Disclaimer: General information only. All kinds of investment (particularly trading Cryptocurrencies involve significant risk, including the possibility of losing more than the amount invested, as well as market volatility and liquidity hazards. Past performance does not guarantee future results. Most investors will find such operations unsuitable.

Cryptocurrency trading has rapidly gained traction in Saudi Arabia as digital assets become increasingly mainstream. Investors and enthusiasts are constantly seeking reliable platforms that offer secure and efficient ways to buy sell and trade digital currencies. The Saudi Arabian crypto market presents unique opportunities for both seasoned traders and newcomers looking to explore digital financial landscapes.

Quick takeaway:

Navigating the complex world of crypto exchanges requires careful consideration of multiple factors including security trading fees available cryptocurrencies and user experience. While global platforms like Binance and Kraken have strong presences the local market also boasts specialized exchanges such as Rain and BitOasis that cater specifically to Saudi Arabian traders and other traders in the Middle East. These platforms provide localized services and understand the nuanced financial ecosystem of the region.

Top crypto brokers in Saudi Arabia in February 2026

As the cryptocurrency landscape continues to evolve Saudi Arabian investors have access to an impressive array of trading platforms that balance innovative technology with robust security measures. Understanding the key features of these exchanges can help traders make informed decisions and maximize their digital asset investment strategies.

Binance

Binance is one of the world’s largest and most popular cryptocurrency exchanges, providing customers with low-fee trades and extensive liquidity. This exchange has built its name by providing a dependable and safe platform for traders to quickly buy, sell, and store cryptocurrencies.

Binance’s trading fees are tiered, with the charge decreasing as the trade volume increases. This encourages traders to trade more and enjoy lower fees as a result.

Binance is most recognized for its spot market, which allows users to trade cryptocurrencies against each other or fiat currencies. Spot market fees begin at 0.1%, making it one of the most cost-effective exchanges accessible.

The exchange also provides numerous trading pairings for popular cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and Binance Coin (BUSD).

Binance is incredibly popular globally because of its size and history as an industry platform, and it also has a substantial user base in Norway as well.

Key Features of Binance

Binance hosts over 100 cryptocurrencies, enabling diverse investment strategies through multiple revenue generation methods. The platform supports advanced financial instruments including staking, savings accounts, yield farming, and an integrated NFT marketplace featuring static and animated digital assets.

Pros

- It has sophisticated trading features

- Binance Academy provides cryptocurrency instruction

- A wide range of crypto assets are available for purchase

- Low transaction costs

- They offer an “earn” Program that offers a high APY on cryptocurrency

Cons

- It is not necessarily the most simple platform for those who have never utilized an exchange before

- It has faced numerous regulatory problems in the past

Traders should carefully evaluate platform capabilities against individual investment requirements and risk tolerance before committing to Binance as their primary cryptocurrency exchange.

Website screenshot:

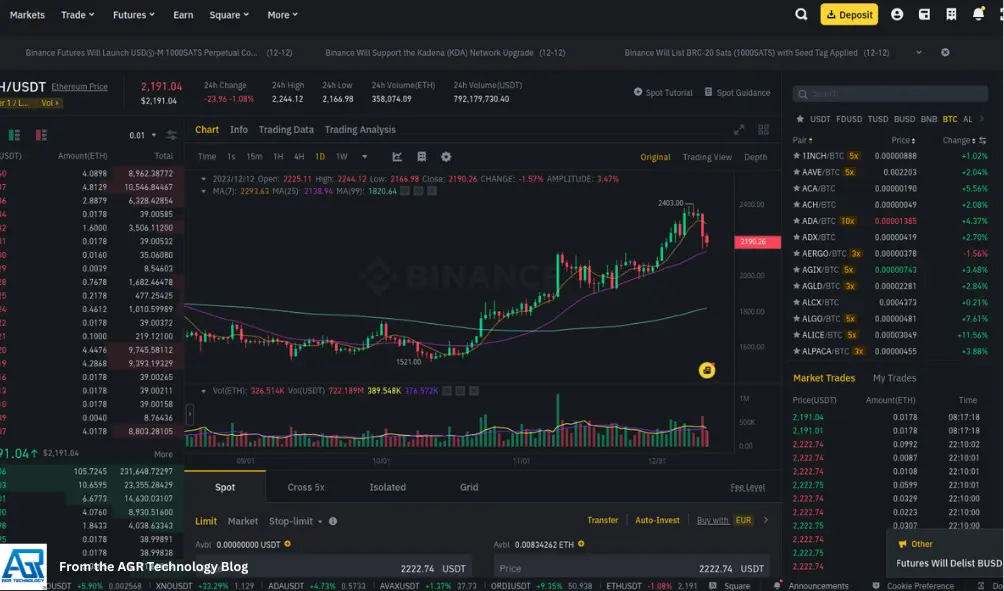

Screenshot of trading component:

AvaTrade (Best for trading Crypto and traditional trading such as CFDs)

AvaTrade is recognized as one of the top Cryptocurrency platforms supporting Saudi Arabia, offering a platform for traders to engage in crypto trading. AvaTrade distinguishes itself as a CFD (Contract For Difference) broker, offering access to a diverse range of over 800 markets. This includes opportunities to trade in forex, stocks, commodities, indices, ETFs, bonds, and cryptocurrencies, providing traders with ample options to diversify their portfolios and pursue their investment goals.

With a wide range of products, including forex, indices, shares, ETFs, commodities, and cryptocurrencies, AvaTrade caters to the needs of both beginner and experienced traders. Additionally, it has earned recognition as one of the leading online brokers in Saudi and around the world, offering reliable services and favorable trading platforms.

Pros

-

Trade over 19,000 assets across diverse markets

-

Multi-regulated security

-

User-friendly platform for trading

-

Top-rated trading experience on both web and mobile platforms

-

Comes with social trading features

- Has options for different types of trading beyond just Cryptocurrency

Cons

-

Requires a $100 minimum deposit requirements to start trading

-

Fewer advanced features

- Doesn’t have functionality for Cryptocurrency wallets to buy and hold Crypto assets can only be used for trading

OKX

Are you ready to take your Crypto trading to the next level? Look no further than OKX – the global Crypto exchange based in Seychelles and now available for use in Saudi Arabia and the MENA region!

With an array of cutting-edge features, OKX offers multiple order types, including margin trading, futures, spot, and options trading, all on one crypto trading platform. But that’s not all – OKX also boasts an NFT marketplace, Crypto staking, lending & borrowing, and much more to enhance your trading experience.

But what about the security of your funds? OKX has got you covered with complete transparency in its holdings. Users can trust that their funds are held 1:1, thanks to OKX’s proof of reserves. Don’t settle for less – choose OKX for a feature-rich, transparent, and exciting Crypto trading experience.

Features of OKX

- Zero fees for deposits and withdrawals

- Competitive trading fees with 0% maker fees and 0.2% taker fees

- Variable spreads depend on the token

- Supports over 300 cryptocurrencies

- Offers 24/7 customer support through live chat, email, and social media

- Provides multiple AED deposit methods, including bank transfer, debit card, credit card, Skrill, Wise, FasterPay, Neteller, Zen, ADIB, and Revolut

Pros

- Offers support for a diverse range of fiat currencies for account opening

- Provides educational resources for users

- Offers a comprehensive range of services and products

- High Staking APY’s available

- Offers hundreds of trading pairs for increased options and flexibility

- Provides an intuitive Buy/Sell dashboard

- Offers quick tech support through online chat

Cons

- At the time of writing has no native Saudi Riyal (SAR) currency compatability for deposits & withdrawals

- Utilizes a complicated and multi-tiered fee structure, which may be challenging to navigate

Website screenshot:

BitOasis

BitOasis emerges as a UAE-native cryptocurrency exchange offering:

- Local regulatory alignment

- Secure digital asset management

- AED, SAR and USD trading pairs

- Enhanced mobile trading experience

- Quick verification processes

- Regional customer support

Pros

- Local platform based in the region licensed by VARA (Virtual Asset Regulatory Authority)

- Supports SAR deposits and withdrawals

- Great mobile app

- Supports credit card and debit card deposits

Cons

- At the time of writing services are only available in the following countries: United Arab Emirates, Saudi Arabia, Kuwait, Bahrain, Oman, Qatar, Egypt, Jordan, Morocco, Algeria, Tunisia, Lebanon, Iraq and Libya

- Lower amount of assets to choose from compared to other platforms

- Higher processing fees compared to other platforms

Website screenshot:

Rain

Looking for Crypto exchanges in the Middle East you can trust? Look no further than Rain – the most secure and reputable exchange operating across several countries. Based in Bahrain, Rain serves customers in several Middle Eastern countries, including the UAE and Saudi Arabia, with its top-tier services.

Rain is a fully licensed and regulated exchange under the Abu Dhabi Global Market and the Central Bank of Bahrain, offering peace of mind regarding your Crypto investments.

Join the Rain community today and experience the ultimate security, reliability, and affordability for all your Crypto trading needs.

Features of Rain

- No deposit or trading fees on Rain

- A withdrawal fee of $15 per transaction

- Supports over 100 crypto assets

- Licensed by the Abu Dhabi Global Market (ADGM)

- Regulated by the Central Bank of Bahrain (CBB)

- Offers 24/7 customer support through live chat, email, phone, and social media

- Provides multiple deposit methods, including bank transfer, debit card, credit card, Fawri, Easy Deposit, and Fawri+

Pros

- Conveniently purchase Bitcoin in the Middle East region

- Complies with Shari’a law

- Holds a license from the Central Bank of Bahrain (CBB), indicating regulatory compliance and oversight

Cons

- Restricted to a limited number of countries, specifically Bahrain, Kuwait, Oman, Saudi Arabia, and UAE

Website screenshot:

Bybit

Bybit is a cryptocurrency exchange that has become a popular choice for crypto traders globally. With over 10 million customers worldwide, the exchange has established itself as one of the leading derivatives trading platforms in the industry.

Bybit offers a range of trading options for cryptocurrencies such as Bitcoin, Ethereum, and Ripple, with a daily trading volume frequently exceeding $10 billion.

One of the critical features of Bybit is its deep liquidity. The exchange has established partnerships with some of the largest liquidity providers in the industry, ensuring that traders can execute trades quickly and efficiently. This, combined with the platform’s rapid trade speed of 100,000 trades per second, attracts many traders looking for a fast and reliable trading experience.

Bybit has an extensive range of over 280 coins available to trade, including many of the most popular cryptocurrencies on the market. This broad selection of assets allows traders to diversify their portfolios and take advantage of a range of trading opportunities.

The exchange is also known for its low trading fees, making it an attractive option for traders looking to keep their costs down. Bybit charges a flat fee of just 0.1% on all trades, which is one of the lowest in NZ.

Bybit also strongly emphasizes security, with 99.99% system functionality and robust security measures in place to protect user accounts and funds. The exchange uses a multi-signature cold storage system to store users’ funds offline and employs two-factor authentication (2FA) and other security measures to prevent unauthorized access.

Finally, Bybit offers 24/7 live chat support to its users, ensuring that traders can get help with any issues they encounter while using the crypto trading platform.

Pros

Bybit presents multiple strategic advantages for cryptocurrency traders:

- Extensive Liquidity: The platform connects with premier industry liquidity providers, ensuring smooth and efficient trade execution.

- Diverse Asset Range: Traders access over 1,400 digital assets, enabling comprehensive investment strategies.

- Competitive Pricing: Bybit maintains low trading fees, including a 0.002% maker fee and 0.055% taker fee for futures trading.

- Advanced Security: Implements multi-layered protection mechanisms to safeguard user funds and transaction integrity.

- Innovative Features: Offers unique services like copy trading, NFT marketplace, crypto Visa card, and AI-powered investment assistant TradeGPT.

Cons

- Complex Interface: The platform’s advanced features might overwhelm novice traders.

- Limited Regional Availability: Not universally accessible across all global markets.

- Regulatory Constraints: Not available in all countries and markets

Website screenshot:

Kraken Exchange

![10 Best Crypto exchanges & apps in Australia [Ranked] 21 KrakenCryptoExchangeLogo](https://cdn-ihdfn.nitrocdn.com/eZVJvoSTyVixkEUySRKiaseNtUlmgCyu/assets/images/optimized/rev-b7ced37/agrtech.com.au/wp-content/uploads/2023/01/KrakenCryptoExchangeLogo-300x200.jpeg.webp)

Kraken is one of the most reputable and well-established cryptocurrency exchanges offering global users sophisticated trading options. The exchange provides access to various order types, such as stop-loss, market, and limit orders, with customisable charts designed to suit experienced traders’ needs.

Kraken has a daily trading volume of US$500 million, making it one of the most liquid crypto exchanges on the market. Traders can expect to execute trades at fair prices and with minimal slippage. This is particularly beneficial for Saudi crypto traders who want to execute large trades or trades with high precision.

The exchange’s trading fees are based on a volume system, which means that high-volume traders can benefit from competitive fees. High-wealth traders with large trading volumes can even get fees as low as zero.

This makes the exchange a great choice for successful traders who want to trade frequently or trade large amounts of assets.

In addition, Kraken offers 24/7 support, a secure and reliable trading platform, and rigorous security measures, which include two-factor authentication and PGP encryption. With all these features, Kraken is considered one of the best exchanges for trading in Australia.

Key features:

- Various order types (stop-loss, market, limit)

- High liquidity ($500 million daily trading volume)

- Volume-based fee structure

Pros

- Advanced trading options for experienced traders

- Wide range of order types

- High liquidity and fair prices

- Volume-based trading fees, with low fees for high-volume traders

- 24/7 customer support

- Secure and reliable trading platform

Cons

- Fewer assets when compared to certain other rivals.

Website screenshot:

![10 Best Crypto exchanges & apps in Australia [Ranked] 23 KrakenScreenshot](https://cdn-ihdfn.nitrocdn.com/eZVJvoSTyVixkEUySRKiaseNtUlmgCyu/assets/images/optimized/rev-b7ced37/agrtech.com.au/wp-content/uploads/2023/11/KrakenScreenshot-300x183.png.webp)

Kraken FAQs

How do I make a deposit into my Kraken account?

Kraken allows a variety of deposit methods, including:

- Cryptocurrency deposits: Transfer cryptocurrency from another wallet to your Kraken account.

- Fiat deposits: You can deposit traditional currencies (USD, EUR, GBP, etc.) using wire transfer, SEPA, or other methods depending on your location. Some countries may also accept credit or debit card deposits. Make sure you enter the correct deposit information for each asset.

How do I withdraw funds from Kraken?

To withdraw funds:

- Navigate to your Kraken account and go to the “Funding” section.

- Select the asset (crypto or fiat) you wish to withdraw.

- For cryptocurrency withdrawals, enter the recipient address and confirm the withdrawal.

- For fiat withdrawals, follow the instructions to send funds to your bank account. Withdrawals may incur fees depending on the method and the asset.

What are Kraken fees?

Answer: Kraken charges fees for trading, deposits, and withdrawals. The fees can vary depending on the type of trade (spot trading, futures, margin) and the trading volume. Some typical fees include:

- Trading Fees: Kraken uses a tiered fee structure based on your 30-day trading volume. The more you trade, the lower the fees.

- Deposit Fees: Crypto deposits are generally free, while fiat deposits may incur a fee, depending on the method.

- Withdrawal Fees: Fees depend on the asset type. Crypto withdrawals may have network fees, while fiat withdrawals could involve bank transfer fees.

For up-to-date fee schedules, check Kraken’s Fee Schedule page.

Paybis

Paybis is a reputable cryptocurrency exchange platform known for its user-friendly interface and efficient services. It boasts over 1 million active users and offers a wide range of cryptocurrencies for trading. Paybis stands out for its smooth transaction process, allowing users to buy and sell crypto using various payment methods, including credit cards, debit cards, and bank transfers. With a focus on accessibility and customer satisfaction, Paybis has become a preferred choice for individuals looking to engage in the crypto market seamlessly.

Supported Cryptocurrencies: Paybis supports a wide range of cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and more.

HKD Deposit Methods: Paybis facilitates fiat-to-crypto transactions through various payment methods, including bank transfers, credit/debit cards, and electronic wallets.

What Makes It Unique?

-

Offers a seamless and user-friendly platform for buying and selling cryptocurrencies with fiat currencies

-

Provides 24/7 customer support to assist users with any issues or inquiries

-

Implements strict security protocols, including SSL encryption and two-factor authentication, to ensure the safety of transactions

-

Supports multiple languages and offers a global reach, catering to users from different regions

Exness (Ideal for tight spreads and a professional-style trading experience)

Exness stands out as one of the best crypto exchanges and comes with a bespoke trading experience in Taiwan. It offers access to over 35 cryptocurrencies, including popular options like Bitcoin, Ethereum, and Litecoin. Catering to all experience levels, Exness provides a variety of account types, ensuring suitability for both beginners and advanced users.

The platform also offers a free demo account, allowing users to familiarize themselves with crypto trading before committing to real funds. With support for MetaTrader software, Exness enhances trading capabilities for advanced users.

As a leading digital currency financial institution, Exness facilitates crypto transactions securely and efficiently. Overall, Exness provides a comprehensive range of trading options, making it a go-to choice within the cryptocurrency industry.

Pros

-

Low trading costs

-

Swap free instruments

-

Access a versatile trading terminal on mobile, desktop, and web browsers

-

There are no charges for inactivity on inactive accounts.

Cons

-

Geographical limitation: clients residing in the USA and Europe are not accepted

-

Limited range of markets

-

No bonuses & promotions

Understanding Cryptocurrency in Saudi Arabia

Cryptocurrency adoption in Saudi Arabia has been evolving rapidly, with the country showing increasing interest in digital financial technologies. The Kingdom’s approach to crypto reflects a complex mix of regulatory caution and technological curiosity.

Legal Status of Crypto

- The Saudi Arabian Monetary Authority (SAMA) has maintained a cautious but progressive stance on cryptocurrencies.

- While cryptocurrencies aren’t considered legal tender, they’re not explicitly banned in the country.

- Investors can trade and own cryptocurrencies, but with significant regulatory oversight.

- The government requires strict compliance with anti-money laundering (AML) regulations for crypto transactions.

- Personal crypto investments are permitted, but institutional involvement remains carefully controlled.

Regulatory Landscape

- Saudi Arabia has implemented a nuanced regulatory framework for cryptocurrency activities

- The Capital Market Authority (CMA) provides guidelines for crypto-related investments

- Exchanges must register and obtain necessary licenses to operate legally in the Kingdom

- Know Your Customer (KYC) and due diligence processes are mandatory for crypto platforms

- The government actively monitors digital asset transactions to prevent financial misconduct

- Cryptocurrency interest in Saudi Arabia has grown significantly in recent years

- Young Saudi investors show increasing enthusiasm for digital asset investments

- Bitcoin and Ethereum remain some of the most popular cryptocurrencies in the market

- Local platforms like BitOasis and Rain have gained considerable traction among Saudi traders

Top Criteria for Choosing a Crypto Exchange

Selecting the right crypto exchange requires careful evaluation of multiple critical factors. Investors in Saudi Arabia should consider several key elements to ensure a safe and efficient trading experience.

Trading Fees and Commissions

Trading fees can significantly impact overall investment returns. The best crypto exchanges in Saudi Arabia typically charge:

- Competitive rates between 0.1% and 1% per trade

- Lower fees for high-volume traders

- Potential discounts for using platform-specific tokens

- Transparent fee structures with no hidden charges

Traders should compare fee schedules across exchanges, noting that lower fees don’t always mean better service. Some platforms offer sliding scale fees that decrease as trading volume increases, providing cost-effective options for active investors.

Security Measures

Critical security features to evaluate include:

- Two-factor authentication (2FA)

- Cold storage for majority of cryptocurrency assets

- Regular security audits

- Insurance coverage for digital assets

- Advanced encryption protocols

- Compliance with international security standards

Robust security measures protect investors from potential cyber threats and unauthorized access. Exchanges regulated by Saudi financial authorities provide an additional layer of protection and credibility.

User Experience

Top crypto exchanges should offer:

- Intuitive, user-friendly interfaces

- Mobile app compatibility

- Multiple language support

- Quick account verification process

- Responsive customer support

- Educational resources for beginners

- Advanced trading tools for experienced investors

A seamless user experience can significantly reduce trading friction and improve overall investment management.

Available Cryptocurrency Options

Ideal exchanges provide:

- Wide range of cryptocurrencies (minimum is typically between 50-100 options)

- Major cryptocurrencies: Bitcoin, Ethereum, Ripple

- Emerging altcoins and tokens

- Regular addition of new digital assets

- Diverse trading pairs

- Futures and derivatives options

Variety allows investors to diversify their cryptocurrency portfolio and explore emerging investment opportunities.

Payment Methods

Recommended payment options include:

- Bank transfers

- Credit/debit cards

- Digital wallets

- Local Saudi Arabian payment systems

- Instant deposit and withdrawal capabilities

- Low transaction fees

- Multiple currency support

Flexible payment methods ensure convenient and quick funding of cryptocurrency trades while minimizing transaction costs.

How to Evaluate Crypto Exchanges

Choosing the right crypto exchange requires careful consideration of multiple critical factors. Investors in Saudi Arabia need to assess exchanges based on comprehensive criteria that ensure security, functionality, and user experience.

Account Verification Process

The account verification process is a crucial first step for Saudi crypto traders. Most reputable exchanges require:

- Identity Verification

- Submit government-issued ID (passport or national ID)

- Provide proof of residence documents

- Complete facial recognition or selfie verification

- Typical verification time ranges from 24-72 hours

- KYC Requirements

- Align with Saudi Arabian Monetary Authority (SAMA) regulations

- Mandatory Know Your Customer (KYC) checks

- Minimum age requirement

- Transparent documentation process with encryption protocols such as SSL/TLS and other security measures

Trading Platform Features

Effective crypto exchanges offer robust trading platform capabilities:

- Technical Analysis Tools

- Advanced charting capabilities

- Real-time price tracking

- Multiple technical indicators

- Support for mobile and desktop platforms

- Trading Options

- Spot trading

- Margin trading

- Futures contracts

- Diverse cryptocurrency pairs

- Low latency order execution

Customer Support Quality

Exceptional customer support distinguishes top-tier crypto exchanges:

- Support Channels

- 24/7 live chat support

- Email assistance

- Phone support in Arabic and English

- Comprehensive FAQ and knowledge base

- Response Metrics

- Average response time under 30 minutes

- Multi-language support

- Technical problem resolution

- Dedicated account management

- Deposit Limits

- Minimum deposit amounts (typically $50-$200)

- Multiple payment methods

- Low transaction fees

- Instant bank transfer options

- Withdrawal Specifications

- Daily and monthly withdrawal caps

- Minimal processing fees

- Quick transaction processing

- Multiple cryptocurrency withdrawal options

Key Considerations for Saudi Arabian Crypto Traders

Navigating the cryptocurrency landscape in Saudi Arabia requires careful attention to unique local financial regulations and cultural considerations. Investors must be aware of several critical factors that can significantly impact their crypto trading experience.

Local Banking Restrictions

Saudi Arabian banks have implemented strict policies regarding cryptocurrency transactions. Most traditional banks prohibit direct crypto-related transactions, creating challenges for traders. Key restrictions include:

- Blocking transfers to crypto exchanges

- Limiting direct bank account connections

- Requiring alternative payment methods like international wire transfers or digital wallets

- Enforcing additional verification for cross-border crypto transactions

Islamic Financial Compliance

Cryptocurrency investments must carefully navigate Islamic financial principles to ensure Sharia compliance. Critical considerations include:

- Verifying that cryptocurrencies meet halal investment criteria

- Avoiding speculative trading that resembles gambling

- Ensuring transparent and ethical underlying asset mechanisms

- Consulting with Islamic financial scholars for definitive guidance

- Selecting exchanges that offer Sharia-compliant investment options

Steps to Start Cryptocurrency Trading

Embarking on your cryptocurrency trading journey requires careful planning and strategic execution. The following steps will guide you through establishing a secure and efficient trading experience in Saudi Arabia.

Creating Your First Account

- Choose a reputable cryptocurrency exchange regulated in Saudi Arabia, such as Binance or BitOasis.

- Visit the platform’s official website and click on the “Sign Up” or “Register” button.

- Provide a valid email address and create a strong, unique password.

- Complete the Know Your Customer (KYC) verification process by:

- Uploading a government-issued ID

- Submitting a proof of residence document

- Verifying your identity through facial recognition

- Enable two-factor authentication (2FA) for enhanced account security.

Funding Your Exchange

- Link a valid payment method accepted in Saudi Arabia:

- Bank transfer

- Credit/debit card

- Local payment platforms

- Check transaction fees and processing times for each funding method.

- Start with a small initial deposit to minimize risk.

- Verify minimum deposit requirements specific to your chosen exchange.

- Ensure your bank allows cryptocurrency-related transactions.

Making Your First Trade

- Navigate to the trading section of your exchange platform.

- Select the cryptocurrency you want to purchase (e.g., Bitcoin, Ethereum).

- Choose between market order and limit order trading:

- Market orders execute immediately at current market price

- Limit orders allow you to set a specific purchase price

- Enter the amount you wish to invest.

- Review all transaction details before confirming.

- Start with a small investment to understand market dynamics.

- Transfer cryptocurrencies to a secure wallet:

- Hardware wallet for maximum security

- Software wallet for convenient access

- Never share private keys or recovery phrases.

- Consider using cold storage for long-term cryptocurrency holdings.

- Regularly update wallet software and exchange account security settings.

- Monitor your investments and be aware of market volatility.

Different Trading Strategies You May Consider

Successful crypto trading in Saudi Arabia requires a strategic approach tailored to individual investment goals and risk tolerance. The following strategies can help investors navigate the volatile cryptocurrency market effectively.

Long-Term Investment Approach

Hodling remains a popular strategy for investors seeking sustainable crypto growth. This approach involves:

- Selecting established cryptocurrencies like Bitcoin and Ethereum with proven track records

- Investing in projects with strong fundamentals and long-term potential

- Minimizing emotional trading decisions during market volatility

- Averaging down during price dips to reduce overall investment cost

- Focusing on technological innovation and blockchain ecosystem development

- Maintaining a patient investment mindset and ensuring your only spending amounts your comfortable with

Short-Term Trading Techniques

Day trading and swing trading offer dynamic opportunities for active Saudi crypto investors:

- Utilizing technical analysis tools for entry and exit points

- Implementing candlestick pattern recognition strategies

- Leveraging momentum indicators like RSI and MACD

- Setting strict stop-loss and take-profit levels

- Monitoring market sentiment and news-driven price movements

Risk Management

Effective risk mitigation is crucial in the unpredictable crypto market here are some things you may wish to consider:

- Never investing more than 5-10% of total portfolio in cryptocurrencies

- Using stop-loss orders to limit potential losses

- Implementing position sizing techniques

- Avoiding emotional trading during extreme market fluctuations

- Maintaining a balanced risk-reward ratio

- Regularly rebalancing portfolio allocations

- Spreading investments across multiple cryptocurrencies

- Allocating funds to different market cap segments

- Balancing high-risk and stable cryptocurrency assets

- Exploring alternative crypto investment vehicles like staking

- Considering decentralized finance (DeFi) opportunities

- Monitoring correlation between different crypto assets

Protecting Yourself from Crypto Scams

The rapidly evolving crypto landscape in Saudi Arabia presents numerous opportunities but also significant risks for investors. Understanding and implementing robust security measures is crucial to safeguarding your digital assets from potential fraudulent activities.

Identifying Red Flags

- Unrealistic Promise Guarantees: Be wary of platforms or investments promising guaranteed high returns. Legitimate crypto exchanges never guarantee fixed profits.

- Pressure Tactics: Scammers often use aggressive marketing techniques that create a sense of urgency. Legitimate platforms allow investors time to make informed decisions.

- Lack of Transparency: Reputable exchanges provide clear information about their team, licensing, and operational details. Platforms with vague or missing information should raise immediate suspicion.

- Unsolicited Communications: Be cautious of unexpected emails, messages, or social media contacts promoting crypto investments or claiming you’ve won cryptocurrency.

- Unverifiable Credentials: Check for official registrations with Saudi Arabian regulatory bodies like SAMA and CMA. Authentic platforms will have verifiable compliance documentation.

Secure Trading Practices

- Two-Factor Authentication (2FA): Always enable 2FA on your trading accounts to add an extra layer of security beyond password protection.

- Regular Security Updates: Keep your trading platform’s app and your device’s operating system updated to protect against potential security vulnerabilities.

- Diversify Storage: Don’t store large amounts of cryptocurrency on exchange platforms. Use hardware wallets or secure cold storage for significant holdings.

- Transaction Verification: Always double-check wallet addresses before transferring funds. Even a small mistake can result in irreversible loss.

- Verify Exchange Legitimacy: Cross-reference exchanges with official Saudi Arabian regulatory lists and international crypto tracking databases.

- Research Platform History: Investigate the platform’s track record, user reviews, and any previous security incidents or legal challenges.

- Suspicious Fee Structures: Be cautious of platforms with unusually high transaction fees or complex, non-transparent pricing models.

- Limited Cryptocurrency Options: Legitimate exchanges typically offer a diverse range of established cryptocurrencies. Platforms with extremely limited options might be suspicious.

- Poor Customer Support: Fraudulent platforms often have non-responsive or low-quality customer service. Test their support channels before committing funds.

Future of Cryptocurrency in Saudi Arabia

The cryptocurrency landscape in Saudi Arabia is poised for significant transformation, driven by technological innovation and evolving regulatory frameworks. The Kingdom’s strategic approach to digital assets signals a promising future for blockchain and crypto technologies.

Emerging Trends

- Blockchain Adoption Acceleration

- Saudi Arabia is witnessing rapid blockchain integration across multiple sectors including finance, government, and technology.

- Local financial institutions are exploring blockchain-based solutions for cross-border transactions and digital asset management.

- Young Saudi investors are increasingly embracing cryptocurrency as an alternative investment class.

- Institutional Investment Growth

- Institutional interest in cryptocurrencies across different countries is expanding

- Venture capital firms are showing increased attention to local crypto startups and blockchain innovations

- Government-supported investment funds are exploring cryptocurrency and blockchain investment opportunities

Potential Regulatory Changes

- Progressive Regulatory Framework

- Saudi Arabian Monetary Authority (SAMA) is developing comprehensive guidelines for cryptocurrency regulation.

- Expected regulatory developments will likely focus on:

- Enhanced investor protection mechanisms

- Robust anti-money laundering protocols

- Clear compliance requirements for crypto exchanges

- Islamic Financial Compliance

- Future regulations will potentially address cryptocurrency’s alignment with Sharia principles.

- Development of crypto investment products compatible with Islamic financial standards.

- Establishing clear guidelines for ethical cryptocurrency trading.

- Blockchain Infrastructure

- Increased investment in blockchain technological infrastructure.

- Potential development of national blockchain platforms for government and private sector applications.

- Exploration of Central Bank Digital Currency (CBDC) technologies.

- Digital Asset Innovation

- Growing focus on developing local cryptocurrency trading platforms.

- Enhancement of cybersecurity measures for digital asset protection.

- Integration of advanced trading technologies like AI-driven analytics and automated trading systems.

Common Inquiries

Cryptocurrency trading in Saudi Arabia presents exciting opportunities for investors willing to navigate the complex digital asset ecosystem. The key lies in selecting robust platforms that align with local regulations and individual investment goals.

Traders must prioritize exchanges offering strong security measures comprehensive market coverage and regulatory compliance. Platforms like Binance OKX and BitOasis provide Saudi investors with sophisticated trading environments that balance advanced features and user-friendly interfaces.

Success in cryptocurrency trading requires continuous learning adaptability and strategic risk management. By staying informed about market trends technological innovations and regulatory developments investors can position themselves effectively in Saudi Arabia’s dynamic digital finance landscape.

Ultimately the cryptocurrency journey demands careful research informed decision-making and a measured approach to digital asset investments. Those who approach trading with diligence discipline and strategic thinking will be best equipped to capitalize on emerging opportunities in this rapidly evolving financial ecosystem.

Key Takeaways

- Cryptocurrency Trading in Saudi Arabia is Rapidly Growing: In Saudi Arabia, the Cryptocurrencies market is expected to have a user base of 7.40m users by 2025.

- Regulatory Environment is Cautiously Progressive: While cryptocurrencies aren’t legal tender, they’re not banned, with the Saudi Arabian Monetary Authority (SAMA) providing a nuanced regulatory framework that allows personal crypto investments under strict compliance guidelines.

- Top Exchanges Prioritize Security and User Experience: Leading platforms like BitOasis and Rain offer robust security measures, including two-factor authentication, cold storage, and compliance with local financial regulations, ensuring a safe trading environment for Saudi investors.

- Diverse Investment Strategies Are Emerging: Investors can choose from long-term “hodling” approaches focusing on established cryptocurrencies like Bitcoin and Ethereum, or explore short-term trading techniques with careful risk management strategies.

- Islamic Financial Considerations are Crucial: Crypto investments must carefully navigate Sharia compliance, requiring verification of halal investment criteria and consultation with Islamic financial scholars to ensure ethical trading practices.

Conclusion

The crypto landscape in Saudi Arabia is rapidly evolving with promising opportunities for investors. As digital assets gain mainstream acceptance technological innovations continue to reshape the financial ecosystem traders must remain adaptable and informed.

Successful cryptocurrency investment requires a strategic approach that balances risk management with technological understanding. By leveraging local and international exchanges Saudi investors can navigate this dynamic market while adhering to regulatory frameworks and implementing robust security practices.

The future of crypto in the Kingdom looks bright with increasing institutional interest blockchain adoption and potential regulatory developments. Investors who stay educated and maintain a forward-thinking mindset will be best positioned to capitalize on the emerging digital finance opportunities in Saudi Arabia.

Why Trust AGR Technology?

AGR Technology’s journey began in 2013 when Alessio Rigoli established it as a YouTube channel back in high school and later expanded into a tech-focused blog. Initially covering diverse topics like Android, Cyber Security, Blockchain, and EdTech, the business has come a long way since its early days.

Today, AGR Technology offers a comprehensive suite of services to businesses, including Website development, Hosting, Software Development, and Digital Marketing. We take pride in our ability to serve clients of all sizes, spanning various industries. Our commitment to providing innovative and high-quality technology solutions has helped numerous businesses achieve growth and success and our focus on content publishing has still remained over the years. We write our own independent assessments and are not owned by an exchange.

Disclaimer:

Crypto assets can be highly volatile unregulated investment products and like any type of investment can increase or decrease in value. By no means is this article designed to be financial advice. While we vet each platform we mention on our website and provide regular content updates, we recommend that you conduct extensive research before making investment decisions, form your own opinion, and invest only what you can afford to lose because there is no such thing as a guarantee in investing.

Factors taken into consideration when writing this article:

- We created criteria for picking exchanges to assess, including as reputation, trading volume, user base, regulatory compliance, and the number of coins available, as well as their websites to confirm they had licenses and compliance to operate in the Kingdom and other things like KYC practices.

- Check each platform to see what type of security features they offer such as anti-phishing codes, 2FA codes and overall reputation for handling cyber security per industry best practices.

- User friendly platform interfaces to ensure the platforms are easy to understand for beginners.

- We collected relevant data on each exchange, which included visiting each exchange’s website, reading user reviews, and looking for recent news or events relating to the exchange.

- Checked each platform to see what types of coins and assets they supported.

Frequently Asked Questions

What are the best cryptocurrency exchanges in Saudi Arabia?

The top cryptocurrency exchanges in Saudi Arabia include BitOasis, Rain, SLEX Exchange, and international platforms like Binance and Kraken. These platforms offer user-friendly interfaces, robust security features, and compliance with local regulations. BitOasis and Rain are particularly popular as they cater specifically to the Saudi market, providing localized support and payment options that align with regional banking practices.

Is cryptocurrency trading legal in Saudi Arabia?

Yes, cryptocurrency trading is legal in Saudi Arabia. The Saudi Arabian Monetary Authority (SAMA) and the Capital Market Authority (CMA) have established guidelines for crypto investments. Traders must comply with Know Your Customer (KYC) processes and anti-money laundering (AML) regulations. While the government maintains a cautious approach, personal crypto investments are permitted, and the regulatory environment continues to evolve.

What cryptocurrencies are most popular in Saudi Arabia?

Bitcoin and Ethereum are the most popular cryptocurrencies in Saudi Arabia. Young investors are particularly interested in these established digital assets. The market shows a growing interest in diversified crypto portfolios, with increasing attention to altcoins and emerging blockchain projects. Local platforms have seen significant growth, with an estimated annual market expansion of 20-25% in cryptocurrency trading.

How do I start trading cryptocurrencies in Saudi Arabia?

To start trading cryptocurrencies, first choose a reputable exchange like BitOasis or Binance. Create an account and complete the KYC verification process. Fund your account using local payment methods like bank transfers or credit cards. Enable two-factor authentication for security. Start with small investments to understand market dynamics. Always research and understand the risks before making any trades.

What security measures should I consider when trading crypto?

Prioritize exchanges with strong security features like two-factor authentication, cold storage, and robust encryption. Use unique passwords and secure your accounts with hardware wallets. Be cautious of phishing attempts and only use trusted platforms. Enable withdrawal whitelists, monitor your account regularly, and keep your trading information confidential. Always verify the legitimacy of exchanges and be wary of suspicious offers.

Are cryptocurrencies compliant with Islamic financial principles?

Some cryptocurrencies can be considered Sharia-compliant if they meet specific criteria. Scholars have different interpretations, but generally, cryptocurrencies that avoid speculative practices and have intrinsic value may be acceptable. Platforms like BitOasis offer guidance on Islamic crypto investing. However, investors should consult with Islamic financial experts to ensure their investments align with religious principles.

What are the tax implications of crypto trading in Saudi Arabia?

Currently, the tax implications for cryptocurrency trading in Saudi Arabia are not clearly defined. There are no specific crypto taxation laws, but traders should maintain detailed records of their transactions. As the regulatory landscape evolves, it’s recommended to consult with financial advisors and stay updated on potential future tax regulations regarding digital asset investments.

What are the risks of cryptocurrency trading?

Cryptocurrency trading involves significant risks, including high market volatility, potential for scams, and lack of regulatory protection. Prices can fluctuate dramatically, leading to substantial financial losses. Be aware of common scams like phishing, fake exchanges, and fraudulent investment schemes. Always conduct thorough research, invest only what you can afford to lose, and use reputable, regulated exchanges.

Source(s) / Bibliography:

[Online]. Available at: https://www.middleeastmonitor.com/20240925-saudi-arabia-and-the-uae-drive-growth-in-338-7bn-crypto-market/ (Accessed: 2 December 2024).

“Cryptocurrencies – Saudi Arabia”, Statista Market Forecast. [Online]. Available: https://www.statista.com/outlook/fmo/digital-assets/cryptocurrencies/saudi-arabia. [Accessed: 2-Dec.-2024].

“Edgemiddleeast.Com.” Accessed December 2, 2024. https://www.edgemiddleeast.com/industry/how-saudi-arabia-and-the-uae-are-fuelling-a-338-7-billion-crypto-market-and-whats-next.

public.bnbstatic.com/static/academy/uploads-original/e0e8fec4cb604f1d84b67b020958fc66.png. Accessed 2 Dec. 2024.

“CMA Warns Investors Against Digital Currency Investment and its Involvement of High Monitoring, Security and Market Risks” 2 Nov. 2018, cma.org.sa/en/MediaCenter/PR/Pages/DC1.aspx. Accessed 2 Dec. 2024.

www.thomsonreuters.com/en-us/posts/wp-content/uploads/sites/20/2022/04/www.thomsonreuters.com/en-us/posts/wp-content/uploads/sites/20/2022/04/Cryptos-Report-Compendium-2022.pdf. Accessed 2 Dec. 2024.

“Avatrade” support.avatrade.com/hc/en-au/articles/360017588538-Does-AvaTrade-accept-traders-worldwide. Accessed 2 Dec. 2024.

“Trade Bitcoin and Buy Cryptocurrencies on BitOasis Crypto App” www.bitoasis.net/en/page/faq. Accessed 2 Dec. 2024.

(2014). Legality of cryptocurrency by country or territory [Online]. Wikipedia. Available at: https://en.wikipedia.org/wiki/Legality_of_cryptocurrency_by_country_or_territory (Accessed: 3 December 2024).

(2017). Al Arabiya.Net العربية.نت [Online]. Available at: https://www.alarabiya.net/aswaq/economy/2017/07/04/%D8%A7%D9%84%D8%B3%D8%B9%D9%88%D8%AF%D9%8A%D8%A9-%D8%AA%D8%AD%D8%B0%D8%B1-%D9%85%D9%86-%D8%AA%D8%AF%D8%A7%D9%88%D9%84-%D8%A7%D9%84%D8%B9%D9%85%D9%84%D8%A9-%D8%A7%D9%84%D8%A5%D9%84%D9%83%D8%AA%D8%B1%D9%88%D9%86%D9%8A%D8%A9-%D8%A8%D9%8A%D8%AA%D9%83%D9%88%D9%8A%D9%86- (Accessed: 3 December 2024).

QR Code of this page for mobile users:

Alessio Rigoli is the founder of AGR Technology and got his start working in the IT space originally in Education and then in the private sector helping businesses in various industries. Alessio maintains the blog and is interested in a number of different topics emerging and current such as Digital marketing, Software development, Cryptocurrency/Blockchain, Cyber security, Linux and more.

Alessio Rigoli, AGR Technology

![logo-new-23[1] logo-new-23[1]](https://cdn-ihdfn.nitrocdn.com/eZVJvoSTyVixkEUySRKiaseNtUlmgCyu/assets/images/optimized/rev-b7ced37/agrtech.com.au/wp-content/uploads/elementor/thumbs/logo-new-231-qad2sqbr9f0wlvza81xod18hkirbk9apc0elfhpco4.png)