India’s digital economy is rapidly evolving with a thriving tech landscape that’s increasingly embracing cryptocurrency. As the country’s median age stands at 28 years young investors are actively exploring digital asset trading platforms that offer secure and reliable cryptocurrency exchanges.

Quick takeaway:

2) WazirX (see updated news below)

Navigating the complex world of crypto trading requires careful selection of platforms that provide robust security robust features and user-friendly interfaces. With numerous exchanges emerging in the Indian market traders need comprehensive insights to make informed decisions about where to invest their digital assets and which platforms offer the most reliable trading experience.

The cryptocurrency exchange landscape in India continues to grow dynamically presenting both opportunities and challenges for investors. Understanding key factors like regulatory compliance transaction fees security protocols and overall user experience becomes crucial for anyone looking to enter or expand their presence in the digital asset trading ecosystem.

Top 10 Crypto Exchanges in India: A Comprehensive Guide for February 2026

1) Binance (Top Global exchange)

Binance is one of the world’s largest and most popular cryptocurrency exchanges, providing customers with low-fee trades and extensive liquidity. This exchange has built its name by providing a dependable and safe platform for traders to quickly buy, sell, and store cryptocurrencies.

Binance’s trading fees are tiered, with the charge decreasing as the trade volume increases. This encourages traders to trade more and enjoy lower fees as a result.

Binance is most recognized for its spot market, which allows users to trade cryptocurrencies against each other or fiat currencies. Spot market fees begin at 0.1%, making it one of the most cost-effective exchanges accessible.

The exchange also provides numerous trading pairings for popular cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and Binance Coin (BUSD).

Binance is incredibly popular globally because of its size and history as an industry platform, and it also has a substantial user base in India as well.

Pros

- It has sophisticated trading features

- Binance Academy provides cryptocurrency instruction

- A wide range of crypto assets are available for purchase

- Low transaction costs

- They offer an “earn” Program that offers a high APY on cryptocurrency

Cons

- It is not necessarily the most simple trading platform for those who have never utilized a trading platform before

- It has faced numerous regulatory problems in the past

Website Screenshot:

2) WazirX: Leading the Indian Crypto Exchange Market

(Note: Due to recent news around potential probes into WazirX and the delisting of the WazirX’s WRX tokens by Binance we suggest exercising caution with this exchange)

WazirX stands out as the most popular cryptocurrency exchange in India. It offers several key features such as:

- User-friendly interface designed for Indian traders

- Support for over 200 cryptocurrencies

- Low trading fees around 0.2%

- Robust security measures including two-factor authentication

- Seamless INR deposit and withdrawal options

Pros:

- Strong local player in the Indian market that has been around for a while

- F.I.U.Registered

- A wide variety of coins are available

Cons:

- Some users experienced poor performance with the mobile app

- Some users experienced delays with values and exchange rates in the mobile app

Website Screenshot:

3) Gemini

Gemini, operating in Singapore, prioritizes trust, security, and transparent financial practices, adhering to stringent security and data protection standards. Regulated by the Monetary Authority of Singapore (MAS), Gemini’s credibility is bolstered, offering users peace of mind.

The platform boasts a sophisticated storage system and top-tier security measures, ensuring the safekeeping of over 100 cryptocurrencies. Additionally, Gemini’s integration with Nifty Gateway provides users with access to an NFT marketplace, facilitating easy acquisition, sale, and storage of non-fungible tokens.

With a user-friendly mobile app and active trader platform, Gemini caters to a wide range of investors. Moreover, investor protection measures are in place, further enhancing the platform’s reputation as a secure and trustworthy crypto exchange in Singapore.

-

Fees: Trade with us for a flat 1.49% fee on all transactions. Plus, no extra fees for depositing or withdrawing SGD

-

Supported Assets: Over 100 Cryptos

Pros

-

Two-tiered platforms cater to both novice and expert traders

-

Complete range of products at your disposal

-

Certified cybersecurity and data protection measures ensure safety

-

Dive into a pool of over 80 cryptocurrencies

Cons

-

Higher fees compared to competitors

-

Limited customer support channels

Website Screenshot:

4) Bitget

Bitget is a popular cryptocurrency exchange noted for its user-friendly interface and extensive trading capabilities. It provides spot trading, futures, and copy trading, allowing both new and experienced traders to interact with a diverse selection of digital assets. Bitget prioritizes security, employing strong techniques such as multi-factor authentication and cold storage for user cash. The platform is also known for its low fees and high liquidity, making it a popular choice among both individual and institutional investors.

Pros:

- Copy trading functionality

- 24/7 customer support

- 800+ Coins Available

- Robust Security Mechanisms for your account

Cons:

- Some users reported slow support response times

- Some users experienced some initial difficulty with KYC submissions

Website Screenshot:

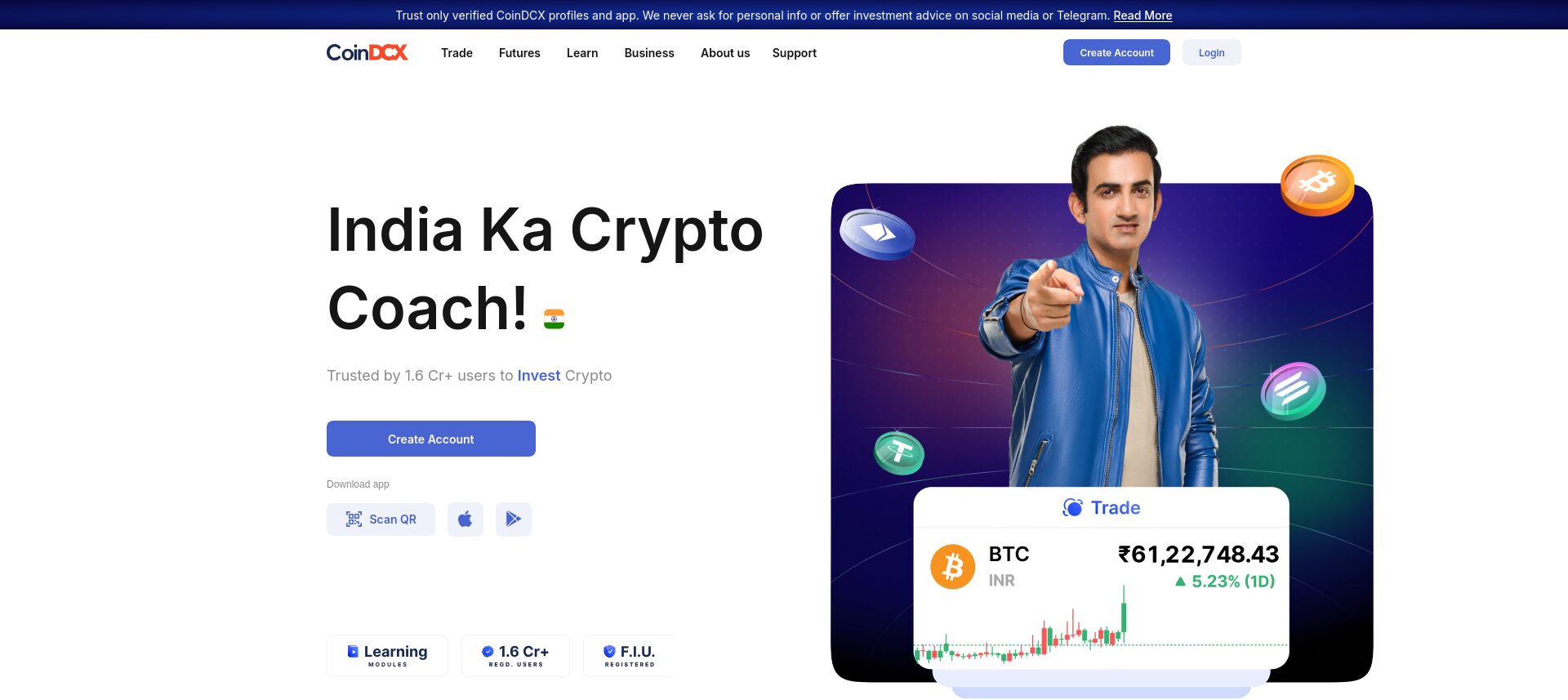

5) CoinDCX: Advanced Trading Platform for Experienced Investors

Key features:

CoinDCX provides sophisticated trading features for crypto enthusiasts:

- Wide range of 500+ cryptocurrency trading pairs

- Margin trading with up to 10x leverage

- Advanced charting tools for technical analysis

- Competitive trading fees starting at 0.1%

- Instant KYC verification process

Pros:

- Easy-to-use user interface

- Native INR currency support

- Registered with the Financial Intelligence Unit (FIU)

Cons:

- Users reported issues with the future trading functionality and the mobile app being buggy

- Some users reported annoying push notifications from the app frequently being sent

Website Screenshot:

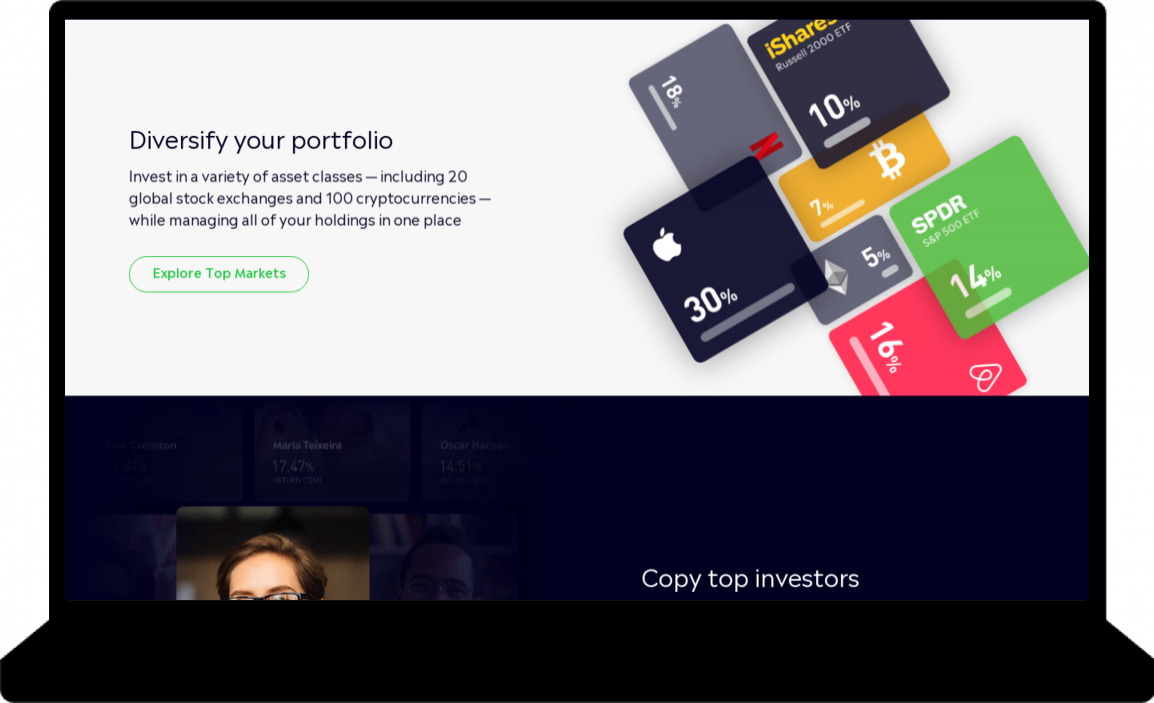

6) Etoro

eToro is a good choice for traders searching for a dependable, user-friendly, secure platform with a wide range of assets and reasonable costs. eToro is a great choice for traders of all levels due to its commitment to regulatory compliance, outstanding customer service choices, and flexible deposit ways. The platform supports not only Crypto assets but also traditional stocks and other types of investments.

eToro is also a regulated and licensed platform, so consumers can be assured that they are safeguarded by regulatory control. The European Securities and Markets Authority (ESMA), CySEC, the Financial Conduct Authority (FCA), and other important regulators oversee and license the platform. This ensures that eToro complies with all applicable rules and regulations, giving users the security and peace of mind they need to trade confidently.

Key features:

- Copy trading functionality

- Social networking capabilities

- Support for various asset types beyond crypto

Pros:

- Provides lots of powerful functionality for traders

- Has a unique “copy trading” feature that allows you to copy trades of other users on the platform

- Has social networking functionality built in to enable you to interact with other users and learn more

- Supports copy trading for crypto and stocks

Cons:

- Can be complicated and overwhelming for new users

- It can be challenging to choose the appropriate trader to copy

- A limited number of cryptocurrencies are available

- Fees and spreads may be higher than those found on crypto exchanges.

7) CoinSwitch Kuber: Beginner-Friendly Crypto Trading

Ideal for new investors looking to enter the cryptocurrency market:

- Simple and intuitive mobile application

- Supports 100+ cryptocurrencies

- Minimum investment as low as ₹100

- Educational resources for new traders

- Instant deposit and withdrawal mechanisms

Pros:

- Supports a large variety of crypto assets such as Bitcoin (BTC), Ethereum (ETH), Binance coin (BNB), Solana (SOL), Dogecoin (DOGE), Shiba Inu (SHIB), XRP, USDT & 250+ popular crypto coins

- CoinSwitch’s straightforward interface makes it easy to use, especially for beginner cryptocurrency traders

- Real-time BTC crypto trade charts

- Rupee-powered online crypto trade

- Crypto API trading

- Crypto to INR Conversions

- Crypto Futures in USDT & Crypto Deposits

Cons:

- Only supports transactions in INR

- Has restricted options for Fiat deposits to fund your account

Website Screenshot:

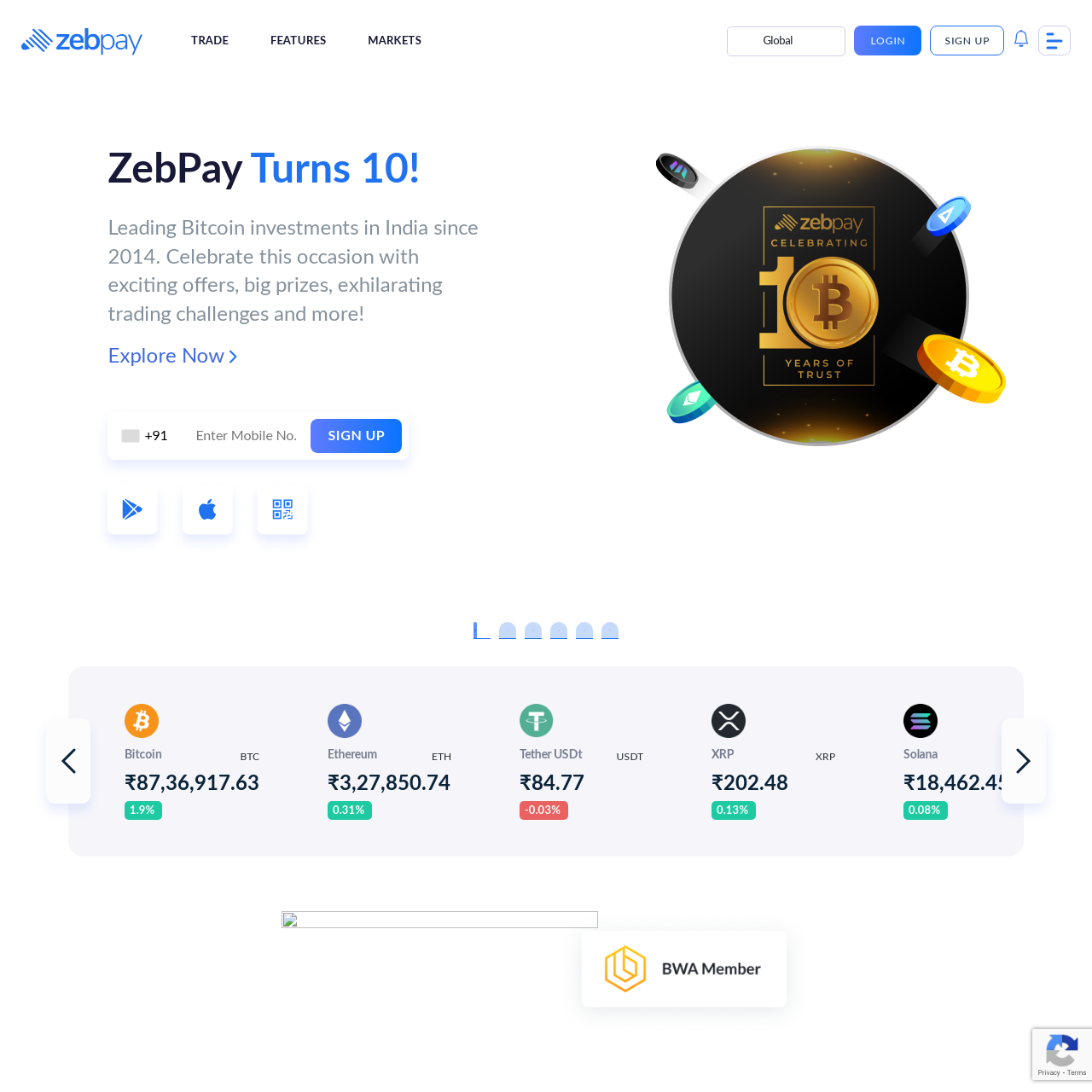

8) Zebpay: Veteran Exchange with Global Reputation

A long-standing cryptocurrency exchange with strong market presence:

- Operating since 2014 with proven track record

- Multi-cryptocurrency support

- Secure wallet infrastructure

- Competitive transaction fees

- 24/7 customer support system

Pros:

- Offers some good returns on crypto lending.

- Zero trading fees on select pairings.

- Super fast Network Payments

- Fee-free trading on selected pairs

Cons:

- Membership fees for those who did not trade last month

- Supports fewer currencies and tokens than other exchanges

- Does not support futures or margin trading at the time of writing

Website Screenshot:

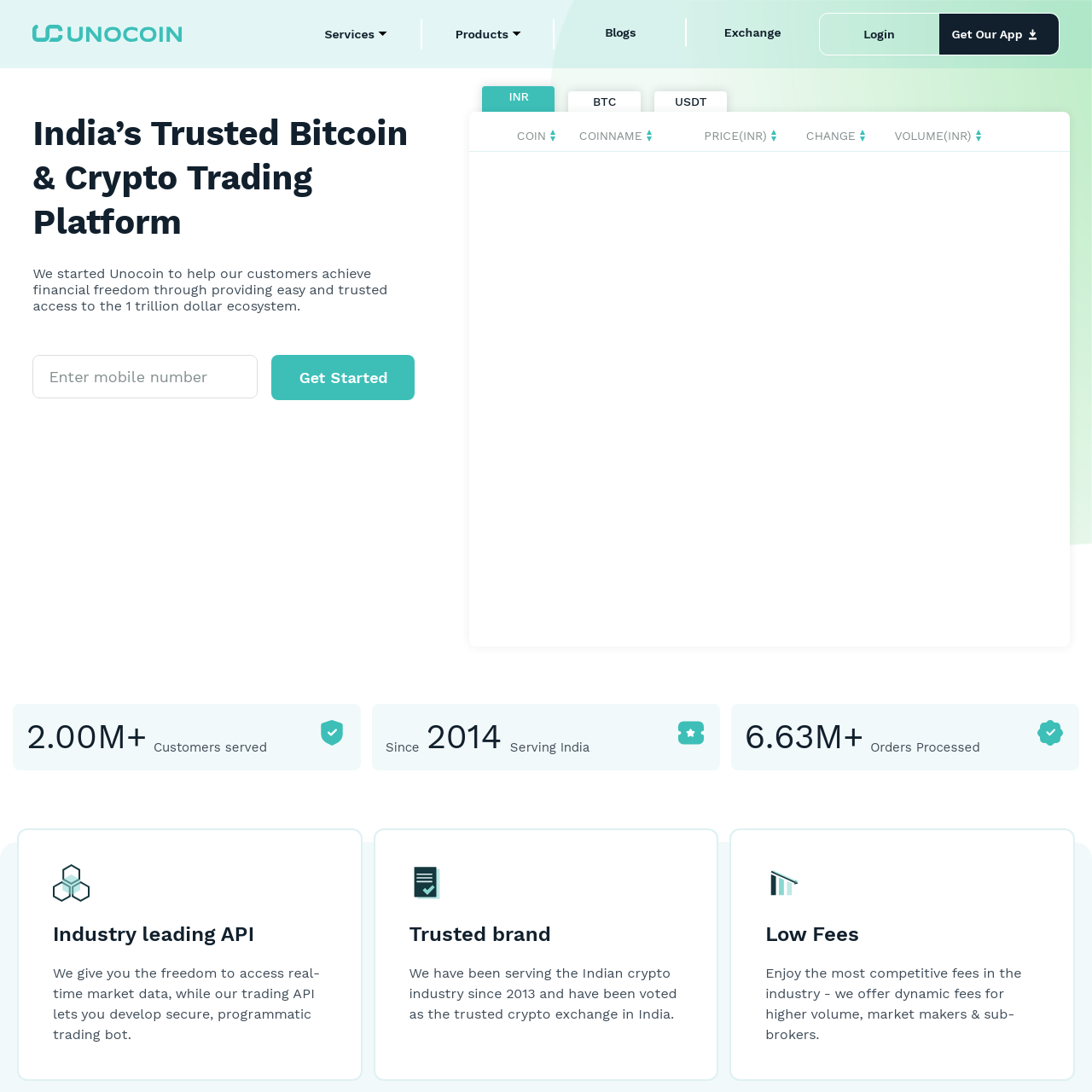

9) UnoCoin: Trusted Local Exchange for Indian Investors

- Regulated and compliant with Indian financial guidelines

- Easy bank integration for INR transactions

- Mobile and web platform options

- Lower transaction fees for long-term investors

- Strong focus on user security and data protection

Pros:

- Numerous investment and trading applications.

- Has membership club functionality

- Contains optimized Bitcoin withdrawals

- Easy-to-use interface

Cons:

- Some users reported poor-quality customer service

- Some users reported issues with the navigation menus on the mobile app

Website Screenshot:

10) Coinbase

Key features:

- Ideal for cryptocurrency beginners

- Covers 150 different cryptocurrencies

- Trading fees around 0.60%

- High-security standards

- Intuitive user interface

Pros:

- The UI is simple and straightforward to use for beginners.

- Industry-leading encryption and security technologies.

- Coinbase Earn program allows trading of over 246 cryptocurrencies and tokens while also providing educational content.

Cons:

- Fees are greater than other cryptocurrency exchanges.

- Coinbase users have reported excessive wait times for customer assistance, as well as unexpected account limits.

Website Screenshot:

Key Considerations When Choosing a Crypto Exchange

| Factor | Importance | Description |

|---|---|---|

| Security | High | Multi-layer protection, cold storage |

| Transaction Fees | Medium | Comparison of trading and withdrawal charges |

| Supported Cryptocurrencies | Medium | Variety of digital assets available |

| User Experience | High | Interface intuitiveness and platform stability |

| Regulatory Compliance | Critical | Adherence to Indian financial regulations |

Trading Tips for Indian Crypto Investors

- Consider starting with small investments

- Consider taking steps to diversify cryptocurrency portfolio

- Stay updated on regulatory changes

- Use strong password and two-factor authentication

- Understand Tax implications of crypto trading

Other factors to be aware of:

- Increasing mobile-first platforms

- Integration of AI-driven trading tools

- Enhanced user education resources

- Improved regulatory frameworks

- Growing institutional investor interest

Understanding Cryptocurrency Exchanges in India

Cryptocurrency exchanges have emerged as critical platforms for digital asset trading in India’s rapidly evolving financial landscape. These online marketplaces play a crucial role in facilitating the purchase, sale, and exchange of digital currencies such as Bitcoin.

What is a Cryptocurrency Exchange?

A cryptocurrency exchange is an online platform that functions like a digital marketplace for trading cryptocurrencies. These platforms enable users to:

- Convert traditional currencies (like INR) into cryptocurrencies

- Trade between different digital assets

- Place various types of trading orders

- Access advanced financial features such as:

- Leverage trading

- Margin trading

- Staking

- Crypto lending

Exchanges act as intermediaries that match buyers and sellers, providing a secure and regulated environment for cryptocurrency transactions. They typically charge transaction fees for facilitating these exchanges and offer different trading interfaces for various user skill levels.

Types of Crypto Exchanges

India offers three primary types of cryptocurrency exchanges:

- Centralized Exchanges (CEXs)

- Operated by companies acting as intermediaries

- Require user identity verification (KYC)

- Manage user private keys

- Examples: CoinSwitch, CoinDCX, ZebPay

- Pros: Easy to use, user-friendly

- Cons: Potential security risks due to centralized control

- Decentralized Exchanges (DEXs)

- Operate without intermediaries

- Use smart contract technology

- Users maintain full control of their funds

- Examples: Uniswap, Sushiswap

- Pros: Enhanced privacy, direct user-to-user trading

- Cons: More complex interfaces, limited support

- Peer-to-Peer (P2P) Exchanges

- Direct trading between users

- Minimal platform intervention

- Flexible payment methods

- Potentially lower transaction fees

Legal Landscape for Crypto Trading in India

The legal environment for cryptocurrency in India remains complex and evolving. Key considerations include:

- Regulatory Status

- No comprehensive cryptocurrency law

- Government maintains cautious approach

- Taxation framework introduced for digital assets

- Investment Considerations

- High volatility

- Speculative market

- Recommended for risk-tolerant investors

- Requires thorough research and understanding

- Compliance Requirements

- Know Your Customer (KYC) mandatory

- Anti-Money Laundering (AML) regulations

- Identity verification for most exchanges

- Proper documentation needed for trading

Investors should stay informed about regulatory changes and approach cryptocurrency trading with careful research and risk management strategies and consider talking to an authorised accountant or financial expert to provide guidance around potential tax implications.

Key Factors to Consider When Choosing a Crypto Exchange

Selecting the right cryptocurrency exchange is crucial for successful and secure digital asset trading in India. Investors must carefully evaluate multiple dimensions to ensure they choose a platform that meets their specific investment needs and risk tolerance.

Trading Fees and Charges

Cryptocurrency exchanges typically charge various fees that directly impact trading profitability. Investors should analyze:

- Trading Fees: Percentage-based charges on each transaction ranging from 0.1% to 0.5% depending on trading volume.

- Deposit Fees: Most Indian exchanges offer free fiat and crypto deposits.

- Withdrawal Fees: Vary by cryptocurrency type and can range from fixed amounts to percentage-based charges.

- Maker and Taker Fees: Lower fees for providing market liquidity (makers) and slightly higher fees for executing immediate trades (takers).

Security Features

Robust security measures are non-negotiable when selecting a crypto exchange. Key security considerations include:

- Two-Factor Authentication (2FA): Additional verification layer preventing unauthorized access.

- Cold Storage: Keeping majority of funds offline to minimize cybersecurity risks.

- Fund Insurance: Platforms offering protection against potential digital asset theft.

- Regular Security Audits: Exchanges conducting frequent comprehensive security assessments.

- Encryption Protocols: Advanced data protection mechanisms safeguarding user information.

Supported Cryptocurrencies

Diversity of cryptocurrency offerings determines an exchange’s attractiveness. Investors should evaluate:

- Number of Cryptocurrencies: Platforms supporting 100+ digital assets provide greater trading flexibility.

- Major Cryptocurrency Availability: Bitcoin, Ethereum, and other top market cap cryptocurrencies.

- Emerging Altcoins: Exchanges listing promising new digital assets.

- Trading Pairs: Variety of fiat and crypto trading combinations.

User Experience

Intuitive platform design significantly impacts trading efficiency. Important aspects include:

- Mobile App Compatibility: Seamless smartphone trading interfaces.

- Dashboard Clarity: Easy-to-navigate trading screens.

- Real-time Market Data: Live price charts and trading information.

- Educational Resources: Tutorials and market insights for beginners.

- Order Types: Multiple trading order options like market and limit orders.

Payment Methods

Flexible funding options enhance user convenience. Recommended payment methods:

- Bank Transfers: Direct Indian bank account integrations.

- UPI Payments: Instant and low-cost transaction capabilities.

- Credit/Debit Cards: Quick deposit alternatives.

- Net Banking: Comprehensive banking platform connections.

- Multiple Contact Channels: Email, phone, and live chat support.

- Response Time: Quick resolution within 24-48 hours.

- Multi-language Assistance: Support for English and regional languages.

- Comprehensive FAQ Sections: Self-help resources for common queries.

- Dedicated Account Managers: Personalized support for high-volume traders.

Evaluating Crypto Exchange Performance

Performance metrics are crucial for assessing the effectiveness and reliability of cryptocurrency exchanges in India’s dynamic digital asset landscape.

Trading Volume

Trading volume serves as a critical indicator of an exchange’s market activity and popularity. High trading volumes suggest:

- Greater market depth and easier trade execution

- More active trader participation

- Reduced price volatility

- Increased market confidence

- Better overall market liquidity

Key benchmarks for strong trading volumes include:

- Daily trading volume exceeding ₹500 crore

- Consistent trading activity across multiple cryptocurrencies

- Balanced volume across major digital assets like Bitcoin and Ethereum

Liquidity

Liquidity represents an exchange’s ability to facilitate quick trades without significant price fluctuations. Essential liquidity characteristics include:

- Rapid order matching

- Minimal spread between buy and sell prices

- Quick transaction completion times

- Sufficient market depth for large trades

Indicators of high liquidity:

- Multiple trading pairs

- Large number of active traders

- Consistent order book depth

- Low slippage rates during transactions

Platform Reliability

Platform reliability encompasses several critical technological and operational aspects:

- Uptime percentage above 99.9%

- Robust server infrastructure

- Minimal system downtimes

- Seamless trade execution

- Advanced security protocols

Reliability assessment factors:

- Technical infrastructure stability

- Performance during high-traffic periods

- Quick response to technical issues

- Regular system upgrades

Regulatory Compliance

Regulatory compliance ensures legal and secure trading environments. Critical compliance elements include:

- Registration with relevant Indian financial authorities

- Adherence to Know Your Customer (KYC) guidelines

- Implementation of Anti-Money Laundering (AML) protocols

- Transparent reporting mechanisms

- Regular financial audits

- Valid operational licenses

- Documented regulatory frameworks

- Transparent financial reporting

- Proactive engagement with regulatory bodies

How to Get Started with Crypto Exchanges in India

Starting your cryptocurrency trading journey in India requires careful navigation of the digital exchange landscape. Here’s a comprehensive guide to help you begin trading securely and efficiently.

Account Registration Process

- Choose a Reputable Exchange: Select a crypto exchange regulated in India with strong security features and positive user reviews.

- Create Your Account: Visit the exchange’s official website or mobile app and click on the “Sign Up” or “Register” button.

- Provide Basic Information: Enter required details including your full name, email address, phone number, and create a strong password.

- Agree to Terms: Read and accept the platform’s terms of service and privacy policy carefully before proceeding.

- Email Verification: Complete the registration by clicking the verification link sent to your registered email address.

Verification and KYC Requirements

- Personal Documentation: Prepare necessary documents including:

- Government-issued photo ID (Aadhaar card, PAN card)

- Proof of address (utility bill, bank statement)

- Selfie with ID document

- Verification Levels:

- Basic level: Limited trading with minimal documentation

- Advanced level: Higher transaction limits requiring comprehensive verification

- Verification Process:

- Upload clear, high-resolution document scans

- Expect 24-48 hours for document review

- Receive confirmation via email or app notification

Deposit and Withdrawal Methods

- Supported Payment Options:

- Bank transfer

- UPI

- Net banking

- Debit/credit cards

- Deposit Considerations:

- Minimum deposit amounts vary by exchange

- Check transaction fees for each method

- Ensure instant transfer capabilities

- Withdrawal Guidelines:

- Verify withdrawal limits

- Confirm processing times

- Understand associated transaction charges

- Choose Authentication Method:

- Google Authenticator

- SMS-based verification

- Authenticator apps

- Implementation Steps:

- Navigate to account security settings

- Select preferred 2FA method

- Scan QR code or link mobile number

- Save backup codes securely

- Best Practices:

- Enable 2FA immediately after account creation

- Use dedicated authentication apps over SMS

- Store backup codes in a secure location

- Regularly update authentication settings

Risk Management for Crypto Investors

Effective risk management is crucial for navigating the dynamic and unpredictable cryptocurrency market. Investors can protect their capital and optimize their trading strategies by implementing comprehensive risk mitigation techniques.

Diversification Strategies

The following are some strategies you may wish to consider in order to adopt a diversification strategy:

- Spread investments across multiple cryptocurrencies to minimize potential losses.

- Balance your portfolio with established cryptocurrencies like Bitcoin and Ethereum.

- Allocate funds to smaller altcoins with growth potential.

- Implement a strategic asset allocation approach:

- Large-cap cryptocurrencies: 50-60% of portfolio

- Mid-cap cryptocurrencies: 30-40% of portfolio

- Emerging altcoins: 5-10% of portfolio

Understanding Market Volatility

- Recognize cryptocurrency markets fluctuate dramatically compared to traditional financial markets.

- Monitor key volatility indicators:

- Price movements

- Trading volumes

- Market sentiment

- Use stop-loss orders to limit potential losses.

- Avoid emotional trading decisions during extreme market conditions.

- Set realistic investment expectations and risk tolerance levels.

Secure Asset Storage

- Choose secure storage solutions for cryptocurrency assets.

- Utilize hardware wallets for long-term cryptocurrency storage.

- Implement multi-factor authentication on exchange accounts.

- Consider cold storage options for significant cryptocurrency holdings.

- Regularly update security protocols and backup recovery phrases.

- Understand cryptocurrency taxation regulations in India.

- Report all cryptocurrency transactions for tax purposes.

- Calculate capital gains tax on crypto asset disposals.

- Maintain detailed transaction records:

- Date of transaction

- Cryptocurrency type

- Transaction amount

- Value in Indian Rupees

Consult tax professionals for personalized guidance on crypto tax compliance.

Best Practices for Crypto Trading

Successful cryptocurrency trading requires a strategic approach and careful risk management. These best practices can help investors navigate the complex and volatile crypto market more effectively.

Starting Small

Beginning investors should start with modest investments to minimize potential losses. The cryptocurrency market’s volatility demands a cautious approach where traders can learn market dynamics without risking significant capital. By investing small amounts initially traders can:

- Understand market behavior without substantial financial risk

- Gain practical trading experience

- Build confidence through controlled exposure

- Learn platform functionality

- Test personal risk tolerance

Continuous Learning

Cryptocurrency markets evolve rapidly requiring ongoing education and skill enhancement. Successful traders commit to:

- Following cryptocurrency news platforms

- Attending webinars and online courses

- Reading market analysis reports

- Understanding blockchain technology developments

- Tracking regulatory changes

- Monitoring global economic indicators affecting crypto markets

Staying informed helps investors make data-driven decisions and adapt quickly to market shifts. Dedicating at least 3-5 hours weekly to learning can significantly improve trading strategies.

Using Trading Tools

Modern crypto exchanges offer advanced tools that can enhance trading performance. Effective traders leverage:

- Market analytics platforms

- Trading bots for automated strategies

- Demo accounts for risk-free practice

- Price alert systems

- Technical analysis charting tools

- Historical data visualization

These tools help traders make informed decisions by providing real-time insights and reducing emotional trading responses. Utilizing such resources can improve trade execution and risk management.

Avoiding Common Pitfalls

Experienced traders identify and prevent typical cryptocurrency trading mistakes:

- Avoid emotional decision-making

- Never invest more than affordable to lose

- Diversify cryptocurrency holdings

- Use stop-loss orders

- Manage leverage carefully

- Maintain disciplined trading strategy

- Secure personal cryptocurrency wallets

- Verify transaction details meticulously

Understanding these potential risks helps investors protect their capital and maintain a balanced approach to crypto trading. Developing a strategic mindset is crucial for long-term success in the volatile cryptocurrency market.

Emerging Trends in Indian Crypto Exchanges

The Indian cryptocurrency market is rapidly evolving, with innovative technologies and trading mechanisms transforming the digital asset landscape. Here are the key emerging trends reshaping crypto exchanges in India:

Futures and Margin Trading

Futures and margin trading are revolutionizing cryptocurrency investment strategies in India by offering advanced trading capabilities. These sophisticated financial instruments enable traders to:

- Leverage investments by borrowing funds to increase potential returns

- Trade cryptocurrency contracts without owning the underlying asset

- Implement complex trading strategies like short-selling and hedging

- Access more flexible risk management tools

- Potentially amplify profits through strategic positioning

Leading Indian exchanges now provide margin trading with leverage ratios ranging from 2:1 to 10:1, allowing experienced traders to maximize their potential gains while managing increased risk exposure.

Decentralized Exchange Alternatives

Decentralized exchanges (DEXs) are gaining significant traction among Indian crypto enthusiasts seeking greater autonomy and security. Key characteristics of DEX platforms include:

- Peer-to-peer trading without centralized intermediaries

- Enhanced privacy and reduced counterparty risks

- Direct wallet-to-wallet transactions

- Lower transaction fees compared to traditional exchanges

- Greater control over personal cryptocurrency assets

Emerging DEX platforms like Uniswap and SushiSwap are attracting Indian traders by providing more transparent and secure trading environments.

Blockchain Technology Innovations

Blockchain technology continues to drive transformative changes in Indian cryptocurrency exchanges through:

- Enhanced security protocols using advanced cryptographic techniques

- Implementation of smart contract functionality

- Integration of artificial intelligence for trading analytics

- Development of more efficient transaction processing systems

- Creation of hybrid exchange models combining centralized and decentralized features

Cutting-edge blockchain innovations are enabling Indian exchanges to offer more sophisticated, secure, and user-friendly trading experiences while maintaining regulatory compliance and protecting investor interests.

Conclusion: Choosing the Right Crypto Exchange

Selecting the ideal crypto exchange in India requires a strategic approach that balances multiple critical factors. Here are key steps to make an informed decision:

Evaluate Security Measures

- Check for advanced encryption protocols

- Verify two-factor authentication availability

- Research the exchange’s history of security incidents

- Look for cold storage options for digital assets

Assess Trading Features

- Compare transaction fees across platforms

- Examine supported cryptocurrency variety

- Analyze trading interface complexity

- Check margin and futures trading capabilities

Consider Regulatory Compliance

- Verify KYC documentation requirements

- Ensure platform follows Indian regulatory guidelines

- Check tax reporting capabilities

- Validate platform’s legal standing in India

Review User Experience

- Test mobile app functionality

- Evaluate customer support responsiveness

- Check deposit and withdrawal processing times

- Read user reviews and testimonials

Financial Considerations

- Analyze minimum deposit requirements

- Compare transaction fee structures

- Understand withdrawal limits

- Check supported payment methods

- Measure platform uptime reliability

- Assess trading speed and execution

- Evaluate liquidity across trading pairs

- Check real-time market data accuracy

By methodically examining these dimensions, investors can identify a crypto exchange that aligns with their specific trading objectives and risk tolerance in the dynamic Indian cryptocurrency marketplace.

Frequently Asked Questions About Crypto Exchanges in India

The cryptocurrency landscape in India continues to evolve rapidly presenting both exciting opportunities and complex challenges for investors. Navigating this dynamic market requires strategic thinking careful research and a commitment to ongoing learning.

Successful crypto trading isn’t just about choosing the right platform—it’s about developing a holistic approach that balances risk management technological understanding and adaptability. Investors who stay informed about regulatory shifts market trends and emerging technologies will be best positioned to capitalize on the potential of digital assets.

As blockchain technology and cryptocurrency ecosystems mature Indian investors can expect more sophisticated trading tools enhanced security protocols and increasingly user-friendly platforms. The key to long-term success lies in maintaining a disciplined investment strategy continuous education and a willingness to adapt to the ever-changing digital finance landscape.

Frequently Asked Questions

Can I trade cryptocurrency in India?

Yes, cryptocurrency trading is currently legal in India. While digital assets are not recognized as legal tender, investors can buy, sell, and hold cryptocurrencies through regulated exchanges. The government has introduced a taxation framework, requiring investors to report crypto transactions and pay applicable taxes. However, the regulatory landscape remains dynamic, so investors should stay informed about the latest legal developments.

Which is the safest crypto exchange in India?

WazirX is considered one of the safest cryptocurrency exchanges in India. It offers robust security features, including two-factor authentication, cold storage for funds, and comprehensive KYC verification. The platform supports over 200 cryptocurrencies and is owned by Binance, a globally recognized crypto exchange. Its user-friendly interface, strong security protocols, and compliance with Indian regulations make it a reliable choice for investors.

What are the best cryptocurrencies for Indian investors?

Top cryptocurrencies for Indian investors include Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), and Solana (SOL). Bitcoin remains the most established digital asset, while Ethereum offers smart contract capabilities. Binance Coin provides utility within the Binance ecosystem, and Solana offers high-speed transactions. Investors should research each cryptocurrency’s potential, market trends, and align investments with their risk tolerance and financial goals.

How do I start trading cryptocurrencies in India?

To start trading cryptocurrencies in India, first choose a reputable exchange like WazirX or CoinDCX. Complete the KYC verification process by submitting identification documents. Link a bank account or payment method, and enable two-factor authentication for security. Start with a small investment, diversify your portfolio, and stay informed about market trends and regulatory changes. Always invest only what you can afford to lose.

What are the risks of cryptocurrency trading?

Cryptocurrency trading involves significant risks, including high market volatility, potential security breaches, and regulatory uncertainty. Prices can fluctuate dramatically within short periods, leading to potential substantial financial losses. Investors should be prepared for market unpredictability, implement risk management strategies like diversification, use stop-loss orders, and only invest funds they can afford to lose. Continuous learning and staying updated on market trends are crucial.

Are cryptocurrency exchanges in India regulated?

Cryptocurrency exchanges in India operate in a partially regulated environment. While there’s no comprehensive crypto-specific legislation, exchanges must comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. The government has introduced a taxation framework for crypto assets, requiring investors to report transactions and pay applicable taxes. Regulations continue to evolve, so investors should stay informed about the latest legal developments.

What fees are associated with crypto trading?

Cryptocurrency exchanges typically charge various fees, including trading fees (usually 0.2% to 0.5% per transaction), deposit fees, and withdrawal fees. Some platforms offer tiered fee structures based on trading volume. Additional charges may include network transaction fees for blockchain transfers. Investors should carefully review the fee structure of their chosen exchange, as these costs can significantly impact overall investment returns.

How can I secure my cryptocurrency investments?

To secure cryptocurrency investments, use exchanges with robust security features like two-factor authentication and cold storage. Enable all available security protocols, use strong, unique passwords, and consider hardware wallets for long-term storage. Diversify investments across multiple assets and exchanges, be cautious of phishing attempts, and regularly update security settings. Stay informed about potential security risks and best practices in the crypto ecosystem.

Bibliography:

T. O. India, (2024). WazirX probe hits wall as suspect flees to B’desh [Online]. Times of India. Available at: https://timesofindia.indiatimes.com/city/delhi/wazirx-probe-hits-wall-as-suspect-flees-to-bdesh/articleshow/116575615.cms (Accessed: 24 December 2024).

“WazirX News: WRX Token Price Plunges 60% as Hacked Exchange Hopes for ‘Fresh Start”” 18 Dec. 2024, www.coindesk.com/markets/2024/12/18/wazir-xs-wrx-plunges-60-after-binance-delisting-dampening-hopes-of-a-fresh-start. Accessed 24 Dec. 2024.

.. Var, (2024). Binance Is Fully Functional in India Now! [Online]. Coinpedia on Binance Square. Available at: https://www.binance.com/en/square/post/12198392258345 (Accessed: 12 December 2024).

Antrix3, CC BY-SA 4.0, via Wikimedia Commons

QR Code For Mobile Users:

Alessio Rigoli is the founder of AGR Technology and got his start working in the IT space originally in Education and then in the private sector helping businesses in various industries. Alessio maintains the blog and is interested in a number of different topics emerging and current such as Digital marketing, Software development, Cryptocurrency/Blockchain, Cyber security, Linux and more.

Alessio Rigoli, AGR Technology

![logo-new-23[1] logo-new-23[1]](https://cdn-ihdfn.nitrocdn.com/eZVJvoSTyVixkEUySRKiaseNtUlmgCyu/assets/images/optimized/rev-b7ced37/agrtech.com.au/wp-content/uploads/elementor/thumbs/logo-new-231-qad2sqbr9f0wlvza81xod18hkirbk9apc0elfhpco4.png)