Note: AGR Technology may receive a commission on sales generated by partner links on this page, but this has no influence on our opinions or evaluations and is completely free of charge to you.

Small businesses, recognised as the backbone of the Australian economy, play a pivotal role in innovation, job creation and contributing to local communities. Yet, the challenge of securing financing looms large for small business owners. In this article we have curated and compared some of the best small business loan platforms in Australia and different options to consider when looking to get a loan for your business.

Top 10 Small Business Loan Providers in Australia February 2026

1) Lumi – Best Flexible Small Business Loans in Australia

Introduction to Lumi

Lumi stands at the forefront of small business financing solutions in Australia, offering a robust platform that prioritizes flexibility and transparency.

With a commitment to empowering businesses, Lumi provides unsecured loans ranging from anywhere from $5,000 to $300,000, helping to simplify the lending process for entrepreneurs.

Lumi Business Loan Application Process

- Quick:Simple online application process to submit your information and the type of loan your after to get started

- Simple: Simply gather your ABN/ACN, driver’s license, and bank details and find out pretty quick if your approved

- Fast: Approval can come as fast as 2 hours, and funding can hit your account within the same business day

Features of Lumi Business Loans

- Loan Amount Flexibility: Borrowers can access loans ranging from $5,000 to $300,000, accommodating diverse business needs

- Speedy Application and Approval: Lumi’s emphasis on quick processing allows applicants to receive funds within the same business day, facilitating timely responses to business opportunities

- Transparent Fee Structure: Lumi sets itself apart with minimal fees, notably a 2.5% establishment fee, providing clarity and predictability for borrowers

- Unsecured Loans: With a focus on inclusivity, Lumi offers unsecured business loans, eliminating the need for collateral for amounts up to $300,000

- Flexible Repayment Options: Weekly repayment frequencies, principal and interest repayment types, and the option for extra repayments contribute to a borrower-friendly repayment structure

- Early Repayment Benefits: Lumi distinguishes itself by allowing borrowers to pay off their loans early without incurring penalties. Early payout options and discounts are available, with principal-only payouts accessible after 6 months

- Eligibility Criteria: Lumi caters to businesses that are at least six months old, with a minimum annual turnover of $50,000, establishing accessibility for a broad range of enterprises

Application Process for Lumi Business Loans

Quick: Simple online application process to submit your information and the type of loan you’re after to get started

Simple: Gather your ABN/ACN, driver’s license, and bank details to find out quickly if you’re approved

Fast: Approval can come as fast as 2 hours, and funding can hit your account within the same business day

2) Prospa – Your Partner for Nationwide Business Success

Overview of Prospa

Navigating the landscape of small business loans in Australia? Prospa is another solid contender in the market across both Australia and New Zealand. Prospa provides small business owners with a quick and simple way to obtain financing, and it has already assisted thousands of Australian small enterprises. Prospa received the Deloitte Tech Fast 50 in 2015, after increasing by 6071% in three years, making it Australia’s fastest growing technology firm and Asia’s third quickest. Prospa was a Telstra Business Awards finalist in 2015 and ranked 33rd globally as a leading innovator in KPMG’s Fintech 100.

How Prospa Small Business Loans Work

Prospa offers loans from $5,000 up to $500,000 for cash flow or growth. You can apply online in about 10 minutes and often get a decision the same day (with funds possible in 24 hours).

No upfront security is needed for loans under $150,000. Loan interest rates vary based on your business and are calculated upfront. This helps you to know the total cost before you borrow. Early repayment options are available to save on interest.

Benefits of Prospa Business Loan

Choosing Prospa for your business financing needs means opting for a partner who understands the nuances of small Australian businesses.

Simple Application Steps: Prospa ensures a straightforward application process that respects your time and urgency. With an online form that takes around 10 minutes, you’re on your way to financial support without unnecessary delays.

Flexible Loan Uses: Prospa allows you to utilize the loan for various business objectives, from buying supplies to expanding your team or renovating your workspace. Your business, your choices.

Variable Loan Durations: With loan periods ranging from 3 months to 3 years, Prospa caters to different business needs. Whether you want a short-term loan (boost) or a more extended financial support plan, Prospa offers flexibility.

Modular Payment Schedules: Prospa understands that one repayment schedule doesn’t fit all. You have the freedom to schedule repayments based on your business’s cash flow, choosing between weekly and daily payments.

Quick Approval and Funding: Prospa lives up to its promise of being swift. A 10-minute online application, coupled with approval possible within the hour depending on your scenario ensures you don’t miss out on capital.

Prospa’s business loans offer numerous advantages:

- Streamlined application: The online form takes only 10 minutes to complete, respecting your time and urgency.

- Versatile loan purposes: Use funds for various business objectives, including purchasing supplies, expanding your team, or renovating your workspace.

- Flexible loan terms: Choose from loan periods ranging from 3 months to 3 years, tailored to your specific business needs.

- Customisable repayment options: Schedule repayments based on your business’s cash flow, with weekly and daily payment options available.

- Rapid approval process: Depending on your situation, approval is possible within an hour of application submission.

3) Valiant Finance – Navigating Your Business to Success Nationwide

Overview of Valiant Finance

Feeling lost in the loan jungle? Valiant Finance is another trusted name on our list, guiding you through the dense financial terrain to uncover the perfect small business loan for your specific needs. With over 7 years of expertise and access to 80+ lenders, they are like financial matchmakers, pairing your needs with the ideal funding partner.

Requesting Process of Valiant Finance Loan

Forget the tedious paperwork and step into loaning heaven with Valiant Finance. Start on their website, where a quick online application form guides you through your specific business loan needs. Think of it as building your loan wish list, tailor-made for your company.

Once you hit submit,Valiant’s platform gets to work and scours its network of lenders, picking options that best match your requirements. From here a Valiant rep dives in, chatting with you to understand your needs even better.

If all goes well (don’t worry, Valiant’s experts guide you every step of the way!), approval comes knocking, and boom! Funds between $5,000 and $1 million can land in your account, ready to fuel your business dreams. Plus, the repayment options are flexible, so you can adjust them to your company’s financial situation.

Benefits of Valiant Finance Loan Applications

Choosing Valiant Finance means opting for a partner invested in your business’s success:

- Transparent Financial Journey: No hidden fees or application costs to get going with Valiant

- Diverse Financing Options: With a network of over 70 lenders, including major financial institutions such ANZ, Bank of Queensland, Westpac etc, Valiant Finance offers clients diversity in the choices tailored to different business needs

- New Business Friendly: Startups are welcome, provided they meet certain conditions. A minimum monthly revenue requirement opens the doors for new enterprises with growth ambitions so long as they meet the eligibility requirements, such as monthly turnover.

- Flexible Repayment Options: The repayment schedule isn’t one-size-fits-all. Valiant Finance leaves it to your chosen lender to determine a plan that suits you, offering financial flexibility

- Adjustable Loan Terms and Rates: Recognising business diversity, Valiant Finance offers adjustable loan terms ranging from 3 months to 5 years to accommodate varying financial situations. Interest rates start at 7.1% per annum and vary depending on the lender. It’s important to understand that Valiant is only a broker and not an actual lender, so the rates will vary depending on the financial institution you choose to take out a loan with.

4) ebroker – Your Go-To Choice for Aussie Small Business Loans

Overview of ebroker

If you’re navigating the realm of small business loans in Australia, ebroker is a name that deserves attention. It’s not just a platform; it’s your ally in securing the right financing for your business. Imagine having access to over 70 lenders, all ready to cater to your business needs. That’s the promise ebroker brings to the table.

The Starting Business Loan Journey with ebroker

Understanding the ebroker business loan process is straightforward. Acting as a broker, eBroker doesn’t directly lend to businesses but serves as a marketplace. Here, potential borrowers can explore diverse business loan options from over 70 lenders, including banks and non-banking institutions.

The platform offers various loan products, accommodating needs like low-doc loans, short-term solutions, and options for those with less-than-ideal credit histories. However, it’s important to note that while ebroker provides access to a range of loan opportunities, there are no guarantees of approval for any specific loan application.

Why Choose ebroker Loans?

Diverse Financing Options: ebroker is your gateway to a myriad of lenders – more than 70 of them. What does this mean for you? Options. You get to compare and choose from a range of lenders, ensuring you find the perfect fit for your business.

Borrowing Flexibility: Starting as low as $5,000, your business can apply for loans with ceilings reaching an impressive $5,000,000. Whether you’re a small startup or a thriving enterprise, ebroker accommodates diverse financing needs.

Small business grants are available: The website includes an option for businesses to discover if lenders will consider their application for a grant

Inclusive to All Credit Histories: Have a less-than-perfect credit history? No worries. ebroker opens doors to lenders who may be willing to work with you, without scrutinizing your credit history

Tailored Financing Choices: Your business is unique, and ebroker gets that. The platform offers both secured business loans and unsecured loan options, allowing you to tailor your loan to match your specific needs

Impartial Guidance: What sets ebroker apart? It’s not tied to any single lender. This means you’re getting recommendations based on your needs, not on who has the biggest marketing budget. Unbiased and objective – just what you need

5) Scotpac – One of the Best Small Business Loan Solutions in Australia.

Introduction to Scotpac

For over 30 years, Scotpac has been Australia’s trusted ally for small businesses seeking growth. They offer a diverse range of flexible financing solutions designed to meet your specific needs, from invoice finance to asset finance and traditional business loans. Whether you’re just starting out or looking to expand, Scotpac helps you unlock your potential and achieve your goals.

Scotpac Loan Application Process

- Swift Application: ScotPac boasts a streamlined 10-minute application process, ensuring a quick and hassle-free experience for small businesses

- Same-Day Approval: Eligible businesses can receive approval on the same day they apply, addressing the urgent funding needs of small enterprises

- Fast Funding Access: ScotPac ensures access to funding within as little as 24 hours, allowing businesses to expedite their financial goals

- Minimal Documentation: While specific requirements may vary, the application typically involves submitting 6 months of business bank statements, a photo ID and a complete application form

Benefits of ScotPac Business Loans:

- Flexible Funding Range: ScotPac offers business loans ranging from $10,000 to $500,000, providing flexibility to meet diverse financial needs

- Rapid Funding: Businesses can benefit from same-day approval and access to funding within 24 hours, ensuring quick response to financial challenges or opportunities for your business

- Industry Support: ScotPac stands out by supporting businesses across all industries, recognizing the diverse needs of Australian enterprises

- No Early Payout Penalties: ScotPac’s loan terms come with the advantage of no penalties for early repayment, offering businesses greater financial flexibility and options to pay off ahead of time

- Transparent Fee Structure: With a commitment to simplicity, ScotPac avoids hidden fees and provides a transparent fee structure and has no upfront application fee and interest rates from 14% per annum

6) OnDeck: A Popular Source of Small Business Loans in Australia

Overview of OnDeck:

Forget the lengthy and complicated processes typical of many small business loans. OnDeck is another solid player in the Australian market with a straightforward online application for loans up to $250,000. Depending on the quantity of your loan, you can get funds within one business day or as little as two hours.

How OnDeck Business Loans Work:

Eligibility Check: Start by checking your eligibility through OnDeck’s online tool. This soft credit check won’t affect your credit score

Simple Application: Fill out the online application, providing basic business information and financial documents

Fast Approval: OnDeck’s proprietary Koala Score™ technology expedites the process, offering quick decisions, often within minutes

Funding: Upon approval, funds are electronically deposited into your business account, potentially as soon as the same day

Repayment: Repayments are made through fixed weekly debits from your nominated business bank account

Features of OnDeck Loans:

- Loan amounts: Range from $10,000 to $250,000, catering to diverse business needs

- Terms: Flexible repayment periods between 6 and 24 months

- Speed: The potential to receive capital within 24 hours for smaller loans and potentially the same day for larger ones

- Convenience: Easy online application and quick decision-making process

- No collateral: Unsecured business loans eliminate the need for putting up valuable assets as security

- Transparency: Fixed loan interest rates and clear fees provide predictable costs. With a 3% origination fee for small business loans and a 1.5% renewal fee for existing loans however the rate may be subject to their credit assessment

7) Moula

Moula is known for transparent lending practices. They provide loans ranging from AUD 5,000 to AUD 250,000 with decisions as quick as 24 hours to find out if your approved. They offer loan terms from 6 to 24 months with no asset security required. Their online application process focuses on streamlined document submission and is very easy to use.

Key features of Moula’s small business loans include:

- Fast application process: Complete online in just 10 minutes

- Quick decision-making: Receive an answer within 24 hours

- Rapid fund disbursement: Access funds in as little as 24 hours upon approval

- Flexible repayment terms: Choose from 6 to 24 months

- Competitive interest rates: Starting from 15.95% p.a.

- No hidden fees: Transparent pricing with no early repayment penalties

For eligibility, businesses must:

- Have been operating for at least 6 months

- Generate a minimum annual revenue of $50,000

- Have a valid ABN or ACN

Moula integrates with popular accounting software like Xero, MYOB, and QuickBooks, simplifying the application process and enabling faster approvals. This tech-forward approach aligns with modern business practices, making Moula an attractive option for tech-savvy entrepreneurs.

8) Max Funding

Introduction to Max Funding

Max Funding emerges as another compelling option in our list ready to empower your business journey. The pre-approval process takes around five minutes is quick and east, and you can often receive funds in a timely manner.

Applying process for Small Company Loan with Max Funding

Step one to get started is showing you’re a responsible borrower with a good credit history and maybe some collateral like a car or other asset. Next, you complete their quick online application which has no application fee

Finally, Max Funding works its magic, zipping through your paperwork verification, often resolving it within the same day. If everything checks out, you can often receive your funds on the same day as your application. Minimal waiting, just speedy disbursement to support your business’s every need.

Key Features of Max Funding Loans

Now, let’s dive into what makes Max Funding stand out in the crowded arena of small business loans:

- Transparent Costs: The interest rate is laid out at the time of application, and there’s no prepayment penalty. Making it simple to know what you’re getting into from the get-go

- Flexible Financing Levels: Your business is unique, and so are its financial needs the platform offers loans ranging from a modest $3,000 up to $30,000. It’s a sweet spot for covering various operating expenses without financial strain

- Business-Friendly Credit Policies: Not every business has a flawless credit history. Max Funding understands this, stepping in where major Australian banks might hesitate. Whether you’re a startup or a seasoned player, there are financial options tailored to your business size and stage

- Adaptable Repayment Plans: The repayment plan is designed to sync with your cash flow and business goals. No need to worry about fitting into rigid payment schedules – flexibility is the name of the game

9) Capify

Capify specialises in working capital solutions. They lend between AUD 10,000 and 1 million. Capify’s approval takes approximately 24 hours, with funds available within days. Their loan terms extend from 3 to 12 months. Customers often highlight the flexible, daily repayment structure.

In order to meet their eligibility businesses must have been in operation for at least six months and have a minimum monthly turnover of $10,000, as well as a current Australian Business Number (ABN). They consider various aspects including your credit score, business history, revenue, and financial health.

Eligibility Criteria

To qualify for a Capify loan, businesses must:

- Have been operating for at least 6 months

- Generate a minimum of $10,000 in monthly revenue

- Possess a valid ABN or ACN

Application Process

Capify’s online application process is streamlined and user-friendly:

- Complete the online application form

- Submit required documentation

- Receive a decision within 24 hours

- Access funds within 24 hours of approval

- Fast approval and funding

- Flexible repayment options

- No asset security required

- Transparent fee structure

- Dedicated account manager

10) Banjo Loans

Banjo Loans caters to growth-focused businesses. They offer unsecured loans up to AUD 1 million. Banjo’s loan terms range from 6 months to 24 months. They emphasize a personalised approach to lending, considering the individual needs of each business. They also provide quick access to funds, usually within a few days.

Other options & traditional banks

In addition to dedicated lending platforms there are other apps and services worth looking into including the traditional Australian banks that offer small business loans and often unsecured options although at a higher interest usually compared to dedicated loan companies.

Here are some other options to consider:

Commonwealth Bank

- Offers unsecured and secured business loans

- Loan amounts from $5000 – $100,000 and other options for higher financing requirements

NAB (National Australia Bank)

- Offers unsecured and secured business loans

- Loan amounts from $5000 – $250,000 and other options for higher financing requirements

- Options for smaller amounts for things like vehicle and equipment financing and business options

ANZ

- Provides business loans with no ongoing fees

- Loan amounts ranging from $10,000 to $500,000

- Fast approval process, often within 24 hours

- 1-30 years loan terms

Judo Bank

- Focuses on relationship-based lending

- Tailored loan solutions for SMEs

- Loan amounts from $250,000 to $5 million

- Competitive rates based on individual business assessment

Judo Bank is an Australian neobank that specialises in lending to small and medium-sized businesses while simultaneously providing customers with a variety of personal term deposit products. As of January 2020, Judo Bank had lent $1 billion to Australian enterprises and $1 billion in digital retail term deposits.

Westpac

- Business loans with flexible repayment options

- Loan amounts from $10,000 to $250,000

- Access to dedicated business banking specialists

Tyro

- Provides both unsecured and secured business loans

- Loan amounts from $5,000 to $350,000

- Repayments tied to daily EFTPOS takings

- No fixed term contracts or lock-in periods

St George Bank

Australian bank St.George Bank, with its main office in Sydney, has been a member of Westpac since 2008. It ceased to function as a stand-alone licenced deposit-taking institution in 2010 when it was deregistered. The bank is present in Victoria, Western Australia, Queensland, and New South Wales, however its main service area is New South Wales. Through its affiliate BankSA, it also conducts business in the Northern Territory and South Australia. Throughout Australia, St. George operates a large number of retail locations, ATMs, and back offices in Bangalore, India.

St Georges Loan features:

- Take out a loan of $20k

- Rates that are fixed or variable with adjustable payback choices

- Depending on the collateral given, loan to value ratios of up to 100% are possible.

- Redraw facilities are available

- Possible tax advantages

Nimble

Nimble is another Australian platform designed to make it simple to borrow small amounts ranging from $300 to $5000 in a fast simple process.

Here’s a summary from their about page:

An Australian firm called Nimble made money easily and quickly in an effort to remove hurdles associated with traditional lending. They were the first to successfully process paperless applications in 2009, and by 2011 they were providing straight-through processing. They had sponsored one million Nimble loans by 2016. They made the decision to develop new solutions in 2019 for Australian clients, using the same Nimble reasoning to enhance lending for all. With a passionate staff and a great vision for the Nimble brand, the company has a bright future. The group is committed to keeping its word and making sure lending gets better in the future.

ING Direct

An Australian direct bank, NG Bank (Australia) Limited is a division of the international Dutch bank ING Group. Since its founding in 1999, it has expanded to overtake Australia’s Big Four banks as the biggest lender for mortgages. Of all the main Australian financial institutions, ING has the greatest net promoter score and a solid customer satisfaction rating. The bank had more over 2.8 million customers as of December 2023, and it managed AU$1.6 billion in super funds in addition to a mortgage portfolio of AU$38.6 billion. By December 2020, ING’s entire client base had grown to 2.8 million, with a $65.2 billion loan portfolio and $46.6 billion in deposits.

They offer business funding options with fixed interest rate terms from 1-5 years and duration up to 20 years for general commercial borrowing as well as commercial property.

Bendigo Bank

Retail banking is the primary business of Australian financial institution Bendigo and Adelaide Bank. It was created in 2007 when Adelaide Bank and Bendigo Bank merged. Prior to the merger, Bendigo Bank operated around 900 locations throughout Australia, comprising 160 corporately owned branches, 220 Community Bank branches owned by the community, 100 agencies, and 400 Elders locations. Following the merger, the united bank runs 400 branches, 25 of which are owned by Adelaide Bank. The national headquarters of the bank are located in Bendigo, Victoria.

Like the other banks they offer commercial funding options to borrow up to $10,000 and offer other financial products for things like vehicle equipement financing and trade finance.

Qualifications

A person or business entity that is 18 years of age or older, resides in Australia, and needs the finance for reasons other than investing in real estate; additionally, the person or business must meet the credit standards and credit policy requirements outlined in any applicable offer for this product.

From traditional banks to fintech lenders, each provider has unique features, loan amounts, and interest rates. When choosing a lender, we suggest considering factors such as loan terms, repayment flexibility, approval speed, and any additional fees or charges.

Pros and Cons of Small Business Loans 💵

Pros of Small Business Loans:

Small business loans offer several benefits for Australian entrepreneurs:

- Quick access to capital: Loans provide immediate funds for growth opportunities, inventory purchases, or equipment upgrades.

- Flexible repayment terms: Many lenders offer customizable repayment schedules to match your business’s cash flow.

- Maintain ownership: Unlike equity financing, loans don’t require giving up a portion of your business.

- Build credit: Timely loan repayments can improve your business credit score, opening doors to better financing options in the future.

- Tax deductions: Interest paid on business loans is often tax-deductible, reducing your overall tax burden.

Cons of Small Business Loans:

While loans can be beneficial, they also come with potential drawbacks:

- Debt burden: Taking on debt means committing to regular repayments, which can strain cash flow during lean periods.

- Collateral requirements: Some loans require personal or business assets as security, putting these at risk if you default.

- Interest costs: Over time, interest payments can significantly increase the total cost of borrowing.

- Strict qualifying criteria: Lenders often have stringent eligibility requirements, making it challenging for new or struggling businesses to secure loans.

- Personal liability: For sole proprietors or partnerships, you may be personally responsible for repaying the loan if your business fails.

Factors to Consider Before Taking a Small Business Loan

Before applying for a loan, evaluate these key factors:

- Loan purpose: Clearly define how you’ll use the funds to ensure they contribute to your business’s growth or stability.

- Repayment capacity: Analyse your cash flow to confirm you can comfortably meet repayment obligations without jeopardizing operations.

- Loan terms: Compare interest rates, fees, repayment periods, and early repayment penalties across different lenders.

- Business plan: A solid business plan demonstrates to lenders that you have a clear strategy for using and repaying the loan.

- Alternative options: Explore other financing methods like grants, crowdfunding, or invoice financing before committing to a loan.

By carefully weighing these pros and cons and considering your specific business needs, you’ll be better equipped to decide if a small business loan is the right choice for your Australian enterprise.

10 Common Types of Small Business Loans

Small business loans in Australia offer diverse financing options to support entrepreneurial growth. Each loan type addresses specific business needs and financial challenges.

General Purpose Business Loans

Term Loans

Term loans provide businesses with a lump sum payment repaid through fixed monthly installments. Entrepreneurs can secure these loans for:

- Equipment purchases

- Inventory expansion

- Working capital investments

- Business infrastructure development

Loan terms typically range from 1-5 years with interest rates between 7%-25% per annum.

Business Line of Credit

Business lines of credit deliver flexible financing with unique advantages:

- Access funds up to a predetermined credit limit

- Pay interest only on utilized amounts

- Revolving credit structure allows repeated borrowing

- Ideal for managing unpredictable cash flow expenses

Specific Purpose Business Loans

Equipment Financing

Equipment loans help businesses acquire essential machinery and technology:

- Cover purchase or leasing costs of specialized equipment

- Repayment terms aligned with equipment depreciation

- Loan amounts ranging from $5,000-$500,000

- Often use purchased equipment as collateral

Commercial Real Estate Loans

Commercial property financing supports business expansion through:

- Property purchase

- Renovation projects

- Building construction

- Longer repayment terms compared to standard mortgages

- Loan sizes from $50,000-$5 million

Microloans

Microloans provide small-scale funding for emerging businesses:

- Loan amounts typically under $50,000

- Designed for startups and microbusinesses

- Lower qualification requirements

- Often offered by nonprofit organizations

- Support entrepreneurial development

Alternative Financing Solutions

Invoice Financing

Invoice financing enables businesses to leverage outstanding customer invoices:

- Invoice Factoring: Sell unpaid invoices to third-party collectors

- Invoice Discounting: Borrow against receivables while maintaining customer relationships

- Advance rates between 70%-90% of invoice value

- Quick access to working capital

Merchant Cash Advances

Merchant cash advances offer rapid funding based on future sales:

- Immediate lump sum payment

- Repayment through daily credit card transaction percentages

- Quick approval process

- Higher cost compared to traditional loans

Crowdfunding

Crowdfunding platforms enable businesses to raise capital through:

- Online fundraising campaigns

- Multiple small investments from diverse contributors

- Platforms like Kickstarter, GoFundMe and Pozible to name a few

- No traditional loan requirements

Peer-to-Peer Lending

Peer-to-peer lending connects businesses directly with individual investors:

- Online platform-based lending

- Competitive interest rates

- Faster approval processes

- Flexible loan terms

Investor Funding

- Private investor presentations

- Equity exchanges

- Startup competition platforms

- Potential mentorship opportunities

Additional Loan Types Available for Small Businesses

Expanding your funding options can make a significant difference in your business’s financial health. Explore these viable alternatives to traditional loans to find what aligns best with your needs.

Funding Through Self-financing

Self-financing involves using your savings or personal assets. This approach offers autonomy. You can run your business without external interference. However, it requires careful financial planning.

Loans from Friends and Family

Friends and family can be a convenient funding source. Establish clear terms to avoid misunderstandings. Outline repayment schedules, interest rates if applicable, and legal agreements to ensure all parties are on the same page.

Financing for Regional Enterprises

Regional programs often provide grants, low-interest loans, and other incentives to support local businesses. These programs aim to boost economic growth. Check with your local council or state government for available grants and perks. Visit the Australian Government website on research and development grants for more information.

| Funding Source | Characteristics | Eligibility |

|---|---|---|

| Local Council Grants | Low-interest support | Location-specific businesses |

| State Government Programs | Economic development funds | Businesses contributing to regional growth |

| Rural Development Initiatives | Targeted small business support | Agricultural and service sector enterprises |

Remember:

- Seek advice from consultants to navigate the funding landscape effectively.

- Maintain a clear, concise business plan to present to lenders.

- Combine multiple funding sources for stability.

- Build relationships with investors, grant providers, and entrepreneurs for additional funding opportunities.

- Evaluate non-bank lenders like Lumi and Prospa.

- Consult a business loan broker or financial advisor.

- Match loan types and terms to your business needs.

- Assess your business’s requirements and risks.

- Negotiate terms to ensure favorable conditions.

- Stay updated on government programs and grant opportunities.

Remember:

- Don’t go it alone! Consultants and advisors can help you navigate the funding landscape and make informed choices

- A solid business plan is a very valuable document. Make it clear, concise, and include the potential of your business to share with lenders

- Don’t put all your eggs in one basket. Combining different funding sources can reduce risk and creates a more stable foundation for your business

- Building relationships with investors, grant providers, and fellow entrepreneurs can open doors to other funding opportunities

Quick Tips on how to find the best finance option for your small business

When searching for the ideal finance option for your small business in Australia, we suggest following these quick tips:

- Assess your needs:

- Determine the exact amount you need

- Identify the purpose of the funds

- Consider your repayment capacity

- Compare multiple lenders:

- Research traditional banks, online lenders, and alternative financing options

- Use comparison websites to evaluate interest rates, fees, and terms

- Read customer reviews and ratings

- Check eligibility criteria:

- Review minimum credit score requirements

- Assess time-in-business prerequisites

- Evaluate annual revenue thresholds

- Understand loan terms:

- Analyse interest rates and APR

- Examine repayment schedules

- Identify any prepayment penalties or hidden fees

- Prepare documentation:

- Gather financial statements

- Organise tax returns

- Update your business plan

- Consider government-backed options:

- Explore Small Business Administration (SBA) loans

- Investigate state-specific programs

- Look into industry-specific grants

- Seek professional advice:

- Consult with a financial advisor

- Discuss options with your accountant

- Reach out to business mentors or associations

- Evaluate alternative financing:

- Consider invoice financing or factoring

- Explore equipment leasing options

- Look into merchant cash advances

- Negotiate terms:

- Don’t hesitate to ask for better rates or terms

- Leverage competing offers to your advantage

- Be prepared to walk away if the terms aren’t favorable

- Plan for the future:

- Consider scalability of the financing option

- Think about potential business growth and additional funding needs

- Maintain a good relationship with lenders for future opportunities

By following these tips, you’ll be better equipped to find the best finance option for your small business in Australia.

How to Apply for a Small Business Loan

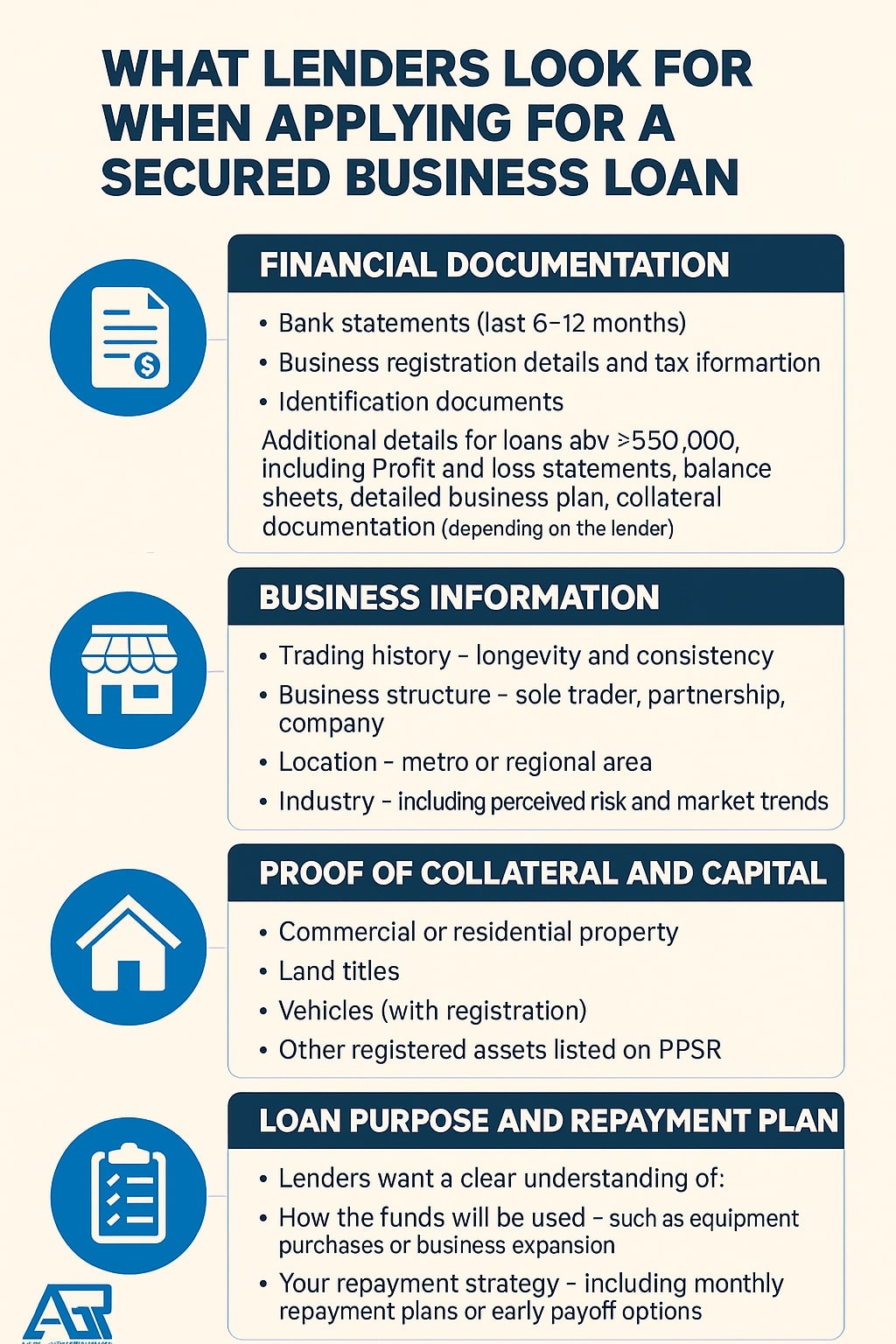

Infographic summary:

When you’re in the process of applying for a secured loan for a small business, lenders take a close look at several factors. Here’s a breakdown of some things to consider:

Your Financial Documents

To evaluate your cash flow and your ability to repay the loan, lenders will need:

- Bank statements covering the last six to 12 months

- Information about your business registration and taxes

- Identification documents

For loans exceeding $150,000, you may also need to provide additional documentation, including profit and loss statements, business balance sheets and a detailed business plan and depending on the lender some collateral or security over an asset.

Your Business Information

Lenders dive into the details of your business, examining its trading history, structure, location and industry.

Lenders examine business details, including:

- Trading history (length and stability)

- Business structure (sole proprietorship, partnership)

- Location (urban, regional)

- Industry (retail, services)

Providing evidence of your operational history and structure is crucial during this phase.

Proof of Collateral and Capital

Asset verification involves presenting comprehensive documentation for potential collateral:

- Property details

- Commercial real estate

- Residential properties

- Land ownership certificates

- Vehicle registration documents

- Asset valuations registered with Personal Property Securities Register (PPSR)

Loan Purpose

Lenders seek clarity on how you plan to use the funds by evaluating:

- Intended loan purpose (expansion, equipment purchase)

- Repayment strategy (monthly payments, early payoff plans)

- Loan duration (short-term, long-term)

Strengthen your application by providing a comprehensive business plan with financial projections. This adds depth and credibility to your request.

What are some popular options according to Reddit.com users (Redditors)

Here are some curated opinions from the popular social networking website reddit.com:

For a 150,000 unsecured company loan I believe you are more likely to look at a second-tier nonbank lender. Typically, you would go through a broker, but they all work directly with customers. Lumi Finance, Shift, and Moula are just a few examples. Interest rates will be higher, ranging from 10% to 30%, depending on your personal credit score, corporate credit score (if you own a business), industry, etc. These lenders typically request bank statements, ato tax balances, financial statements, and so forth.

As others have said, banks tend to avoid younger enterprises and those that lack property as collateral. The trade-off is that you are viewed as a larger risk, resulting in a higher interest rate and costs. (Paraphrased)

Crowdfunding platforms such as Kickstarter and Indiegogo can help businesses raise capital by presenting their products or services and allowing the public to support their aspirations. Merchant cash advances (MCAs) can be a financial ally for firms with consistent daily credit card sales, providing a lump sum upfront and payback based on a percentage of daily card sales. However, understanding the terminologies, such as factor rate and holdback %, is critical to ensuring a successful operation. MCA Legend is a subreddit that offers important insights and knowledge about small business loans, alternative financing, and other relevant issues. (Paraphrased)

If it’s a product-based business/startup, consider Kickstarter or Shark Tank. Shark Tank provides you with publicity that you may use to promote your Kickstarter campaign. (Paraphrased)

I’d go to your bank first. Otherwise, check Vega or Prospa. I don’t know much about them; they are just the two company loan providers I’ve heard the most about. (Paraphrased)

Reddit users often recommend small business loans from:

- Second-tier nonbank lenders: Lumi Finance, Shift, and Moula. These lenders work with brokers or directly with customers. Interest rates range from 10% to 30%, depending on credit scores and industry. Required documents include bank statements, ATO tax balances, and financial statements (User feedback).

- Alternative financing: Crowdfunding platforms like Kickstarter and Indiegogo help businesses raise capital by presenting products or services to the public. Merchant cash advances (MCAs) provide a lump sum upfront, repaid via a percentage of daily credit card sales. Understanding terms like factor rate and holdback percentage is essential for success (User feedback).

- Product-based businesses/startups: Kickstarter and Shark Tank. Shark Tank offers publicity that can promote a Kickstarter campaign (User feedback).

- Banks and other lenders: Some users suggest starting with your bank, then exploring options like Vega or Prospa. These are known for their business loan services (User feedback).

Other opinions from different forums and discussions online

Here are some additional comments and opinions curated from different forums and discussion platforms such as Quora and Whirlpool:

Several banks offer microloans for businesses with amounts under $20,000. They also provide loans to specific groups that you might be eligible for. I’m confident that NAB offers these kinds of loans. It’s definitely better to avoid using your credit card for this purpose.

Source: Whirlpool forum comment (paraphrased)

When applying for a business loan, banks will typically need some form of tangible and reliable security. Avoid starting a business using a credit card, as the interest rates can be very burdensome.

Source: Whirlpool forum comment (paraphrased)

Today, numerous financial institutions (NBFCs) provide loans tailored for micro, small, and medium enterprises (MSMEs). Therefore, the real consideration isn’t which institutions offer small business loans, but rather what factors you should evaluate when comparing various loan providers.

Source: Quora comment/answer

Several financing companies provide working capital loans, including:

– **Loanbuilder**: A PayPal product that offers loans ranging from $5,000 to $500,000. Eligibility requires a credit score of 620, with fees varying between 2.9% and 18.72%.

– **KabbageFunding**: This solution provides up to $150,000 in funds and requires a credit score of 640. Funding charges range from 0.25% to 3.5% per month.

– **OnDeck**: Offering working capital loans from $5,000 to $500,000, OnDeck has an annual interest rate starting at 9.99%. You need a credit score of 600 and an annual revenue of $100,000.Securing a working capital loan to maintain business operations and handle emergencies can be intricate. You should:

– Assess your working capital needs

– Review both your business and personal credit scores

– Research and compare lenders to find the best fit

– Complete a formal loan application and provide necessary documentationSource: Quora comment/answer

I searched online via Google search for “fast business loan Sydney” and found several results, such as:

– [Merchant Cash](https://merchantcash.com.au/)

– [Max Funding](http://www.maxfunding.com.au/)

– [Prospa](https://www.prospa.com/)Source: Quora comment/answer

Financing strategies recommended by various online forums:

- Explore microloans under $20,000

- Compare multiple lending institutions

- Evaluate working capital loan options

- LoanBuilder

- KabbageFunding

- OnDeck

- Research local financing solutions

- Merchant Cash

- Max Funding

- Prospa

Entrepreneurs must meticulously prepare documentation, understand lending criteria, and strategically match their financial needs with appropriate loan products to maximize approval potential.

Final Thoughts of Small Business Loans Australia

Starting a new business, often referred to as a startup, requires financial support to get things off the ground. These small business loans can be used for a range of needs. Whether it’s purchasing equipment, acquiring inventory or covering marketing expenses – those small business loans in Australia provide entrepreneurs with the necessary capital to turn their dreams into reality. We hope you found this article on our blog to be helpful and find some solid options to secure your loan and we hope you have a a bright future ahead with your business venture.

Why Trust AGR Technology?

Alessio Rigoli launched AGR Technology in 2013 with the intention of focusing on YouTube and blogging on technology issues such as Android, Cyber Security, Blockchain, and EdTech. Since then, the business has grown to cover services such as website creation, hosting, software development, and digital marketing. AGR Technology assists companies in a range of industries by providing innovative and high-quality technology solutions to help them thrive.

Note: This is not financial advice and is just designed to provide general information. While we run our own checks and assess each company included on our website, we may not have covered all options. If you decide to apply for a product, you will interact directly with the vendor, not AGR Technology. AGR Technology suggests that you read the appropriate PDS or offer documents before accepting any financial product offer to assess whether the products are suitable for you. Target Market Determinations are available on the provider’s website.

AGR Technology may receive a commission on sales generated by partner links on this page, but this has no influence on our opinions or evaluations and is completely free of charge to you. While we make every attempt to keep our content up-to-date this should not be taken as financial advice, be sure to seek professional advice if required.

Factors considered when writing this article:

We set criteria for picking loan platforms to analyse, such as reputation, services offered, user base, regulatory compliance, types of loans available and the years of operation along with browsing the respective websites to validate they have licences and compliance to operate in Australia, as well as other things like KYC protocols and contacting the companies.

Checked each platform for user-friendly design interfaces to ensure platforms are straightforward for beginners and more experienced customers to grasp. We obtained information about each company by visiting their separate websites, signing up for an account, reading user reviews, and looking for recent news or events related to the platforms.

Key Takeaways

- Diverse Financing Options: Australian small businesses can access multiple loan types ranging from $5,000 to $500,000, including traditional bank loans, online lending platforms, and alternative financing solutions

- Quick Digital Application Processes: Modern lending platforms offer streamlined online applications with potential same-day approvals and 24-hour fund disbursement, enabling rapid access to critical business capital

- Flexible Loan Eligibility: Most lenders require businesses to have a minimum 6-12 month operational history, an Australian Business Number (ABN), and monthly revenues between $10,000-$120,000 to qualify for financing

- Competitive Interest Rates: Business loan interest rates in Australia typically range from 7% to 25% per annum, with terms spanning 3 months to 5 years and options for secured and unsecured lending

- Strategic Loan Selection: Entrepreneurs should compare loan features, assess total borrowing costs, and align financing with specific business growth objectives to maximize financial potential

- Multiple Lending Platforms: Top providers like Prospa, Lumi, OnDeck, and Valiant Finance offer tailored solutions supporting various industry sectors and business development stages

Frequently Asked Questions

What are small business loans?

Small business loans are financial products designed to provide capital to entrepreneurs for business growth, operational expenses, or specific investments. These loans can be obtained from banks, credit unions, online lenders, and government programs. They come in various forms, including traditional term loans, lines of credit, and unsecured financing options, helping small businesses bridge financial gaps and support their expansion efforts.

How do I qualify for a small business loan?

To qualify for a small business loan, lenders typically assess several key factors: your business’s annual revenue (usually minimum $50,000), credit score, time in business (often 12+ months), financial statements, and business plan. Lenders will evaluate your business’s financial health, cash flow, debt-to-income ratio, and ability to repay the loan. Having organized financial documentation and a strong business performance history increases your approval chances.

What documents are needed for a business loan?

Essential documents for a business loan include business tax returns, personal and business bank statements, financial statements (profit/loss, balance sheet), business registration documents, proof of business ownership, detailed business plan, and personal identification. Additional requirements might include business licenses, commercial lease agreements, and recent accounts receivable. Having comprehensive and up-to-date documentation significantly improves your loan application’s success rate.

What are the types of small business loans?

Small business loans include term loans, lines of credit, equipment financing, invoice financing, merchant cash advances, microloans, commercial real estate loans, and SBA loans. Each type serves different business needs, from purchasing equipment to managing cash flow. Some loans are secured by collateral, while others are unsecured. The best option depends on your specific business requirements, financial situation, and growth objectives.

What interest rates can I expect?

Business loan interest rates typically range from 7% to 30%, depending on the lender, loan type, and your business’s financial health. Traditional bank loans often have lower rates (7-15%), while alternative and online lenders might charge higher rates (15-30%). Factors influencing rates include credit score, business revenue, time in operation, and overall financial stability. Secured loans generally offer lower interest rates compared to unsecured options.

How long does loan approval take?

Loan approval times vary by lender. Traditional banks might take 2-3 months, while online lenders can approve loans within 24-48 hours. Some platforms like Lumi and Prospa offer same-day funding for qualified businesses. The speed depends on your documentation completeness, business financials, and the lender’s assessment process. Online lenders and alternative financing platforms typically provide faster approvals compared to traditional banking institutions.

Can I get a loan with bad credit?

Yes, some lenders offer loans for businesses with less-than-perfect credit. Alternative lenders and online platforms are more flexible, focusing on current business performance rather than credit history. Options include secured loans, merchant cash advances, and specialized bad credit business loans. However, these typically come with higher interest rates and stricter terms. Improving your credit score and demonstrating strong business revenue can help secure better loan conditions.

What are the risks of business loans?

Business loans carry risks including potential debt accumulation, strict repayment schedules, and the possibility of losing collateral if unable to repay. High-interest rates can strain cash flow, and defaulting can damage credit ratings. Over-borrowing might lead to financial stress and reduced business flexibility. Additionally, some loans require personal guarantees, meaning personal assets could be at risk if the business cannot meet loan obligations.

How much can I borrow?

Loan amounts vary widely, typically ranging from $5,000 to $500,000, depending on the lender and your business’s financial health. Online lenders like Lumi offer loans between $5,000-$300,000, while traditional banks might provide larger amounts. The borrowing limit depends on factors such as annual revenue, credit score, business performance, and the specific loan type. Most lenders assess your ability to repay before determining the loan amount.

What alternatives exist to traditional loans?

Alternatives to traditional business loans include crowdfunding, peer-to-peer lending, government grants, angel investors, venture capital, equipment leasing, invoice factoring, and personal savings. Each option has unique advantages and considerations. Some entrepreneurs combine multiple funding sources to meet their financial needs. Platforms like Valiant Finance and ebroker can help businesses explore and compare various financing alternatives tailored to their specific requirements.

Quick Links:

QR Code of this page for mobile users:

Source(s) cited / Bibliography:

Your Trusted Business Loan Marketplace [Online]. Valiant. Available at: https://valiant.finance/ (Accessed: 2 February 2024).

Small Business Loans of Up to $1M in Australia. Max Funding. https://www.maxfunding.com.au/. Accessed February 2, 2024.

“Small Business Lending That’s Fast & Easy.” OnDeck. Accessed February 2, 2024. https://www.ondeck.com/.

[Online]. Available at: https://www.scotpac.com.au/ (Accessed: 2 February 2024).

“ebroker – Find a loan easily in real-time.” Ebroker, www.ebroker.com.au/. Accessed 2 Feb. 2024.

Reddit.com [Online]. Available at: https://www.reddit.com/r/AusFinance/comments/selctk/first_time_getting_a_business_loan_any_advice/ (Accessed: 2 February 2024).

“Reddit.” Accessed February 2, 2024. https://www.reddit.com/r/smallbusiness/comments/v8pq60/best_small_business_loans/.

“Lumi Business Loans” Lumi Australia – Small business loans, 24 May 2017, www.lumi.com.au/. Accessed 2 Feb. 2024.

“Lumi Business Loans” FAQs, 24 May 2017, www.lumi.com.au/faq. Accessed 3 Feb. 2024.

Reddit.com [Online]. Available at: https://www.reddit.com/r/PersonalFinanceNZ/comments/119twad/best_place_to_get_a_business_loanraise_capital/?rdt=46807 (Accessed: 3 February 2024).

https://www.scotpac.com.au/blog/frequently-asked-questions-about-business-finance/. Accessed February 3, 2024.

“Crunchbase – Prospa” Accessed February 3, 2024. https://www.crunchbase.com/organization/prospa.

[Online]. Available at: https://www.prospa.com/loc-faqs (Accessed: 3 February 2024).

“OnDeck’s credit scoring innovation ‘KOALA’ gives SMEs more access to credit” Australian FinTech, 27 Apr. 2021, australianfintech.com.au/ondecks-credit-scoring-innovation-koala-gives-smes-more-access-to-credit/. Accessed 3 Feb. 2024.

“Crunchbase.com” www.crunchbase.com/organization/max-funding. Accessed 3 Feb. 2024.

“Frequently Asked Question” Max Funding, www.maxfunding.com.au/faqs.html. Accessed 3 Feb. 2024.

What is a Business Line of Credit?, Xero AU https://www.xero.com/au/guides/business-line-of-credit/.

“Find out more about invoice financing”, [Online]. Available: https://www.commbank.com.au/articles/business/invoice-financing-explained.html. [Accessed: 3-Feb.-2024].

upload.wikimedia.org/wikipedia/commons/5/59/JudoBankLogo.png. Accessed 17 Aug. 2024.

(2004). St.George Bank [Online]. Wikipedia. Available at: https://en.wikipedia.org/wiki/St.George_Bank (Accessed: 17 August 2024).

(2018). Judo Bank [Online]. Wikipedia. Available at: https://en.wikipedia.org/wiki/Judo_Bank (Accessed: 17 August 2024).

[Online]. Available at: https://www.tyro.com/products/business-loans/ (Accessed: 17 August 2024).

[Online]. St.George Bank. Available at: https://www.stgeorge.com.au/business/business-loans/small-business-loans (Accessed: 17 August 2024).

Eyers, James. “Big four business bankers flood Judo with job applications” 16 Jan. 2020, www.afr.com/companies/financial-services/big-four-business-bankers-flood-judo-with-job-applications-20200116-p53s38. Accessed 17 Aug. 2024.

CommBank, www.commbank.com.au/business/loans-and-finance.html. Accessed 17 Aug. 2024.

Accessed August 17, 2024. https://www.nab.com.au/business/loans-and-finance/business-loans.

(n.d.) ANZ. https://www.anz.com.au/business/loans-finance/business-loan/

(n.d.). Westpac. https://www.westpac.com.au/business-banking/loans-finance/business-loan/

[Online]. Available at: https://forums.whirlpool.net.au/archive/1325648 (Accessed: 22 August 2024).

Kabbage-Funding-from-American-Express-Helps-Small-Businesses-Get-Whats-Needed-When-Its-Needed [Online]. Available at: https://www.americanexpress.com/en-us/newsroom/articles/amex-for-business/kabbage-funding-from-american-express-helps-small-businesses.html (Accessed: 22 August 2024).

“Who provides small business loans in Australia at a competitive rate?” Quora, www.quora.com/Who-provides-small-business-loans-in-Australia-at-a-competitive-rate. Accessed 22 Aug. 2024.

Where can I get very fast business loans in Sydney? [Online]. Quora. Available at: https://www.quora.com/Where-can-I-get-very-fast-business-loans-in-Sydney (Accessed: 22 August 2024).

“About Us.” Learn More About Nimble and Our Journey. Accessed August 22, 2024. https://nimble.com.au/about-us/.

ING Nederland, CC BY-SA 2.0, via Wikimedia Commons

Commercial Property Loans | ING [Online]. Available at: https://www.ing.com.au/home-loans/commercial-loan.html (Accessed: 22 August 2024).

Bendigo Bank, www.bendigobank.com.au/business/loans-and-finance/business-loan/. Accessed 22 Aug. 2024.

“Bendigo and Adelaide Bank” Wikipedia, 3 June 2004, en.wikipedia.org/wiki/Bendigo_and_Adelaide_Bank. Accessed 22 Aug. 2024.

[Online]. Available: https://www.bendigobank.com.au/globalassets/globalresources/brand-logos/bendigobank-logo.png. [Accessed: 22-Aug.-2024].

Related news feeds:

Alessio Rigoli is the founder of AGR Technology and got his start working in the IT space originally in Education and then in the private sector helping businesses in various industries. Alessio maintains the blog and is interested in a number of different topics emerging and current such as Digital marketing, Software development, Cryptocurrency/Blockchain, Cyber security, Linux and more.

Alessio Rigoli, AGR Technology

![logo-new-23[1] logo-new-23[1]](https://agrtech.com.au/wp-content/uploads/elementor/thumbs/logo-new-231-qad2sqbr9f0wlvza81xod18hkirbk9apc0elfhpco4.png)