Learning Curve and Interface Complexity: The platform’s rich functionality and customizable workspace require an initial investment of time to master. Traders who prefer simple or minimalist interfaces may find it challenging to navigate and optimize their workflow without dedicated study.

Subscription Cost: Trade Ideas is a subscription-based service with pricing that reflects its advanced features. Traders with budget constraints or those seeking more basic scanning tools might consider alternative options.

No Native Mobile Application: While browser and desktop versions are available, Trade Ideas lacks a dedicated mobile app. Traders who require on-the-go access may find this limiting for real-time monitoring outside of a desktop environment.

Automated Trading Overrides: The platform supports automated trading strategies based on AI recommendations; however, this can sometimes reduce direct user control over individual trade decisions. Traders valuing hands-on discretion should weigh the balance between automation and manual intervention.

No Standalone Trade Execution Without Broker Link: Trade Ideas does not execute trades independently and requires linkage to supported brokers for order placement. Users must maintain brokerage accounts with compatible firms to take advantage of integrated trading features.

2. Trendspider

TrendSpider is a technical analysis platform designed to assist traders and investors in making more informed decisions through a range of advanced charting and automation tools. The software specializes in automating aspects of technical analysis that are traditionally manual and time-consuming, such as identifying chart patterns, drawing trendlines, and backtesting trading strategies.

The platform supports multiple asset classes, including equities, forex, futures, and cryptocurrencies, allowing users to scan and analyze diverse markets with real-time data. With a strong emphasis on customization, TrendSpider offers over 190 technical indicators, multi-timeframe and multi-symbol charting, and the ability to create personalized alerts and trading bots without coding expertise.

TrendSpider is tailored toward users who seek to integrate automated technical tools into their workflow, such as experienced traders, quantitative analysts, and technically savvy investors. While the platform provides a rich feature set, its complexity and learning curve may present challenges for beginners or traders who prefer simpler, more intuitive interfaces.

Pros:

-

Automation and Efficiency: Automated pattern recognition, multi-factor alerts, and trading bots streamline analysis and reduce manual effort.

-

Customizable Analysis: Extensive charting options, scripting, and backtesting capabilities allow traders to tailor strategies precisely.

-

Wide Market Coverage: Supports multiple asset types and offers real-time scanning across broad markets.

-

Advanced Visual Tools: Features like Raindrop™ charts and volume profile add depth to technical analysis.

-

Multi-Timeframe & Multi-Symbol Views: Facilitates monitoring several markets and timeframes concurrently for comprehensive insight.

Cons:

-

Complex Interface: The extensive toolset results in a steep learning curve and can be overwhelming for new users.

-

No Direct Trading: Lack of broker integration means trades must be placed through separate platforms.

-

Cost and Tier Limitations: Pricing plans restrict access to advanced features in lower tiers and can be expensive for full access.

-

Navigation Challenges: Deeply nested menus and hidden options require users to invest time in mastering platform workflows.

Video showcasing the platform:

2. Tickeron

Tickeron combines artificial intelligence with comprehensive market analysis tools to deliver a powerful stock screening experience. The platform’s AI Robots analyze patterns across multiple timeframes, generating buy and sell signals with specific entry and exit points. These robots evaluate over 10,000 stocks daily, providing probability scores for each trading opportunity.

What sets Tickeron apart is its natural language processing capabilities, which translate complex market data into easy-to-understand insights. The platform offers AI-driven trend predictions, pattern recognition, and fundamental analysis in one unified dashboard. With subscription options starting at $29.95/month, Tickeron provides excellent value for both novice traders learning the ropes and experienced investors seeking algorithmic confirmation of their strategies.

Tickeron is a versatile AI-powered trading platform designed to assist investors and traders by integrating advanced quantitative analysis and algorithmic tools into their decision-making process. The platform combines artificial intelligence with big data to provide sophisticated pattern recognition, predictive analytics, automated trading bots, and portfolio management solutions.

At its core, Tickeron aims to democratize access to tools historically reserved for institutional investors and quant funds, making complex trading strategies more accessible to retail traders, active investors, and quantitative strategists alike. Users benefit from real-time market scanning across multiple asset classes including stocks, ETFs, forex, and cryptocurrencies, enabling a comprehensive view of market opportunities.

The platform’s AI algorithms are trained on extensive historical and real-time data to identify meaningful chart patterns and trends. By assigning confidence and likelihood scores to each signal, Tickeron helps users prioritize the most promising setups while reducing manual chart analysis workload. This approach facilitates both technical and quantitative analysis, catering to a range of trading styles from day trading and swing trading to longer-term investing.

One standout feature is Tickeron’s AI Robots — customizable automated agents capable of executing trades based on defined strategies. These bots can adapt to changing market conditions and allow traders to maintain an active presence without continuous monitoring. Complementing these are AI Portfolios, which offer actively managed investment baskets driven by machine learning models targeting specific investment themes or risk profiles. This makes the platform suitable for investors seeking diversified, low-maintenance exposure with dynamic rebalancing.

Beyond the core trading tools, Tickeron includes a marketplace that fosters a community-driven ecosystem where users can buy and sell custom-built algorithms, pattern scanners, and trading models. This collaborative environment supports users without programming expertise and offers an additional layer of strategy curation and validation through performance metrics and user feedback.

Tickeron also provides backtesting capabilities, risk management features, and educational resources designed to enhance users’ trading knowledge and confidence. The platform’s mobile app and user-friendly interface facilitate on-the-go market monitoring, though navigating the breadth of available tools may require a learning period.

Pros:

-

AI-powered pattern recognition and trend prediction assist active and technical traders in identifying high-probability setups efficiently.

-

Customizable AI Robots enable automated trading strategies adaptable to market conditions.

-

AI Portfolios provide actively managed, theme-based investment options for diversification seekers.

-

The marketplace offers a unique way for users to access or monetize quantitative tools and strategies.

-

Comprehensive backtesting and risk management support strategy development and risk mitigation.

Cons:

-

The platform’s extensive features and data can be complex for beginners and may require time to master.

-

Premium features are locked behind higher subscription tiers, which may be cost-prohibitive for some users.

-

Limited third-party integrations restrict seamless connectivity with external brokerages or tools.

-

The wealth of information can be overwhelming, necessitating customization for an optimal user experience.

Video overview of the platform:

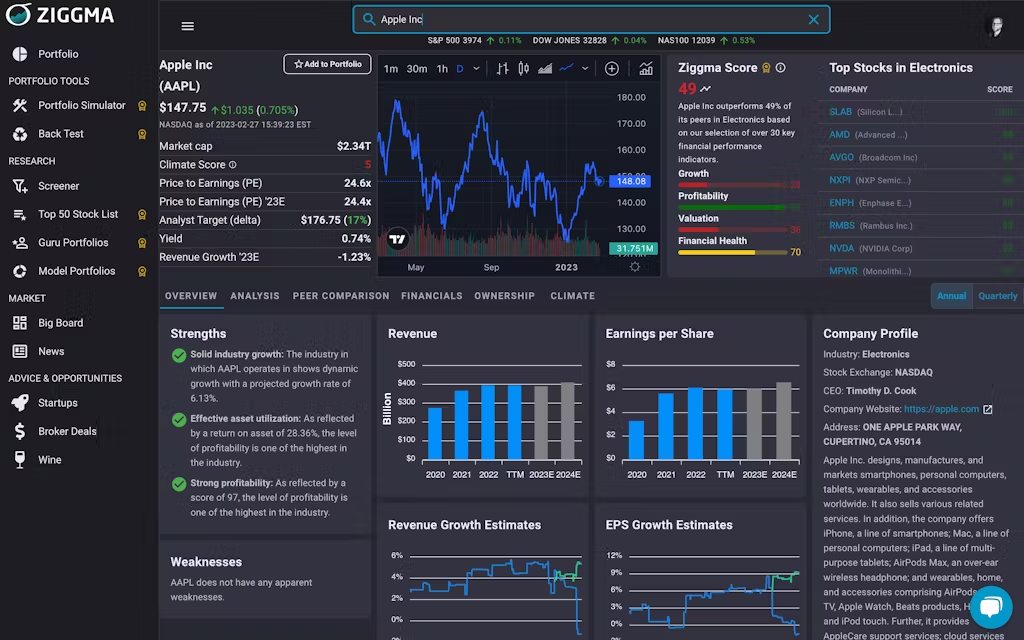

3. Ziggma

Ziggma stands out with its proprietary AI-driven stock rating system that evaluates companies across 25 financial metrics. The platform assigns quality scores from 0-100 based on fundamental analysis, growth metrics, valuation models, and technical indicators. Research shows that stocks with Ziggma quality scores above 80 have historically outperformed the S&P 500 by an average of 12% annually.

Beyond its scoring system, Ziggma offers portfolio analysis tools that identify concentration risks and suggest optimization strategies. Its natural language processing capabilities scan financial news and earnings calls to extract sentiment data, providing additional context for investment decisions. With plans starting at $9.90/month, Ziggma represents one of the most affordable entry points into AI-powered investment research.

Pros:

Streamlined Portfolio Tracking: Investors who manage multiple accounts can benefit from Ziggma’s account aggregation feature, which consolidates holdings into a single dashboard. This enables clearer visibility across stocks, ETFs, and dividends, simplifying portfolio monitoring without the need for manual updates.

Algorithm-Based Scoring System: Users interested in data-driven investment decisions can utilize Ziggma’s proprietary scoring model, which evaluates company fundamentals and portfolio diversification. This feature supports informed assessments by highlighting potential strengths and risks within the portfolio.

Portfolio Simulator: Those focused on understanding portfolio risk and potential return scenarios will find the portfolio simulator helpful. It allows investors to model adjustments and project possible outcomes, aiding in the refinement of investment strategies with a practical forecasting tool.

Multi-Tier Pricing Plan: Ziggma offers different pricing tiers, accommodating various investor needs—from individuals looking for basic portfolio insights on a limited budget to those requiring access to more advanced analytics and account linking. This flexible structure helps users select plans aligned with their investment goals and resource availability.

Cons:

No Trade Execution Capability: Ziggma serves as an analysis and management tool rather than a brokerage platform. Investors who require direct buying or selling of securities must use separate trading accounts in conjunction with the software.

Limited Advanced Features: While the platform provides core portfolio management functions, users seeking comprehensive technical analysis or advanced screening beyond fundamental data may find some limitations in the available tools.

Limited Support Options: Ziggma’s customer support is primarily online, which might affect users who prefer direct, real-time assistance through additional channels such as phone or live chat.

Product screenshot:

4. FINVIZ Elite

FINVIZ Elite enhances the popular free stock screener with advanced AI capabilities and real-time data. The platform utilizes machine learning algorithms to identify correlations between various market indicators that human analysts might miss. Its heatmap visualization tools provide instant insights into sector performance and market trends.

The backtesting feature allows investors to evaluate how specific screening criteria would have performed historically, with data suggesting strategies tested on FINVIZ Elite have shown up to 25% improvement in accuracy compared to traditional screening methods. At $39.96/month, FINVIZ Elite offers an excellent balance of sophisticated AI analysis and user-friendly interface, making complex market data accessible to investors at all levels.

Pros:

Data Visualization Tools: FINVIZ offers interactive heatmaps, sector maps, and detailed charts that visually represent market trends, performance, and capitalization. These visualization tools help traders and investors quickly grasp market conditions and identify potential opportunities by simplifying complex datasets into intuitive graphics.

Ideal for: Visual learners, swing traders, portfolio managers, and anyone who benefits from clear, visual representations of market data.

Robust Stock Screening: With a broad range of fundamental and technical criteria, the platform’s stock screener enables filtering through thousands of equities and ETFs. Users can tailor searches with filters such as price, volume, sector, technical indicators, and fundamental metrics, allowing personalized strategy development.

Ideal for: Active traders, swing traders, long-term investors, and analysts seeking to identify specific stock characteristics.

Real-Time and Pre-Market Data (Elite Subscription): The Elite tier provides access to up-to-date quotes and market movements, including pre-market and after-hours data. This feature supports timely decision-making based on current market conditions.

Ideal for: Day traders, swing traders, and active investors who require immediate market insights.

Portfolio Management and Alerts

Users can create multiple portfolios and watchlists, track individual stock performance, and set alerts for price changes or news updates. This supports ongoing monitoring and strategic adjustments.

Ideal for: Investors managing diversified holdings and traders seeking to automate market monitoring.

Cryptocurrency and Forex Screening

Beyond equities, FINVIZ offers tools to screen and analyze cryptocurrencies, futures, and Forex markets, providing multi-asset coverage for diversified portfolios.

Ideal for: Traders and investors with interests in alternative asset classes seeking consolidated market data.

Financial News Aggregation

The platform curates news from reputable financial outlets, delivering relevant market updates connected to specific stocks or sectors. This integration helps users stay informed about market-moving events.

Ideal for: All market participants requiring timely context and updates to supplement technical and fundamental analysis.

Cons:

Limited Fundamental Metrics Compared to Some Platforms: While FINVIZ provides a solid range of fundamental data, some users may find the scope of available fundamental metrics narrower than specialized financial databases or research platforms.

Consideration for: Fundamental analysts and value investors who require deep, granular financial statement data.

Advertising in the Free Version: The free tier includes advertisements that can interrupt the user experience and potentially slow navigation.

Consideration for: Casual users or those beginning to explore stock screening tools who may find ads distracting.

Absence of a Dedicated Mobile Application: FINVIZ does not currently offer a standalone mobile app, relying instead on mobile browser access for on-the-go usage.

Consideration for: Traders and investors needing seamless, optimized mobile access for quick decisions and market tracking.

Backtesting and Historical Scan Limitations: The platform’s backtesting tool offers historical data analysis but lacks the ability to run continuous historical scans or fully automate strategy testing.

Consideration for: Quantitative traders or algorithmic investors seeking comprehensive backtesting and historical data functionalities.

5. EquitySet

EquitySet leverages deep learning algorithms to analyze corporate financial statements, identifying discrepancies and potential red flags that traditional analysis might miss. The platform’s AI engine processes over 10 years of historical financial data for each company, creating predictive models that forecast earnings trends with remarkable accuracy—in some cases predicting earnings surprises up to 72 hours before official announcements.

What makes EquitySet unique is its sentiment analysis capabilities, which process thousands of news articles, social media posts, and analyst reports to gauge market perception. The platform offers customizable alerts based on both fundamental changes and sentiment shifts, giving investors a comprehensive view of potential catalysts. At $99/month, EquitySet caters to serious investors who value in-depth fundamental analysis enhanced by artificial intelligence.

Pros:

Sentiment Analysis for Market Insight: EquitySet processes sentiment from news articles and social media platforms to help users gauge public and market mood around stocks. This feature benefits fundamental investors and portfolio managers seeking to complement traditional analysis with real-time sentiment trends.

Earnings Call Transcript Analysis for Fundamental Research: By analyzing earnings call transcripts, EquitySet offers users detailed insights into company performance and management tone, valuable for investors focused on long-term value and fundamental stock evaluation.

Unusual Options Activity Detection for Advanced Signals: Detecting atypical options trading patterns allows more experienced traders and analysts to identify potential shifts in market expectations or investor sentiment, supporting more nuanced decision-making.

Pattern Recognition Across Multiple Data Sources for Comprehensive Analysis: The platform integrates diverse data sets, allowing users to identify trends and correlations that may not be evident from single data sources. This feature is useful for data-driven investors looking to enhance their research depth.

Custom Alert System for Timely Updates: EquitySet’s alert system enables users to personalize notifications based on specific criteria, helping active investors stay informed about market developments relevant to their portfolio or watchlist.

Cons:

Information Density May Require Time to Navigate: The platform provides a rich set of data points and analyses which might feel overwhelming initially. Users new to alternative data or comprehensive market analytics may need to spend time familiarizing themselves with the interface and features.

Limited Focus on Short-Term and Day Trading Strategies: EquitySet is primarily designed for fundamental and longer-term investment approaches, making it less suited for traders looking for intraday or very short-term market signals.

6. Stock Rover

Stock Rover combines traditional screening capabilities with AI-powered analytics to help investors identify quality stocks for long-term portfolios. The platform’s proprietary algorithms evaluate companies based on growth, value, quality, and sentiment metrics, assigning composite scores that simplify comparison across different sectors.

Its correlation analysis feature uses machine learning to identify relationships between stocks in your portfolio, highlighting potential diversification issues. The platform’s research reports, generated through natural language processing, summarize key financial data and analyst opinions in easily digestible formats. With plans starting at $7.99/month, Stock Rover offers exceptional value for fundamental investors seeking AI assistance in building stable, diversified portfolios.

Pros:

Comprehensive Stock and Fund Screening: Stock Rover offers a broad and flexible stock and fund screening system featuring hundreds of financial metrics and pre-built screens. Investors who prioritize detailed fundamental analysis and want to filter stocks or ETFs based on various criteria will find this feature especially valuable. Users can also customize screening criteria to fit their unique investment strategies.

Advanced Portfolio Management and Analysis: With seamless brokerage integration, Stock Rover enables users to connect their portfolios directly, making it easier to track performance, analyze diversification through correlation testing, and identify portfolio risks. Investors focused on portfolio optimization, rebalancing, or long-term wealth management benefit from these tools.

Rich Charting and Visualization Tools: Stock Rover’s charting capabilities allow users to plot multiple fundamental metrics and compare securities or portfolios visually. Traders and investors who prefer data-driven decision-making and want to analyze trends beyond price movements will appreciate the ability to visualize key financial indicators alongside market data.

User-Friendly Interface with Pre-Built Research Tools: The platform is designed with accessibility in mind, providing pre-built research tools such as quality scores and well-known investment strategies. New investors and those without extensive finance backgrounds can leverage these resources to gain insight without needing to build complex models from scratch.

Cross-Device Web-Based Application: Being fully web-based, Stock Rover operates smoothly across desktops, tablets, and mobile devices. Users who need flexible access to their investment data and research, whether at home or on the go, benefit from this adaptability.

Educational Resources and Support: Stock Rover includes a library of educational content, including videos and webinars, to support users in developing their investing skills. Beginner to intermediate investors can use these resources to better understand investment metrics and enhance their analysis techniques.

Cons:

Focused on North American Markets: The platform’s data and analysis capabilities primarily cover North American stocks, ETFs, and funds. Investors interested in international or global market coverage might find the scope limiting.

No Real-Time Market Data: Stock Rover does not provide real-time price data or intraday updates, focusing instead on end-of-day data and fundamental metrics. This means active day traders or those requiring real-time technical signals may prefer platforms tailored to intraday trading.

Understanding AI Stock Screeners and Their Advantages

AI stock screeners represent a significant advancement in investment technology, leveraging artificial intelligence and machine learning to transform how investors analyze market opportunities. These sophisticated tools process vast amounts of data in real-time, helping investors make more informed decisions with greater efficiency than traditional screening methods.

How AI Technology Enhances Stock Screening

AI technology elevates stock screening capabilities through several revolutionary features:

- Lightning-fast data processing enables investors to analyze hundreds of criteria simultaneously, identifying trading opportunities in seconds rather than hours. This computational power far exceeds human capabilities, allowing for immediate strategy adjustments as market conditions change.

- Deep learning algorithms uncover hidden patterns and correlations in market data that would typically remain invisible to human analysts. These algorithms continuously learn from new information, improving their predictive accuracy over time.

- Real-time analytics monitor market movements, company financials, and news developments simultaneously, providing instant updates on potential investment opportunities. The speed of this analysis gives investors a significant edge in fast-moving markets.

- Sentiment analysis tools evaluate social media, news articles, and financial reports to gauge market and investor sentiment toward specific stocks. This alternative data source offers valuable insights beyond traditional financial metrics.

- Backtesting capabilities allow investors to test their strategies against historical data, measuring potential performance before risking actual capital. These simulations help refine investment approaches based on objective results rather than assumptions.

Key Features to Look for in AI Stock Screeners

When selecting an AI stock screener, investors should prioritize these essential features:

- Customizable screening criteria enable users to set specific parameters tailored to their investment strategy. The best platforms offer extensive customization options for both technical and fundamental metrics, allowing for precise stock filtering.

- Comprehensive data integration combines traditional financial metrics with alternative data sources such as social sentiment, institutional ownership changes, and news analysis. This holistic approach provides a more complete view of potential investments.

- Real-time alerts and notifications inform users immediately when stocks meet their pre-defined criteria or when significant market events occur. These timely updates ensure investors never miss important trading opportunities.

- Technical and fundamental analysis tools provide multiple perspectives on stock performance, including chart patterns, financial ratios, and growth metrics. The combination of these analytical approaches delivers more balanced investment insights.

- Automated trading capabilities allow for hands-free execution of trades based on AI-identified opportunities. These features typically include risk management settings to protect capital during volatile market conditions.

- Intuitive visualization tools transform complex data into easily digestible charts, heatmaps, and graphs. These visual representations help investors quickly understand market trends and stock performance relative to peers.

- Accessibility across devices ensures investors can monitor their watchlists and receive alerts whether they’re at their desk or on the go. Mobile optimization has become increasingly important for active traders who need constant market access.

Trade Ideas: The Pioneer in AI-Driven Market Intelligence

Trade Ideas stands out as an industry leader in AI-powered stock screening technology, offering sophisticated tools that transform how traders identify market opportunities.

Trade Ideas’ Holly AI and Backtesting Capabilities

Holly AI revolutionizes the stock screening process by analyzing hundreds of trading criteria at exceptional speed. This powerful AI assistant is specifically designed for day traders who need to make quick, data-driven decisions in fast-moving markets. Holly AI doesn’t just identify potential trades—it continuously learns and adapts to market conditions, providing increasingly refined recommendations over time.

Trade Ideas’ comprehensive backtesting features allow traders to validate their strategies before risking real capital. Users can test their trading hypotheses against historical market data to measure potential effectiveness, identify weaknesses, and optimize parameters. This robust backtesting environment helps traders develop confidence in their approaches while reducing the likelihood of costly mistakes in live trading scenarios.

Real-Time Alerts and Scanner Technology

Trade Ideas delivers cutting-edge real-time alert capabilities that notify users the moment a stock meets their predefined criteria. These alerts can be customized based on price movements, volume spikes, technical indicators, or pattern formations, ensuring traders never miss potential opportunities that align with their strategies.

The platform’s advanced scanner technology works tirelessly to identify trading opportunities across the entire market landscape. What sets Trade Ideas apart is its ability to conduct pre-market and post-market scans, giving traders a significant edge by capturing potential trades outside regular trading hours. This extended coverage helps users prepare for market opens, react to after-hours news events, and develop more comprehensive trading plans based on complete market activity.

TrendSpider: Advanced Pattern Recognition for Technical Traders

TrendSpider stands out as a powerful AI stock screener specifically designed for technical traders who rely on chart patterns and trend analysis for their investment decisions. Its sophisticated algorithms and automated features make it an essential tool for traders seeking to identify profitable opportunities through technical analysis.

Automated Trendline Detection and Analysis

TrendSpider’s automated trendline detection capabilities revolutionize how traders identify key support and resistance levels. The platform uses advanced AI algorithms to automatically recognize and draw trendlines across charts, eliminating human error and bias from the equation. This feature saves traders countless hours of manual chart analysis while providing more accurate and consistent results. The system can detect multiple trendline types simultaneously, including historical patterns that might be missed by the human eye, giving traders a comprehensive view of potential price movements and key reversal points.

Multi-Timeframe Analysis Capabilities

The multi-timeframe analysis tools in TrendSpider enable traders to examine charts across various time periods at once, providing a more complete picture of market trends. This powerful feature allows users to identify correlations between different timeframes, from minute charts to weekly and monthly views, all on a single screen. By analyzing multiple timeframes simultaneously, traders can confirm trends, spot divergences, and make more informed decisions about entry and exit points. This holistic approach helps technical traders avoid false signals that might appear when looking at just one timeframe in isolation, ultimately improving trading accuracy and confidence.

Stock Rover: Comprehensive Fundamental Analysis with AI Integration

Stock Rover leverages artificial intelligence to enhance its robust fundamental analysis capabilities, giving investors deeper insights into financial data that traditional screeners might miss. This powerful platform combines AI algorithms with comprehensive stock research tools to help investors make more informed decisions.

Portfolio Management and Performance Tracking

Stock Rover offers advanced portfolio management tools that utilize AI to track investment performance across multiple metrics. Investors can monitor their portfolios in real-time with detailed analytics showing allocation breakdowns, risk assessments, and performance against key benchmarks. The platform’s AI algorithms continuously analyze portfolio holdings to identify potential weaknesses, strengths, and correlation issues that might affect overall performance.

Users can create unlimited watchlists and portfolios, allowing them to test different investment strategies before committing real capital. The performance tracking features include customizable reporting dashboards that display critical metrics like total return, dividend yield, and volatility measurements. Stock Rover’s correlation analysis helps investors build truly diversified portfolios by highlighting hidden connections between seemingly unrelated assets.

Research Reports and Screening Templates

Stock Rover’s AI-enhanced research reports provide comprehensive analyses that compile fundamental data, growth metrics, and valuation indicators into easily digestible formats. These reports include proprietary ratings for value, growth, and quality factors, helping investors quickly evaluate potential opportunities. The platform updates these reports daily, incorporating new market data and company announcements to ensure investors have the most current information.

The screening templates represent one of Stock Rover’s most powerful AI-integrated features. Users can access dozens of pre-built templates targeting specific investment strategies like dividend growth, value investing, or momentum trading. Each template incorporates complex filtering criteria that would take hours to build manually. Advanced users can customize these templates or create entirely new screens using over 650 metrics and indicators. The AI system remembers frequently used criteria and can suggest refinements based on historical performance of similar screens, continuously improving results over time.

Tickeron: AI-Powered Trade Ideas and Pattern Recognition

Tickeron stands out in the crowded AI stock screener market by combining sophisticated pattern recognition technology with community-driven insights to help traders make more informed decisions.

AI-Driven Trend Predictions and Pattern Detection

Tickeron’s platform leverages advanced AI algorithms to analyze historical market data and identify potential trading opportunities with remarkable accuracy. The system excels at detecting various technical chart patterns including head and shoulders, double tops, triangles, and flags that human traders might miss. These pattern recognition capabilities help investors spot potential market movements before they occur, giving them a significant edge in timing their entries and exits.

The AI engine constantly monitors thousands of stocks simultaneously, providing real-time alerts when it identifies high-probability trading setups. Unlike traditional screeners, Tickeron’s AI adapts to changing market conditions and learns from new data patterns, continually improving its prediction accuracy. Traders receive detailed analysis of each potential trade, including risk assessment metrics and projected price targets based on historical pattern performance.

Educational Resources and Trading Community

Tickeron doesn’t just provide trade signals—it also focuses on educating users to become better traders. The platform offers comprehensive tutorials, webinars, and knowledge base articles that explain the underlying principles behind various trading strategies and technical patterns. These educational resources help users understand not just what trades to make, but why they should consider them.

The platform’s trading community feature creates a collaborative environment where investors can share insights, discuss trading strategies, and learn from experienced traders. This social element distinguishes Tickeron from many competitors, creating a space where knowledge is exchanged and refined. Users can follow top-performing traders, view their strategies, and even copy successful trades, making it an invaluable resource for both beginners looking to learn and experienced traders seeking new perspectives.

Seeking Alpha: Natural Language Processing for Investment Research

Sentiment Analysis and News Filtering

Seeking Alpha leverages sophisticated natural language processing technology to analyze vast amounts of financial news, research reports, and social media content. The platform’s AI algorithms scan through thousands of articles daily, extracting key sentiment indicators that might impact stock performance. This powerful sentiment analysis capability helps investors identify potential market-moving trends before they become mainstream knowledge. Unlike traditional news aggregators, Seeking Alpha’s NLP tools can detect subtle language patterns and contextual nuances in financial discussions, providing deeper insights into market sentiment that might be missed by human analysis alone.

Stock Ratings and Portfolio Integration

Seeking Alpha’s AI-powered stock rating system evaluates companies across multiple dimensions including value, growth potential, profitability, and momentum. The platform assigns quantitative ratings based on comprehensive financial data analysis, helping investors quickly identify investment opportunities aligned with their strategies. For portfolio integration, Seeking Alpha offers seamless tools that allow users to import existing holdings and receive personalized alerts when new research affects their investments. The platform’s portfolio analysis features use AI to highlight potential concentration risks, sector imbalances, and correlation issues that might not be immediately apparent to investors. This intelligent portfolio monitoring continuously tracks performance against benchmarks and suggests optimization opportunities based on the latest market conditions and sentiment data.

FINVIZ Elite: Visual Stock Screening with AI Elements

FINVIZ Elite stands out in the AI stock screening landscape with its powerful visualization tools and comprehensive market analysis capabilities. While not exclusively AI-focused, it incorporates intelligent elements that enhance the traditional screening experience for both novice and advanced traders.

Advanced Charting and Technical Analysis Tools

FINVIZ Elite provides sophisticated charting and technical analysis tools that surpass basic screening platforms. The system offers detailed interactive charts with over 50 technical indicators and drawing tools that help traders identify patterns and potential entry or exit points. Users can customize their technical analysis with multiple timeframes ranging from intraday to monthly views, enabling comprehensive trend analysis. The platform’s visual approach to technical indicators makes complex patterns more accessible, displaying support and resistance levels, moving averages, and volume analysis in an intuitive format that helps traders make more informed decisions.

Real-Time Data and News Integration

FINVIZ Elite delivers real-time market data and seamlessly integrates financial news to create a comprehensive trading environment. The platform features instant updates on stock prices, volume, and market movements without the 20-minute delay found in the free version. Its intelligent news aggregation system collects and categorizes financial news from various sources, highlighting potentially market-moving information relevant to specific stocks in a trader’s watchlist. The insider trading and institutional ownership tracking features provide valuable insights into smart money movements that could indicate future price direction. With customizable alerts for price movements, volume spikes, and breaking news, FINVIZ Elite ensures traders never miss critical market developments that could impact their investment decisions.

How to Choose the Right AI Stock Screener for Your Trading Style

Selecting the ideal AI stock screener requires careful consideration of your specific trading approach, goals, and budget. The right platform can dramatically improve your trading outcomes while the wrong choice may leave you with sophisticated tools that don’t match your needs.

Considerations for Day Traders vs. Long-Term Investors

Day traders and long-term investors have fundamentally different requirements when it comes to AI stock screeners. Day traders need tools that deliver lightning-fast analysis and real-time intelligence.

For day traders, platforms like Trade Ideas stand out with their ability to analyze hundreds of criteria at exceptional speed. Trade Ideas’ AI-powered virtual analyst “Holly” scans over 70 investment algorithms daily, providing immediate trade alerts that can be critical for capturing short-term opportunities. The platform’s pre-market and post-market scanning capabilities give day traders an edge when markets aren’t officially open.

TrendSpider is another excellent option for day traders, particularly those who rely heavily on technical analysis. Its automated chart pattern recognition eliminates human bias, while multi-time frame analysis helps traders confirm patterns across different timeframes simultaneously. The AI-powered trend line detection can identify support and resistance levels that might be missed by the human eye.

For long-term investors, platforms that focus on fundamental analysis and longer-term performance prediction deliver better value. Danelfin provides straightforward AI scoring (1-10) for stocks, indicating their likelihood of outperforming the market over a three-month period.

FINQ caters to long-term investors through deep learning models that analyze company financials, market conditions, and sentiment data from news and social media. Its four main AI-powered portfolios have consistently outperformed industry benchmarks, making it suitable for investors focused on long-term growth rather than daily fluctuations.

Pricing and Value Assessment

The cost of AI stock screeners varies significantly, requiring traders to evaluate the return on investment carefully:

Trade Ideas offers two main tiers:

- Standard: $118/month

- Premium (includes Holly AI): $228/month

While Trade Ideas commands premium pricing, it delivers highly accurate trade signals and advanced risk management tools. The platform’s educational resources provide significant value, though beginners should note there’s a steeper learning curve.

TrendSpider provides more accessible options:

- Basic: $39/month

- Premium: $79/month

TrendSpider offers excellent value for technical traders at a more affordable price point. It specializes in pattern recognition but provides limited fundamental data analysis.

Danelfin features a flexible pricing structure:

- Free tier: Access to top 10 daily stock recommendations

- Paid plans: Starting at $17/month with expanded features including detailed stock research

FINQ balances cost and capabilities:

- Starting at $29.17/month with a free trial period

- Focuses on sentiment analysis and alternative data sources

Other platforms like EquitySet, Tickeron, and VectorVest offer varying feature sets and pricing models to consider. EquitySet and Tickeron provide comprehensive analysis with customizable alerts, while VectorVest combines technical and fundamental analysis approaches.

When assessing value, consider not just the monthly cost but how the platform’s capabilities align with your trading strategy. Day traders might justify higher costs for real-time alerts and fast analysis, while long-term investors should evaluate platforms based on their historical performance record and depth of fundamental analysis.

Future Trends in AI Stock Screening Technology

Advanced AI Algorithms

AI stock screeners are rapidly evolving with sophisticated machine learning and deep learning models. These advanced algorithms analyze vast datasets including market conditions, company financials, and sentiment indicators. FINQ exemplifies this trend by using deep learning models that continuously refine predictions based on market trends and alternative data sources. The future of AI screening technology will likely see even more complex algorithms capable of identifying subtle market patterns invisible to human traders.

Real-Time Data Analysis

Real-time analysis capabilities are becoming increasingly powerful in AI stock screeners. Platforms like Trade Ideas and TrendSpider process enormous volumes of market data instantaneously to identify trading opportunities before they become widely recognized. This trend will accelerate as computing power increases, giving traders who use AI screeners a significant timing advantage in fast-moving markets.

Automated Trading and Risk Management

AI stock screeners are increasingly incorporating automated trading and sophisticated risk management features. Trade Ideas leads this trend with its fully automated trading bot and proprietary AI trade signals with SmartStop technology. Future developments will likely focus on more nuanced risk assessment models that automatically adjust position sizes based on volatility and market conditions.

Customization and Personalization

The future of AI stock screening lies in hyper-personalization. Tomorrow’s platforms will offer increasingly customizable filters and personalized scans tailored to individual trading styles. Users can already build custom scans based on specific technical indicators or fundamental metrics, but future systems will likely learn from user behavior to suggest optimized screening parameters automatically.

Integration with Brokerages

Seamless brokerage integration is becoming standard in advanced AI screening platforms. This trend facilitates direct trading from the analysis platform without switching between applications. Trade Ideas has pioneered this approach with connections to TradeZero and other brokers that enable AI-generated automatic trade signals. Future developments will likely expand these integrations to include more brokerages and more sophisticated order types.

Sentiment Analysis and Alternative Data

Sentiment analysis and alternative data sources are revolutionizing AI stock screening. By analyzing social media trends, news sentiment, and other non-traditional data, platforms like FINQ help investors make more informed decisions. This trend will accelerate as natural language processing technology improves, allowing screening platforms to effectively gauge market sentiment across multiple languages and platforms.

Backtesting and Strategy Optimization

Advanced backtesting capabilities will become increasingly sophisticated in future AI stock screeners. Platforms like Trade Ideas and TrendSpider already offer robust backtesting features, allowing users to test strategies against historical data. Future systems will likely incorporate more advanced simulation techniques, including Monte Carlo analysis and stress testing under various market conditions.

Community and Educational Resources

Trading communities integrated with AI screening platforms represent a significant future trend. BlackBoxStocks exemplifies this approach with its robust trading community featuring default chat capabilities. Future platforms will likely expand community features to include mentorship programs, strategy sharing, and collaborative filtering that leverages the collective intelligence of user groups.

Mobile Accessibility

Mobile-first design is becoming essential for AI stock screeners as traders demand anywhere, anytime access. TrendSpider leads this trend with comprehensive mobile applications that ensure traders can analyze data on the go. Future developments will likely include more sophisticated mobile interfaces with voice command capabilities and augmented reality features for visualizing market data.

Cost and Accessibility

While premium AI stock screening tools command higher prices, a parallel trend toward more accessible options is emerging. Trade Ideas offers free plan options, while platforms like Fidelity and Yahoo Finance provide basic stock screening tools at no cost. This democratization trend will likely continue with tiered pricing models that make basic AI screening capabilities available to retail investors while reserving the most advanced features for professional users.

Key Takeaways

- AI stock screeners leverage machine learning algorithms to analyze market data, financial statements, and social sentiment in real-time, identifying opportunities human analysis might miss

- Top platforms like Trade Ideas, Tickeron, and FINVIZ Elite combine sophisticated AI technology with user-friendly interfaces, with subscription costs ranging from $7.99 to $228 monthly

- The best AI stock screening tools offer customizable parameters, real-time alerts, comprehensive data integration, and advanced visualization tools for both technical and fundamental analysis

- Different platforms serve various trading styles – day traders benefit from Trade Ideas’ speed and real-time scanning, while long-term investors may prefer Stock Rover’s fundamental analysis focus

- AI-powered stock screeners have demonstrated impressive performance, with some platforms outperforming market benchmarks by significant margins

- Future trends in AI stock screening include advanced algorithms, automated trading integration, hyper-personalization, and expanded alternative data analysis capabilities

Conclusion: Leveraging AI to Gain a Competitive Edge in Stock Selection

AI stock screeners represent a watershed moment in investment technology enabling traders of all experience levels to harness sophisticated data analysis previously available only to institutional investors. These powerful tools transform overwhelming market information into actionable insights through machine learning algorithms pattern recognition and sentiment analysis.

The best platforms like Trade Ideas TrendSpider and Tickeron offer unique advantages tailored to specific trading styles whether you’re a day trader seeking split-second opportunities or a long-term investor focused on fundamental strength. As AI technology continues evolving these screeners will become increasingly personalized offering even deeper market insights.

Ultimately the right AI stock screener can dramatically improve investment outcomes by eliminating emotional bias identifying overlooked opportunities and helping investors stay ahead of market trends in our increasingly data-driven financial landscape.

Note: This is not financial advice and is just designed to provide general information. While we run our own checks and assess each company included on our website, we may not have covered all options. If you decide to apply for a product, you will interact directly with the vendor, not AGR Technology. AGR Technology suggests that you read the appropriate PDS or offer documents before accepting any financial product offer to assess whether the products are suitable for you. Target Market Determinations are available on the provider’s website.

AGR Technology may receive a commission on sales generated by partner links on this page, but this has no influence on our opinions or evaluations and is completely free of charge to you. While we make every attempt to keep our content up-to-date this should not be taken as financial advice, be sure to seek professional advice if required.

Frequently Asked Questions

What is an AI stock screener?

An AI stock screener is a sophisticated investment tool that uses artificial intelligence, machine learning, and natural language processing to analyze market data, financial statements, and social sentiment in real-time. Unlike traditional screeners, AI-powered versions can adapt to market changes and predict price movements with higher accuracy, giving investors a technological edge in identifying profitable opportunities.

How do AI stock screeners differ from traditional stock screeners?

AI stock screeners process data much faster than traditional tools and can identify complex patterns humans might miss. They adapt to changing market conditions through machine learning, incorporate sentiment analysis from news and social media, and offer predictive capabilities rather than just historical analysis. AI screeners continuously improve their accuracy over time as they process more data.

Which AI stock screener is best for day traders?

Trade Ideas is widely considered the top AI stock screener for day traders. Its Holly AI analyzes hundreds of trading criteria at exceptional speed, providing quick, data-driven recommendations that improve over time. The platform offers comprehensive backtesting, real-time alerts, and advanced scanning technology that works even in pre-market and post-market hours.

Are AI stock screeners worth the investment?

Yes, AI stock screeners can provide significant return on investment by identifying profitable opportunities that human analysis might miss. They save time through automation, reduce emotional trading decisions, and can process vast amounts of data instantaneously. The value depends on your trading volume, strategy, and how effectively you implement the insights provided.

Which AI screener is best for fundamental analysis?

Stock Rover stands out for fundamental analysis with its AI-enhanced capabilities that provide deeper insights into financial data. It offers advanced portfolio management tools that track performance across multiple metrics, analyzes portfolio holdings to identify strengths and weaknesses, and provides customizable reporting dashboards displaying critical metrics for long-term investment decisions.

What features should I look for in an AI stock screener?

Look for customizable screening criteria, comprehensive data integration from multiple sources, real-time alerts, robust technical and fundamental analysis tools, and intuitive visualization capabilities. Additional valuable features include automated trading options, backtesting capabilities, sentiment analysis, cross-device accessibility, and educational resources to help you maximize the platform’s potential.

How much do AI stock screeners typically cost?

AI stock screeners range widely in price from free basic versions to premium subscriptions costing $200+ monthly. Entry-level plans typically start at $30-50 monthly, while mid-tier options range from $80-150 monthly. Professional-grade platforms with advanced AI capabilities can exceed $200 monthly. Many services offer annual discounts of 15-25% and free trials to test functionality.

Can beginners use AI stock screeners effectively?

Yes, beginners can use AI stock screeners effectively, especially platforms designed with user-friendly interfaces like Ziggma and Stock Rover. Look for services that offer educational resources, intuitive dashboards, pre-built screening templates, and strong customer support. Start with basic screening parameters and gradually incorporate more advanced features as your knowledge grows.

Which AI stock screener provides the best pattern recognition?

TrendSpider excels in pattern recognition with its advanced AI technology specifically designed for technical traders. It offers automated trendline detection that identifies key support and resistance levels while eliminating human error. The platform’s multi-timeframe analysis tools allow users to examine charts across various time periods simultaneously, enhancing trend confirmation capabilities.

What are the future trends in AI stock screening technology?

Future trends include more sophisticated AI algorithms, enhanced real-time data analysis, improved automated trading features, greater personalization, and seamless brokerage integration. We’ll also see advanced sentiment analysis using alternative data sources, better backtesting capabilities, expanded community features, improved mobile accessibility, and more affordable pricing models making this technology accessible to more investors.

Alessio Rigoli is the founder of AGR Technology and got his start working in the IT space originally in Education and then in the private sector helping businesses in various industries. Alessio maintains the blog and is interested in a number of different topics emerging and current such as Digital marketing, Software development, Cryptocurrency/Blockchain, Cyber security, Linux and more.

Alessio Rigoli, AGR Technology

![logo-new-23[1] logo-new-23[1]](https://agrtech.com.au/wp-content/uploads/elementor/thumbs/logo-new-231-qad2sqbr9f0wlvza81xod18hkirbk9apc0elfhpco4.png)