Note: AGR Technology may receive a commission on sales generated by partner links on this page, but this has no bearing on opinions or evaluations and is at no cost to you. Please consult an authorised financial adviser if you are unsure whether investing is right for you or which investments are right for you.

Navigating the world of cryptocurrency can be complex for South African investors seeking reliable trading platforms. With the digital currency landscape evolving rapidly local traders need trustworthy exchanges that offer secure transactions competitive fees and a diverse range of cryptocurrencies.

Quick takeaway:

The South African crypto market has seen significant growth in recent years presenting numerous opportunities for both novice and experienced investors. Finding the right exchange requires careful consideration of factors like user-friendliness transaction costs security protocols and the variety of available digital assets. Investors must evaluate platforms that not only meet their immediate trading needs but also provide robust features for long-term investment strategies.

Whether you’re looking to explore Bitcoin Ethereum or emerging altcoins selecting the right cryptocurrency exchange can make a substantial difference in your trading experience. This guide will help South African investors understand the key considerations and top-performing platforms in the dynamic world of digital currency trading and uncover some of the best crypto exchanges and apps.

Top Crypto Exchanges in South Africa for February 2026

South African crypto traders have multiple exceptional platforms to choose from in 2024. Here are the top exchanges that stand out for their unique features, competitive pricing, and robust trading capabilities:

Binance

Key features:

- Offers the widest cryptocurrency selection with 500+ digital assets

- Ultra-low trading fees starting at 0.01%

- Advanced trading tools for experienced investors

- Supports multiple payment methods including local bank transfers

Binance is one of the world’s largest and most popular cryptocurrency exchanges, offering consumers low-cost trades and ample liquidity. This exchange has made its name by offering a stable and secure platform for traders to quickly purchase, sell, and store bitcoins. Binance’s trading fees are tiered, with lower charges as trade volume increases. This encourages traders to trade more frequently, which results in lower fees. Binance is most known for its spot market, which allows users to trade cryptocurrencies against one another and fiat currencies. The exchange also offers several trading pairs for popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, and Binance Coin (BUSD). Binance is extremely popular worldwide due to its size and history as an industry platform and has a substancial user-base in South Africa as well.

Pros:

- It has sophisticated trading features

- Binance Academy provides cryptocurrency instruction

- A wide range of crypto assets are available for purchase

- Low transaction costs

Cons:

- It is not necessarily the most simple platform for those who have never utilized an exchange before

Traders should carefully evaluate platform capabilities against individual investment requirements and risk tolerance before committing to Binance as their primary cryptocurrency exchange.

Website screenshot:

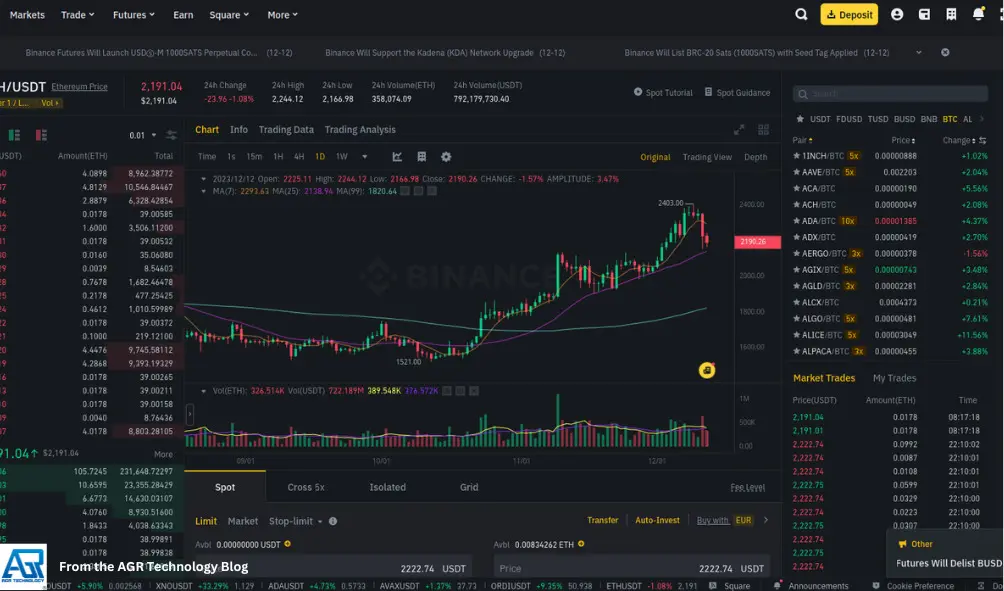

Screenshot of trading component:

License details:

Brickhouse Trading Ltd and Binance Bahrain BSC © offers Futures and Options to users in South Africa in its capacity as a Juristic Representatives of FiveWest OTC Desk (Pty) Limited (Authorised FSP 51619), an authorised financial services provider in South Africa. Brickhouse Trading Ltd and Binance Bahrain BSC © are members of the Binance group of companies.

VALR

VALR.com is a leading local South African based digital asset trading platform based out of Johannesburg that allows users to seamlessly and securely buy, sell, store, and transfer cryptocurrencies. Known for offering one of the most extensive selections of digital assets, VALR.com provides a user-friendly experience designed to meet the needs of both beginner and experienced traders. The platform aims to play a key role in shaping a financial ecosystem that recognizes the interconnectedness of all people. By prioritizing security, innovation, and accessibility, VALR.com strives to empower individuals and contribute to the global growth of the cryptocurrency market.

Key features:

- Premier South African-based cryptocurrency exchange

- Supports 75 cryptocurrencies

- Competitive fees ranging from 0.01% to 0.05%

- Instant ZAR deposits and withdrawals

- Strong focus on local market needs

Pros:

- User-friendly and easy-to-navigate interface

- Smooth deposits and withdrawals with no reported issues

- Secure transactions and real-time market updates

- Diverse cryptocurrency options available for trading

- Helpful customer support, with positive feedback on assistance

Cons:

- Limited staking options, with only three coins available

- No bundle investment feature for diversified portfolios

- High fees for exchanging USDT to Rand and sending to other wallets

- Some users reported inadequate customer support for account deletion and OTP issues

- Unexplained funds or small amounts being added to accounts, causing confusion

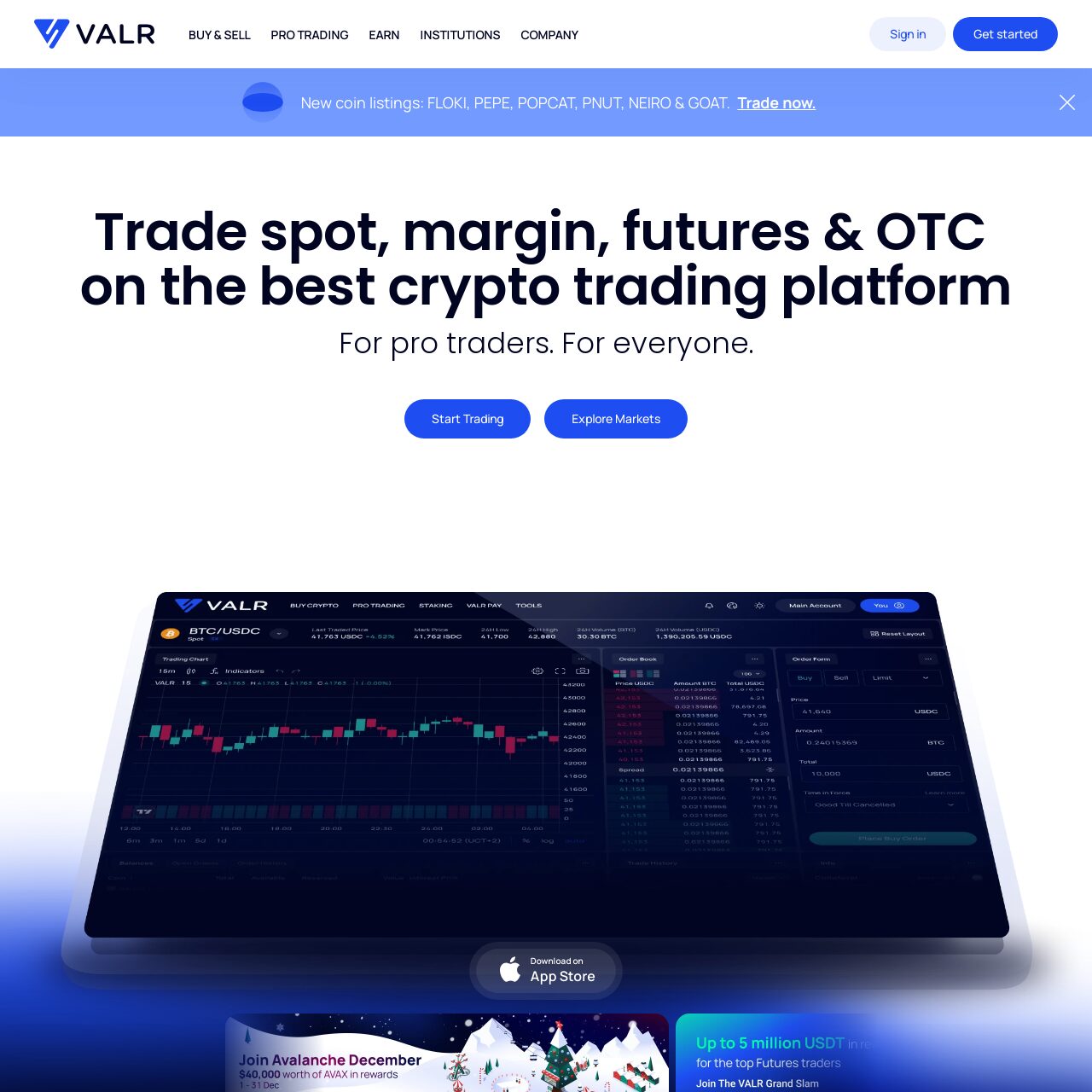

Screenshot of website:

Etoro

eToro is a good choice for traders searching for a dependable, user-friendly, secure platform with a wide range of assets and reasonable costs. eToro is a great choice for traders of all levels due to its commitment to regulatory compliance, outstanding customer service choices, and flexible deposit ways. The platform supports not only Crypto assets but also traditional stocks and other types of investments.

eToro is also a regulated and licensed platform, so consumers can be assured that they are safeguarded by regulatory control. The European Securities and Markets Authority (ESMA), CySEC, the Financial Conduct Authority (FCA), and other important regulators oversee and license the platform. This ensures that eToro complies with all applicable rules and regulations, giving users the security and peace of mind they need to trade confidently.

Key features:

- Copy trading functionality

- Social networking capabilities

- Support for various asset types beyond crypto

Pros:

- Provides lots of powerful functionality for traders

- Has a unique “copy trading” feature that allows you to copy trades of other users on the platform

- Has social networking functionality built in to enable you to interact with other users and learn more

- Supports copy trading for crypto and stocks

Cons:

- Can be complicated and overwhelming for new users

- It can be challenging to choose the appropriate trader to copy

- Fees for foreign exchange on deposits

- A limited number of cryptocurrencies are available

- Fees and spreads may be higher than those found on crypto exchanges.

Screenshot of website:

Luno

Luno is a cryptocurrency investing platform that allows for the secure purchase, storage, and exploration of digital currencies. It strives to empower individuals to use cryptocurrencies responsibly and sensibly.

Since its inception in 2013, Luno has helped millions of individuals worldwide invest safely in cryptocurrencies. The platform focuses on cutting through the noise around cryptocurrency investments by offering help at every stage. Before being featured on Luno, all cryptocurrencies and products must meet strict legal, security, and risk management criteria.

Key features:

- Quick verification process

- Supports 25 cryptocurrencies

- Fees between 0.02% to 0.60%

- User-friendly mobile application

- Excellent for beginners in crypto trading

Pros:

- User-Friendly Interface: Easy to navigate, with continuous improvements to make it more intuitive

- Fast Withdrawal Processing: Quick processing times for withdrawals and funds reflecting in accounts

- Improved Features: Addition of new coins and features over time, enhancing the app’s functionality

- Beginner-Friendly: Great for new users looking to get started with crypto trading and investing

- Reliability for Core Functions: App is stable for essential features like trading, wallet management, and exchanges

Cons:

- App Stability Issues: Crashes, especially with the “Explore” tab, affecting user experience

- No Dark Mode: Lack of a dark mode option, which can cause eye strain during prolonged use

- Referral Program Malfunctions: Ineffective referral system leading to dissatisfaction

- Connectivity Errors: Some users experience “no internet connection” or loading issues after updates

- Withdrawal Restrictions: Unclear restrictions on withdrawals, causing frustration and confusion based on some user reports

License details:

Luno Proprietary Ltd (Registration No. 2013/075107/07) is a licensed financial services provider, registration number 53314, and is registered with the Financial Intelligence Centre, under registration number AI/130605/00024.

Website Screenshot:

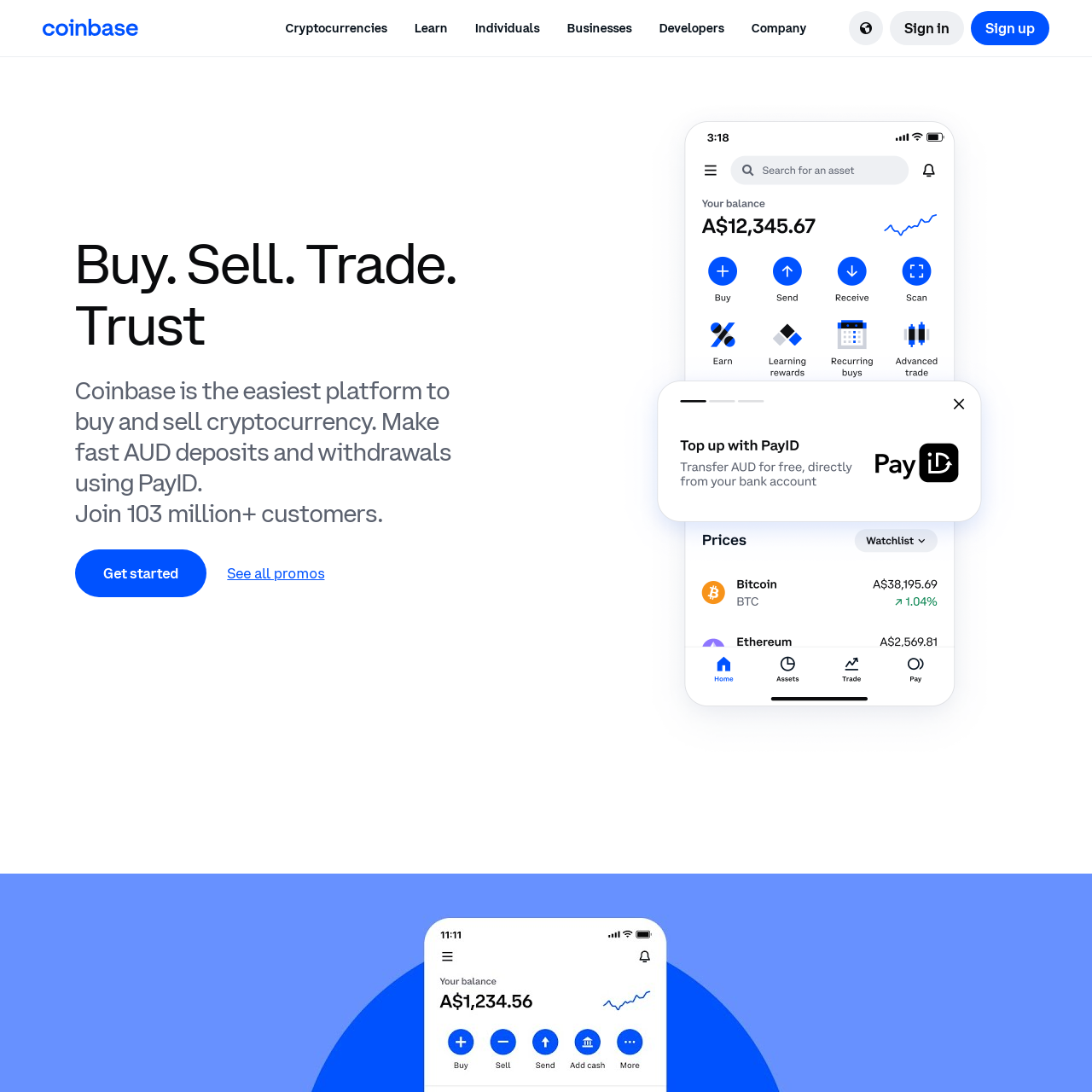

Coinbase

Key features:

- Ideal for cryptocurrency beginners

- Covers 150 different cryptocurrencies

- Trading fees around 0.60%

- High-security standards

- Intuitive user interface

Pros:

- The UI is simple and straightforward to use for beginners.

- Industry-leading encryption and security technologies.

- Coinbase Earn program allows trading of over 246 cryptocurrencies and tokens while also providing educational content.

Cons:

- Fees are greater than other cryptocurrency exchanges.

- Coinbase users have reported excessive wait times for customer assistance, as well as unexpected account limits.

Website Screenshot:

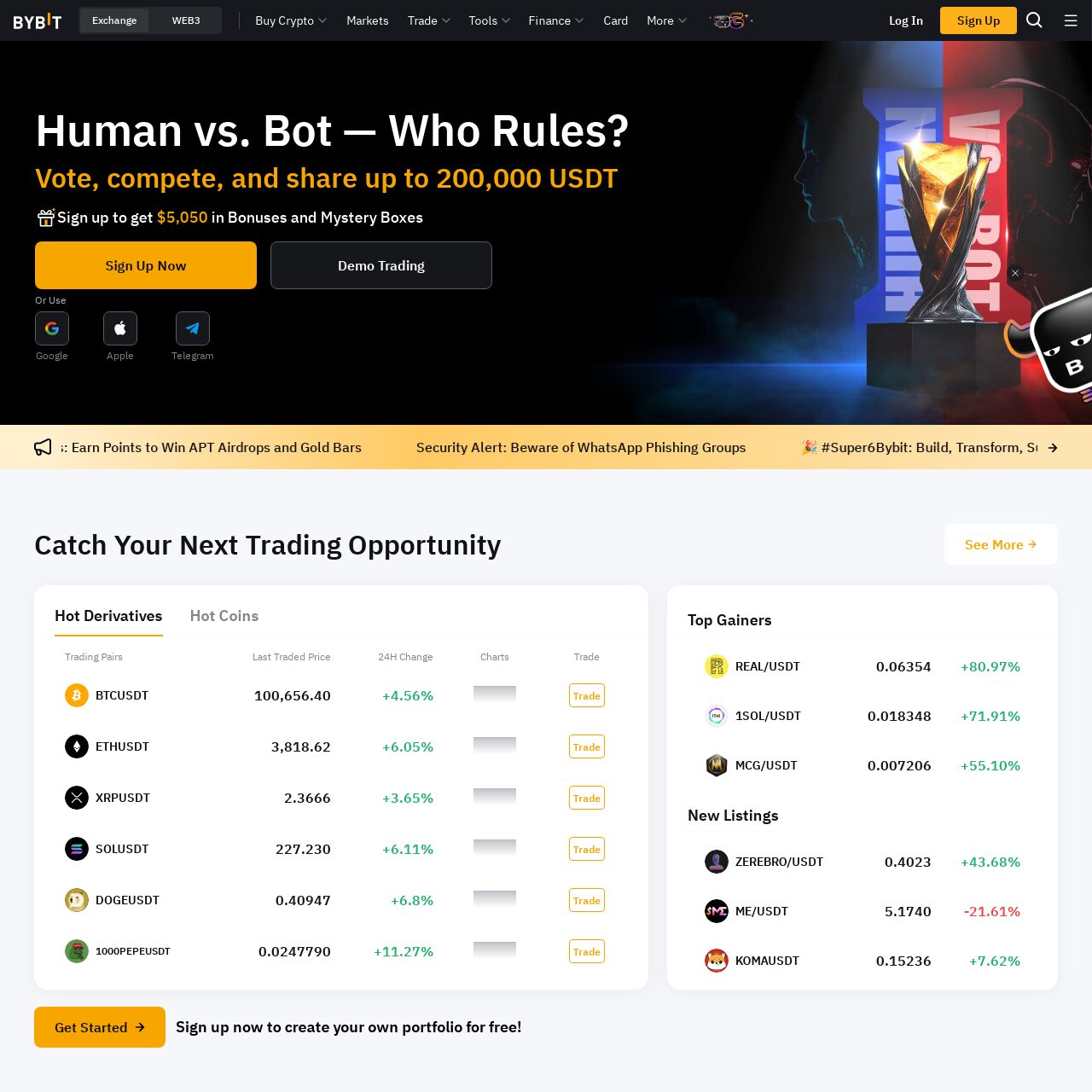

ByBit

Key features:

- Specialized in margin and derivative trades

- Extensive selection of 600 cryptocurrencies

- Low fees at 0.02%

- Advanced trading features

- Suitable for experienced traders

Pros:

- Our trading and matching engine is professional-grade with low fees and advanced features.

- Very detailed / functional web & mobile trading platform.

Cons:

- More oriented towards advanced traders and could be complicated for beginners

Website Screenshot:

Key Considerations for South African Crypto Traders

When selecting a crypto exchange, traders should evaluate:

- Transaction fees

- Supported cryptocurrencies

- Security protocols

- User interface

- Local payment integration

- Customer support quality

- Each platform offers unique advantages, so investors should align their choice with personal trading goals and risk tolerance.

Understanding Cryptocurrency Exchanges in South Africa

Cryptocurrency exchanges serve as digital platforms that enable traders to buy, sell, and trade digital assets. These platforms play a crucial role in South Africa’s rapidly evolving digital financial ecosystem.

Types of Crypto Exchanges

South African traders can choose from several distinct types of cryptocurrency exchanges:

Centralized Exchanges (CEXs)

- Operate with a third-party intermediary managing transactions

- Provide user-friendly interfaces and robust customer support

- Examples include Luno, VALR, and Binance

- Offer simplified trading experiences for beginners and experienced investors

Decentralized Exchanges (DEXs)

- Function without central authority or intermediary

- Enable direct peer-to-peer cryptocurrency transactions

- Provide enhanced privacy and reduced intermediary risks

- Typically require advanced technical understanding

- Offer greater control over personal cryptocurrency assets

Peer-to-Peer (P2P) Platforms

- Facilitate direct trades between individual users

- Allow users to negotiate transaction terms independently

- Provide flexible payment options

- Offer increased transaction privacy

- Ideal for traders seeking more personalized trading experiences

Regulatory Status

- Cryptocurrency trading is legal in South Africa

- No domestic regulations prohibit individual cryptocurrency transactions

- Anti-money laundering laws apply to crypto transactions

- South African Revenue Service (SARS) taxes cryptocurrency gains

Regulatory Oversight

- Financial Sector Conduct Authority (FSCA) monitors crypto activities

- Plans to bring Crypto Asset Service Providers (CASPs) under regulatory framework

- Demonstrates commitment to creating a structured crypto ecosystem

- Compliance Requirements

- Exchanges must implement robust Know Your Customer (KYC) procedures

- Mandatory reporting of significant transactions

- Emphasis on preventing financial fraud and money laundering

- Encourages transparent and secure cryptocurrency trading practices

Criteria for Selecting the Best Crypto Exchanges

Selecting the right cryptocurrency exchange requires careful evaluation of multiple critical factors. Investors must assess various elements to ensure a secure and efficient trading experience.

Security Considerations

- Regulatory Compliance

- Check for licenses from the Financial Sector Conduct Authority (FSCA)

- Verify the exchange’s adherence to South African financial regulations

- Look for platforms implementing robust Know Your Customer (KYC) procedures

- Security Protocols

- Assess the exchange’s two-factor authentication (2FA) capabilities

- Evaluate cold storage options for digital assets

- Examine the platform’s history of security breaches

- Check for insurance coverage against potential digital asset theft

- Fund Protection

- Verify segregated account practices for client funds

- Ensure encryption standards for personal and financial information

- Look for exchanges with comprehensive cybersecurity measures

Trading Fees and Costs

- Transaction Fees

- Compare percentage-based trading fees across platforms

- Analyze fees ranging from 0.1% to 1% per trade

- Consider volume-based fee discounts

- Hidden Costs

- Identify deposit and withdrawal fee structures

- Evaluate spread costs between buying and selling prices

- Check for any additional margin trading fees

Available Cryptocurrencies

- Asset Diversity

- Compare total number of cryptocurrencies offered

- Look for exchanges supporting major coins like Bitcoin and Ethereum

- Assess availability of emerging altcoins

- Verify trading pairs compatible with South African Rand (ZAR)

- Token Selection Criteria

- Check exchange’s token listing standards

- Evaluate the frequency of new cryptocurrency additions

- Consider the platform’s research and due diligence process

User Experience

- Platform Accessibility

- Assess mobile and desktop interface usability

- Check availability of demo trading accounts

- Evaluate platform loading speed and responsiveness

- Educational Resources

- Look for comprehensive trading guides

- Check for real-time market analysis tools

- Verify availability of tutorial content for beginners

- Local Payment Integration

- Verify support for South African banking methods

- Check availability of local payment processors

- Assess transaction processing times

- Deposit Options

- Compare bank transfer capabilities

- Check credit/debit card acceptance

- Evaluate alternative payment methods like EFT and digital wallets

- Currency Support

- Confirm direct ZAR trading pairs

- Check for multiple currency conversion options

- Assess international payment flexibility

Essential Features of Reliable Crypto Exchanges

Identifying reliable crypto exchanges requires a comprehensive evaluation of multiple critical features. South African traders must prioritize platforms that offer robust security, user-friendly interfaces, and comprehensive trading capabilities.

Account Verification Process

- Identity verification is a crucial step in crypto exchange registration that ensures platform security and regulatory compliance.

- Most reputable South African crypto exchanges implement a Know Your Customer (KYC) process that typically involves:

- Submitting government-issued photo identification

- Providing proof of residential address

- Completing a selfie verification

- The verification timeline ranges from 24-72 hours depending on the exchange’s internal procedures.

- Quick and streamlined verification processes enable traders to start trading faster and reduce administrative barriers.

Transaction Limits

![]()

- Transaction limits protect both traders and exchanges from potential financial risks.

- Typical transaction limit structures include:

- Daily withdrawal caps

- Monthly transaction maximums

- Tiered limits based on account verification levels

- Standard transaction limits for South African crypto exchanges range from:

- Daily withdrawals: R50,000 – R250,000

- Monthly transactions: R500,000 – R1,000,000

- Higher verification levels often correlate with increased transaction limits.

Customer Support

![]()

Comprehensive customer support is essential for resolving trading issues and technical challenges.

Top crypto exchanges offer multiple support channels:

- Live chat

- Email support

- Phone assistance

- Comprehensive knowledge base

- Response times typically range from 15 minutes to 24 hours.

- Look for exchanges with multilingual support and 24/7 availability.

- Advanced trading platforms provide critical tools for successful cryptocurrency trading.

- Key features to evaluate include:

- Real-time price charts

- Advanced order types

- Portfolio tracking

- Market analysis tools

- Recommended platform characteristics:

- Intuitive user interface

- Mobile and desktop compatibility

- Low-latency trade execution

- Bonus features like price alerts and automated trading can enhance trading strategies.

How to Choose a Crypto Exchange in South Africa

Selecting the right cryptocurrency exchange in South Africa requires careful consideration of multiple factors. Investors must evaluate several key aspects to ensure a secure and efficient trading experience.

Evaluating Exchange Reputation

- Check regulatory compliance by verifying the exchange’s registration with the Financial Sector Conduct Authority (FSCA).

- Research the platform’s history of security breaches and how they’ve been addressed.

- Read user reviews and independent platform ratings from multiple sources.

- Investigate the exchange’s track record of handling customer funds and resolving disputes.

- Look for exchanges with transparent ownership and clear communication about their operational practices.

Assessing Platform Liquidity

- Examine the trading volume across different cryptocurrencies on the platform.

- Compare the number of active traders and total transaction values.

- Check the bid-ask spread for major cryptocurrencies like Bitcoin and Ethereum.

- Verify the range of trading pairs available on the exchange.

- Assess the ease of executing large trades without significant price slippage.

Understanding Risk Management

- Review the exchange’s security protocols, including:

- Two-factor authentication

- Cold storage options

- Insurance for digital assets

- Investigate the platform’s fund protection measures.

- Understand the exchange’s approach to handling potential cyber threats.

- Check the withdrawal limits and daily transaction caps.

- Evaluate the platform’s risk management tools for traders.

- Analyze the fee structure, including:

- Trading fees

- Deposit and withdrawal charges

- Hidden costs

- Compare the range of supported cryptocurrencies.

- Assess the user interface and trading tools availability.

- Check local payment method integrations for South African traders.

- Evaluate additional features like:

- Mobile app functionality

- Advanced trading options

- Educational resources

- Customer support quality

Key considerations include matching the exchange’s features with your specific trading needs, risk tolerance, and investment goals. South African traders should prioritize platforms that offer robust security, competitive fees, and comprehensive local support.

Regulatory Compliance and Tax Implications

South Africa’s cryptocurrency ecosystem operates within a sophisticated regulatory framework designed to balance innovation with financial security. Investors must navigate complex legal requirements to ensure compliant and transparent crypto trading experiences.

South African Cryptocurrency Regulations

Regulatory Framework

- The Financial Sector Conduct Authority (FSCA) oversees cryptocurrency regulations

- Crypto exchanges must register as Crypto Asset Service Providers (CASPs)

- Platforms require comprehensive licensing to operate legally

- Strict Know Your Customer (KYC) procedures are mandatory

- Anti-money laundering (AML) protocols must be implemented rigorously

Legal Status

Cryptocurrencies are recognized as property in South Africa

- Digital assets are not considered legal tender

- Trading and investing in cryptocurrencies is legal but heavily monitored

- Exchanges must comply with existing financial regulations

- Regular audits ensure platform transparency and consumer protection

Tax Obligations for Crypto Traders

Income Tax Considerations

- Cryptocurrency profits are subject to income tax

- Regular traders must report crypto gains as taxable income

- Capital gains tax (CGT) applies to cryptocurrency disposals

- Transactions involving digital assets are closely tracked by SARS

Compliance Strategies

- Use licensed and regulated cryptocurrency exchanges and apps and avoid any that don’t require KYC or have any registration requirements or information about their cyber security practices

- Maintain accurate and complete transaction documentation

- Consult with local tax professionals specializing in digital assets

- Stay updated on evolving regulatory guidelines

- Implement robust personal financial tracking mechanisms

Common Challenges for South African Crypto Traders

Cryptocurrency trading in South Africa presents unique obstacles that investors must navigate carefully. These challenges range from regulatory restrictions to financial ecosystem limitations that can impact trading strategies.

Payment Method Restrictions

South African crypto traders often face significant payment method restrictions that complicate digital asset transactions. Local banks have implemented stringent policies limiting direct cryptocurrency purchases, forcing traders to use alternative payment channels. Key restrictions include:

- Limited credit card transactions for crypto purchases

- Restrictions on direct bank transfers to crypto exchanges

- Additional verification requirements for international payment platforms

- Higher transaction fees for crypto-related payments

- Periodic bank account freezes for suspected crypto transactions

Safety and Security Best Practices

Protecting your cryptocurrency investments requires a proactive approach to digital security. These essential practices will help South African crypto traders safeguard their digital assets from potential threats.

Two-Factor Authentication

- Two-factor authentication (2FA) provides a critical layer of protection for crypto exchange accounts. Traders should:

- Enable 2FA immediately after creating an account

- Use authenticator apps like Google Authenticator over SMS-based verification

- Select exchanges offering multiple 2FA options (app-based, hardware tokens, biometric)

- Avoid using the same 2FA method across multiple platforms

- Regularly update and review authentication settings

- Store backup codes in a secure, offline location

Cold Storage Options

Cold storage solutions protect cryptocurrencies from online vulnerabilities by keeping assets offline. Recommended strategies include:

- Utilize hardware wallets like Ledger or Trezor

- Store 80-90% of long-term crypto holdings offline

- Choose wallets supporting multiple cryptocurrencies

- Keep hardware wallets in secure, fireproof locations

- Maintain encrypted backup of wallet recovery phrases

- Consider multi-signature wallets for additional security

- Rotate storage locations periodically to minimize risk

- Use unique, complex passwords for each crypto platform

- Implement regular security audits of exchange accounts

- Monitor transaction histories for suspicious activities

- Keep software and wallet applications updated

- Avoid public Wi-Fi when accessing crypto platforms

- Create separate email addresses for crypto-related communications

- Understand and utilize platform-specific security features

Getting Started with Crypto Trading

Embarking on your cryptocurrency trading journey requires careful preparation and strategic decision-making. The following steps will guide South African investors through the essential process of setting up and launching their first crypto trading experience.

Opening Your First Exchange Account

- Choose a Reputable Exchange: Select a South African crypto exchange like VALR, Luno, or Binance that offers robust security and user-friendly features.

- Visit the exchange’s official website

- Click on “Sign Up” or “Register”

- Provide a valid email address

- Create a strong, unique password

- Confirm your email through the verification link sent to your inbox

Complete Identity Verification:

- Prepare government-issued identification (driver’s license or passport)

- Upload a clear scan of your ID document

- Take a selfie holding your ID for additional verification

- Submit required personal information including:

- Full name

- Local South African address

- Phone number

- Wait for account verification (typically 24-72 hours)

Funding Your Account

Select Funding Method:

- Bank transfer (most common in South Africa)

- Credit/debit card

- Electronic payment systems

- Local payment platforms like EFT

Verify Payment Details:

- Check minimum deposit requirements

- Confirm transaction fees

- Ensure your bank allows cryptocurrency-related transactions

- Start with a small initial deposit to test the process

Transfer Funds:

- Navigate to the “Deposit” section

- Choose your preferred payment method

- Enter the deposit amount

- Follow platform-specific instructions

- Confirm transaction and wait for funds to reflect

Research Cryptocurrencies:

- Consider starting off with established cryptocurrencies like Bitcoin or Ethereum

- Review current market prices

- Understand basic trading principles

- Set a conservative initial investment amount

Place Your First Order:

- Select your desired cryptocurrency

- Choose order type (market or limit order)

- Enter the amount you want to purchase

- Review transaction details

- Confirm the trade

- Start with a small investment to minimize potential risks

Monitor Your Investment:

- Track cryptocurrency price movements

- Use platform’s price alert features

- Set realistic profit and loss thresholds

- Learn from each transaction

Key Takeaways

Top Exchanges Offer Diverse Options: South African traders have multiple high-quality crypto exchanges like Binance, VALR, Luno, Coinbase, and ByBit, each providing unique features, competitive fees, and varying cryptocurrency selections.

Security and Regulation are Critical: Always choose exchanges regulated by the Financial Sector Conduct Authority (FSCA), with robust KYC procedures, two-factor authentication, and comprehensive security protocols to protect your digital assets.

Local Payment Integration Matters: The best crypto exchanges for South African traders support ZAR transactions, offer instant local bank transfers, and provide multiple payment methods tailored to the domestic market.

Fee Structures Vary Significantly: Trading fees range from 0.01% to 0.60% across different platforms, making it essential to compare transaction costs, deposit/withdrawal charges, and potential hidden expenses before selecting an exchange.

Crypto Trading Requires Careful Compliance: South African crypto investors must understand tax obligations, report cryptocurrency gains to SARS, and maintain detailed transaction records to ensure legal and financial compliance.

Start Small and Learn Continuously: New traders should begin with established cryptocurrencies, use platform educational resources, and gradually build their trading skills while managing investment risks effectively.

Conclusion: Navigating the South African Crypto Landscape

The South African cryptocurrency market presents exciting opportunities for investors willing to navigate its complex landscape. Choosing the right exchange requires careful consideration of security features user experience and regulatory compliance.

Traders must remain adaptable and informed as the crypto ecosystem continues to evolve. By selecting reputable platforms understanding local regulations and implementing robust security practices investors can position themselves for potential success in this dynamic market.

With diligent research strategic decision-making and a commitment to ongoing learning South African crypto enthusiasts can confidently explore the world of digital assets. The key lies in staying proactive informed and risk-aware throughout their investment journey.

Frequently Asked Questions

What are the best cryptocurrency exchanges in South Africa?

In 2025, the top cryptocurrency exchanges for South African traders include Binance, VALR, Luno, Coinbase, and ByBit. Each platform offers unique features: Binance provides over 500 cryptocurrencies with low fees, VALR focuses on local market needs with 75 supported cryptocurrencies, Luno is beginner-friendly, Coinbase offers high security, and ByBit caters to experienced traders with advanced features and 600 cryptocurrencies.

Is cryptocurrency trading legal in South Africa?

Cryptocurrency trading is legal in South Africa. The Financial Sector Conduct Authority (FSCA) oversees the crypto market, requiring exchanges to register as Crypto Asset Service Providers (CASPs). Traders must comply with Know Your Customer (KYC) procedures and follow anti-money laundering protocols. While cryptocurrencies are not considered legal tender, they are recognized as property and subject to taxation.

What should I consider when choosing a crypto exchange?

When selecting a crypto exchange, consider key factors like transaction fees, supported cryptocurrencies, security protocols, user interface, local payment integration, and customer support quality. Evaluate the platform’s reputation, regulatory compliance, trading volume, and ease of use. Prioritize exchanges with robust security measures, competitive fees, comprehensive local support, and alignment with your specific trading goals and risk tolerance.

How do I start trading cryptocurrencies in South Africa?

To begin crypto trading, first choose a reputable exchange like Binance or VALR. Complete the identity verification process by submitting government-issued ID and proof of address. Fund your account using local payment methods. Start with established cryptocurrencies, place cautious initial orders, and carefully monitor your investments. Enable two-factor authentication and consider using a hardware wallet for enhanced security.

What are the tax implications of crypto trading?

Cryptocurrency gains in South Africa are subject to income tax and capital gains tax. Traders must maintain comprehensive transaction records for accurate reporting. Income from crypto trading is taxed at standard income tax rates, while capital gains are calculated based on the difference between buying and selling prices. It’s recommended to consult a tax professional to ensure proper compliance with current regulations.

What security measures should I implement?

Implement critical security measures like enabling two-factor authentication (2FA) using authenticator apps, creating unique passwords, and monitoring transaction histories. Consider using hardware wallets (cold storage) for long-term cryptocurrency holdings. Choose exchanges with strong security protocols, regular security audits, and fund protection mechanisms. Always be vigilant about potential digital threats and protect your investment carefully.

What challenges do South African crypto traders face?

South African crypto traders encounter challenges like payment method restrictions, limited credit card transactions, and complex banking policies. The local market has reduced liquidity compared to international exchanges, higher cross-border transaction costs, and intricate currency conversion processes. Regulatory compliance and banking limitations can complicate trading strategies, requiring traders to be adaptable and well-informed.

Can I earn passive income from cryptocurrencies?

Several platforms offer passive income opportunities through crypto staking, savings accounts, and lending programs. Exchanges like Luno provide options to earn interest on holdings of Bitcoin, Ethereum, and stablecoins. However, these opportunities come with varying risk levels, and returns are not guaranteed. Always research and understand the specific terms and potential risks before investing.

Why Trust AGR Technology?

AGR Technology’s journey began in 2013 when Alessio Rigoli established it as a YouTube channel back in high school and later expanded into a tech-focused blog. Initially covering diverse topics like Android, Cyber Security, Blockchain, and EdTech, the business has come a long way since its early days.

Today, AGR Technology offers a comprehensive suite of services to businesses, including Website development, Hosting, Software Development, and Digital Marketing. We take pride in our ability to serve clients of all sizes, spanning various industries. Our commitment to providing innovative and high-quality technology solutions has helped numerous businesses achieve growth and success and our focus on content publishing has still remained over the years. We write our own independent assessments and are not owned by an exchange.

Disclaimer:

Crypto assets can be highly volatile unregulated investment products and like any type of investment can increase or decrease in value. By no means is this article designed to be financial advice. While we vet each platform we mention on our website and provide regular content updates, we recommend that you conduct extensive research before making investment decisions, form your own opinion, and invest only what you can afford to lose because there is no such thing as a guarantee in investing.

Source(s) cited:

Licenses, Registrations and Other Legal Matters [Online]. Available at: https://www.binance.com/en/legal/licenses (Accessed: 11 December 2024).

“Reuters.Com” www.reuters.com/business/finance/south-african-cryptocurrency-exchange-valr-targets-global-expansion-2024-04-30/. Accessed 11 Dec. 2024.

“Help Center” help.etoro.com/s/article/Is-eToro-supported-in-my-country?language=en_GB. Accessed 11 Dec. 2024.

“About – The World’s Leading Cryptocurrency Company” Luno, www.luno.com/en/about. Accessed 11 Dec. 2024.

“Luno” Luno, www.luno.com/en/legal/licenses. Accessed 11 Dec. 2024.

https://www.iconfinder.com/icons/4104745/download/png/512 Via CC BY 3.0

[Online]. Available at: https://mms.businesswire.com/media/20230322005219/en/1744461/22/luno_logo.jpg (Accessed: 11 December 2024).

“Crunchbase” Accessed December 11, 2024. https://www.crunchbase.com/organization/valr.

Diriye Amey from Locarno, Switzerland, CC BY 2.0, via Wikimedia Commons

QR Code of this page for mobile users:

Alessio Rigoli is the founder of AGR Technology and got his start working in the IT space originally in Education and then in the private sector helping businesses in various industries. Alessio maintains the blog and is interested in a number of different topics emerging and current such as Digital marketing, Software development, Cryptocurrency/Blockchain, Cyber security, Linux and more.

Alessio Rigoli, AGR Technology

![logo-new-23[1] logo-new-23[1]](https://agrtech.com.au/wp-content/uploads/elementor/thumbs/logo-new-231-qad2sqbr9f0wlvza81xod18hkirbk9apc0elfhpco4.png)